Greetings, dear traders!

As I have already mentioned in my article on the euro/dollar pair, traders ignored extremely weak US GDP figures for the first quarter. Notably, market participants have been paying almost zero attention to economic reports for quite a long time. Sometimes even crucial economic data does not affect the market sentiment. It was exactly what occurred yesterday. Currently, investors are mainly focused on the statements and actions of the world's largest central banks, which are forced to tighten monetary policy due to high inflation. The Fed is now more hawkish compared to others. Perhaps it is quite logical given that it is the most influential central bank worldwide. The Bank of England and the Bank of Canada are following suit. They have already hiked interest rates. However, the Fed is ready to take more aggressive measures amid the tense geopolitical situation. The US dollar maintains its bullish run thanks to these factors.

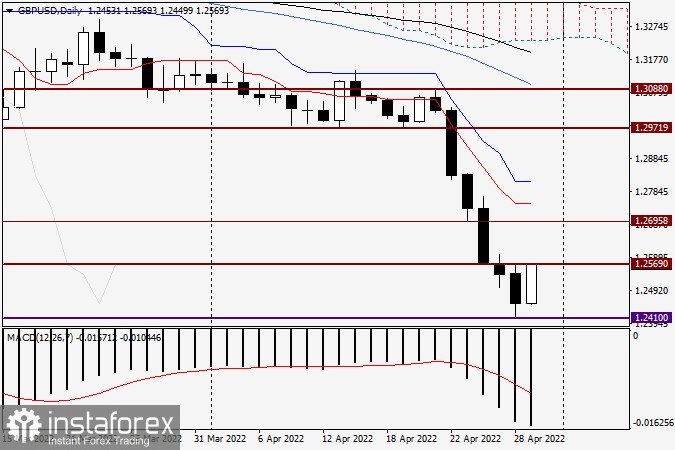

Daily

Today, the UK revealed the Nationwide House Price Index, which turned out to be rather negative. How did the pound sterling react to this? At the time of writing the article, the pound sterling was rising against the US dollar. It once again confirmed the fact that investors little care about macro statistics. During the American session, the US is going to release a batch of economic reports. If you want to see which ones, you need to check the economic calendar. The question is whether the upcoming reports will be able to influence the monthly and weekly trading results. As for the technical indicators, during yesterday's decline, the quotes fell below the psychologically important level of 1.2500. The pair closed at 1.2453. However, the pound sterling is rapidly recovering, trading near 1.2562. The bulls are still trying to push the pair above yesterday's high of 1.2568. The probability of an upward correction is increasing every day. I assume that the pair may start a corrective phase at the 1.2500 level

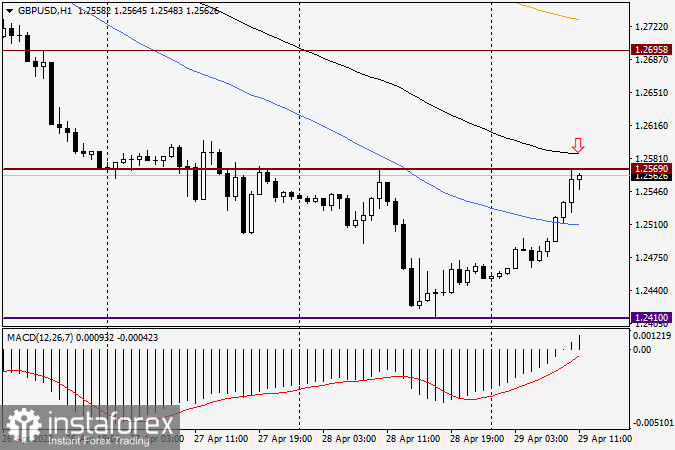

H1

On the 1H chart, we see that the bullish divergence of the MACD indicator has already been completed but it has not brought any results. The pair has already returned above the 50-day simple moving average. It is likely to rise higher. If this scenario comes true, the next resistance levels will be 1.2568-1.2587 where the black 89-exponential moving average is also slightly higher than yesterday's highs. For those who want to open new positions on GBP/USD on the last day of monthly and weekly trading, it is recommended to consider short ones in the indicated zone. It is better to open short positions if there are Japanese candlesticks with bearish patterns at this level. That's all for today. On Monday, I will provide a more extensive analysis after studying the actual monthly and weekly results.

Good luck!