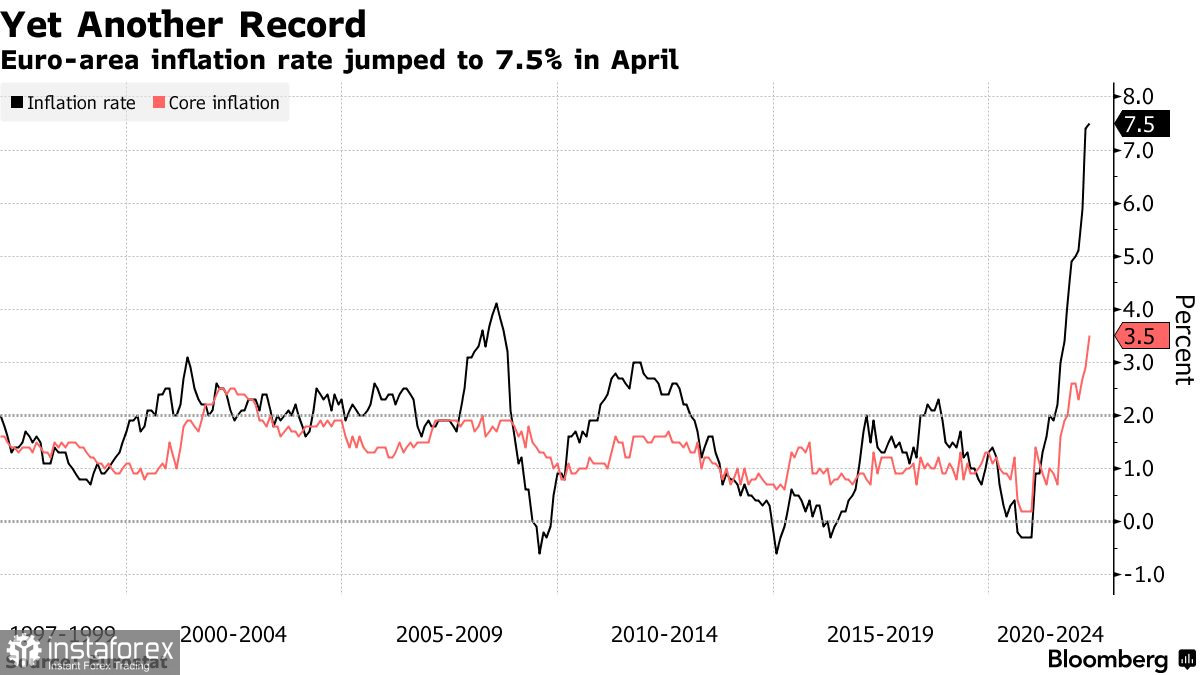

The euro rose before the publication of inflation data in anticipation of a sharper surge in April this year. The report itself was quite unimpressive as it coincided with economists' forecasts. Thus, inflation in the eurozone rose to a new all-time high, which forces the European Central Bank to more actively taper the stimulus program and raise interest rates.

According to the data, consumer prices in the eurozone increased by 7.5% in April yearly, which was in line with economists' average estimates. Core inflation, which excludes energy and food prices, jumped to 3.5%.

Energy remains the key factor that has affected the CPI and is likely to continue to put serious pressure on it. Taking into account the fact that oil prices are above $100 per barrel and Russia has already stopped supplying natural gas to Poland and Bulgaria, threatening other members of the European Union with supply cuts, nothing good can be expected soon. The Europeans, of course, can partially influence Russia's decision, but to do so they will have to pay for fuel in rubles, something that US politicians, who have an enormous influence on EU politicians, do not want to allow.

The European Central Bank most likely expected that inflation rate, but it becomes more and more difficult to talk about a rapid return of inflation to the target level of 2%. We can only speculate on how this will affect the regulator's decision in the summer to end its asset purchase program in full and begin raising interest rates in the fall. However, given the fact that the data coincided with economists' forecasts, most likely no adjustments will be introduced into the central bank's actions. The agenda for the ECB meeting on June 8-9 is complicated not only by inflation but also by extreme uncertainty about the outlook, as the tense geopolitical situation in Ukraine undermines confidence and raises concerns among investors and consumers, which affects their sentiment.

Yesterday, ECB Vice President Luis de Guindos said that price pressure was "very close" to the peak, although he warned that inflation was unlikely to fall below 4% this year.

Americans complain about their finances

Europe is not the only one with problems. A recent survey found that Americans are increasingly pessimistic about their finances as inflation takes a serious toll on their well-being. According to a Gallup survey, less than half of Americans rate their financial situation as "good" or "excellent," the lowest since 2015. About 48% say things are getting worse. Similar changes were seen in April 2020, at the height of the coronavirus pandemic, and in 2008, during the financial crisis.

In the survey, conducted on April 1-19, 32% of Americans believe inflation and the high cost of living are the most important financial problems facing their families today. Consumer prices rose in March at the fastest rate since 1981, especially due to the cost of food, electricity, and housing utilities. Half of about 1,000 Americans surveyed said it was rising gasoline prices that caused financial hardship for their families, but 57% are confident that the high prices will be temporary.

After hitting a new yearly low, the euro corrected slightly, reaching the resistance of 1.0590. Expectations for a more aggressive European Central Bank policy, following the inflation report, helped buyers of risky assets. However, we should keep in mind the May meeting of the Fed, where the interest rate in the US may be increased by 0.75% against the previously announced 0.5%. Worsening geopolitical tension due to Ukraine's refusal of negotiations, as well as supply chain problems in the eurozone, will limit the upside potential of risky assets. In the short term, it is best to bet on a major upward correction, which occurred against the background of profit-taking after the data on the US economy. The slowdown in GDP growth in Q1 of 2022 is a serious problem for the central bank. To stop the bear market, the buyers need to protect the nearest support at 1.0520. If it is missed, bears are likely to drag the trading instrument to new lows: 1.0470 and 1.0420. Support at 1.0390 will be the next target. We can and should speak about the correction in the euro, as bulls have already reached 1.0590 and aim to break through this level. It is expected to perform an upward rush to 1.0620 and 1.0695.

Buyers of the pound protected 1.2490 and now are pushing the pound higher and higher. However, a medium-term bearish trend persists, and the observed correction may very quickly end if the big sellers have a reason. In the short term, it would be better to buy the pound on a downward pullback, as there may be a stronger bullish activity amid profit-taking at the end of the month. The nearest resistance levels are around 1.2590. A breakthrough of this level will lead to an immediate rally of the trading instrument to 1.2640 and 1.2690. A breakthrough of 1.2480 will strengthen the bear market, which will open the way to new lows of 1.2420 and 1.2370. The next target will be the support of 1. 1.2320, which will be reached again if the UK economy deteriorates very quickly.