EUR/USD bears stopped their advance on Friday, making it possible for the bulls to stage a small counterattack. First of all, this is due to the so-called "Friday factor". This week, traders reached 5-year price lows, so every further step towards the downside (especially ahead of the weekend) is given to bears with great difficulty. During the Asian session on Friday, the downward momentum finally faded away, after which the bulls seized the initiative.

In general, dollar bulls have taken a pause across the market: the US dollar index retreated from a two-year high (103.69) and fell to the 102nd figure area. And although the index is still at a high area, the fact remains that the greenback suspended its multi-day, rapid growth on Friday, which puzzled market participants. Including EUR/USD traders, who faced a completely natural question: is the upward price pullback a correction or has the pair formed a price low? Should I open short positions from current levels or take a wait-and-see position in order not to fall into a drawdown?

Looking ahead, it should be noted that it was extremely risky to open any trading positions on the EUR/USD pair on Friday. And even more so - longs. After all, the price rollback was due not only to the "Friday factor", when traders en masse took profits, but also to the release of data on the growth of April inflation in the eurozone. Inflation indicators once again showed significant growth, following multi-month trends.

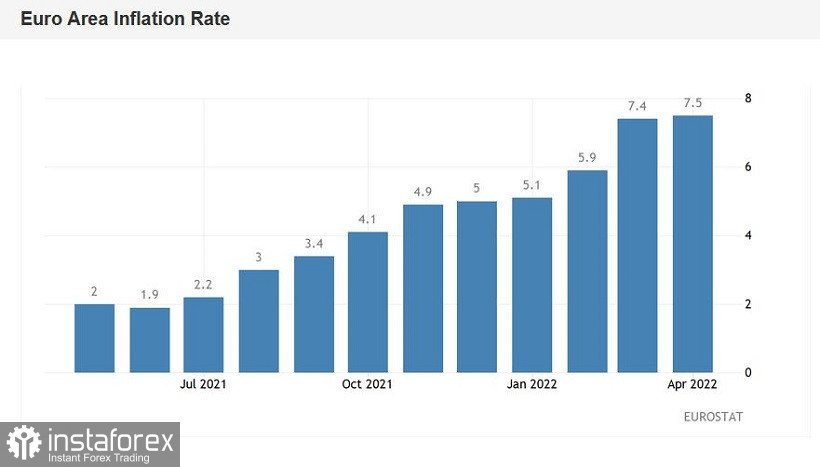

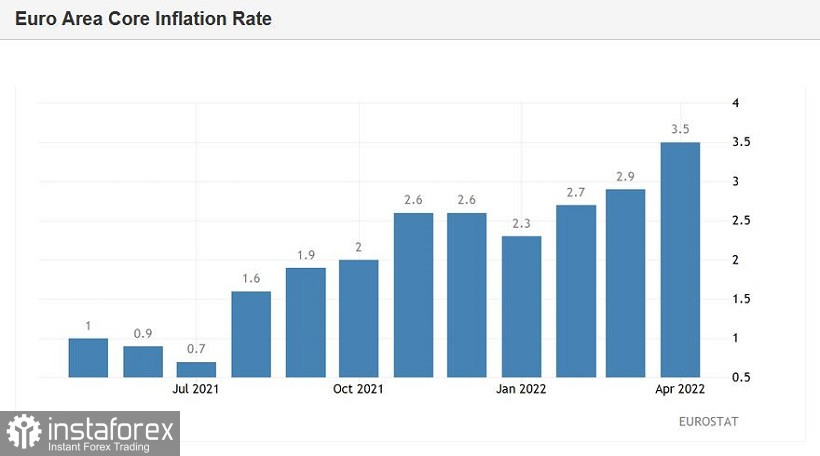

Thus, the general consumer index rose to 7.5% in April (in March it was at the level of 7.4%). This is another historical record, that is, the highest value of the indicator in the entire history of observations (since 1997). The result was higher than most experts' forecasts: analysts polled by Reuters had expected it to remain at 7.4%. The core consumer price index was also in the green zone, excluding volatile energy and food prices. It showed strong momentum, rising to 3.5% (from the previous value of 2.9%). Analyzing the structure of the release, we can conclude that energy prices increased the most in the eurozone countries. This month they have increased by 38%. Prices for food, alcohol and tobacco rose by 6.5%. The cost of services increased by 3.3% compared to 2.7% in March.

In other words, European inflation again demonstrated the strongest growth, continuing the trends of the last half of the year. Thanks to Friday's release, the pair "crawled" out of the area of the 4th figure and rose to 1.0593. Here, the bullish momentum has dried up: bulls have not been able to test the 6th figure, let alone consolidate in this price area.

Traders have learned from the bitter experience of four weeks ago when the March inflation release was published. With rare exceptions, members of the European Central Bank did not tighten their rhetoric in response to the growth of the CPI - the issue of raising the rate is still "hanging in the air", despite inflation records. Therefore, it is quite logical to assume that the April report will not change anything in this regard. Just a week ago, ECB President Christine Lagarde in an interview with the American television channel CNBC, announced an indicative "action plan". The ECB is "likely" to end its asset buyback stimulus program in July or August, she said. After that, "later this year" the central bank will start raising rates.

As you can see, the head of the ECB is not ready for active and (especially) aggressive actions in the context of tightening monetary policy. Despite the hawkish impulses of some representatives of the ECB, most members of the Board of Governors remain cautious. The US Federal Reserve looks much more decisive against the background of the ECB, especially in light of the latest statements by the Fed representatives made during April.

Besides, the rather sluggish reaction of the market to Friday's report is explained by one more circumstance. Indeed, by and large, traders were ready for such results after the release of data on the growth of German inflation. Let me remind you that in Germany, the consumer price index also showed a fairly strong growth: in annual and monthly terms, the indicators also came out in the green zone, signaling similar trends on a pan-European scale.

Thus, the current rise in the price of EUR/USD is of a corrective nature. There are no grounds for a break in the downward trend at the moment. However, short positions looked risky due to the weekend and the notorious "Friday factor". It is likely that the pair will continue to decline at the beginning of next week, ahead of the next Fed meeting (May 3-4). However, until Monday, it is better to take a wait-and-see attitude.