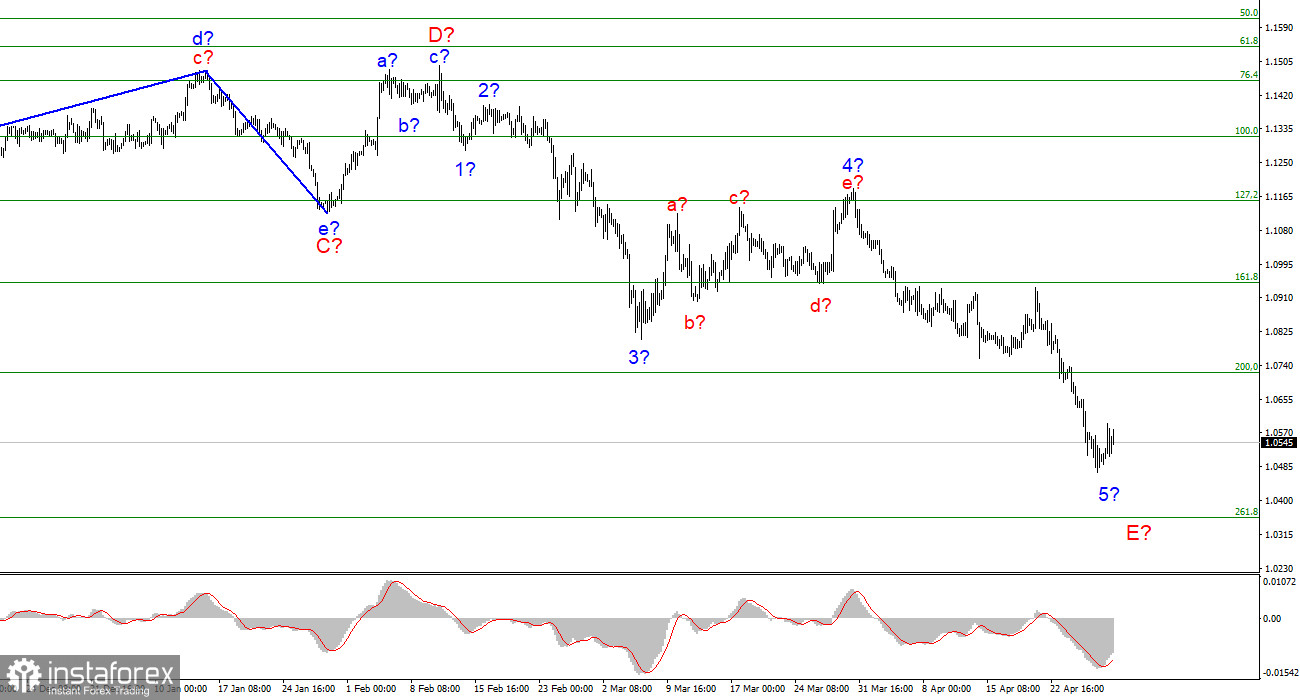

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend segment. If this is true, then the decline in the quotes of the euro currency may continue for several more weeks, since this wave may turn out to be very long, with five waves in its internal structure. At the moment, this wave no longer looks shortened, and five waves are not visible inside it yet. Therefore, I believe that it will continue its construction for some time. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and only 350 basis points will remain at price parity with the dollar. An unsuccessful attempt to break through the 1.0355 mark may mean that the market is ready to build a corrective wave of 5-E. Presumably the fourth wave, since now three waves are visible inside 5-E. I am not considering alternative wave marking options yet.

European inflation continues to rise.

The euro/dollar instrument rose by 50 basis points on Friday. However, I cannot draw any conclusions in this regard. This increase is too small to conclude the completion of the downward trend segment, or at least about the completion of the construction of a downward wave. This increase is too small to indicate a change in market sentiment. This increase is too small to conclude that the market is ready to buy the euro currency. It doesn't say anything. It's just that on Friday the market recorded a part of the profit on sales, that's all.

The news on Friday was very interesting for the euro currency. The consumer price index rose to 7.5% y/y, as well as to 3.5% y/y if we take prices excluding fuel, energy, and food. One way or another, fast or slow, inflation in the European Union continues to grow. Since it is mainly growing now due to geopolitics, and the Ukrainian-Russian conflict, there is no reason to assume that this value is the maximum that the market can see. The European energy crisis is only at the first stage. Now the European Union is considering all possible options for abandoning Russian oil and gas, and Russia, meanwhile, has begun to refuse to export gas to certain European countries that do not want to pay in rubles. Everything is going to the fact that oil and gas supplies from Russia to Europe will only decrease, sanctions will tighten, and prices will rise. Consequently, inflation in Europe may continue to increase. Also yesterday, a report on GDP in the first quarter was released. Its growth was minimal, only 0.2%. Last quarter it was 0.3%. The European economy is quite weak, so I very much doubt that the ECB will go for a rate hike this year. Maybe the rate will be raised once or twice, but hardly more, because the main thing now is not to put additional pressure on a weak economy.General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". In the near future, the construction of a new internal correction wave of 5-E may begin, which may be the fourth.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which may turn out to be as long as wave C. If this assumption is correct, then the European currency will still decline.