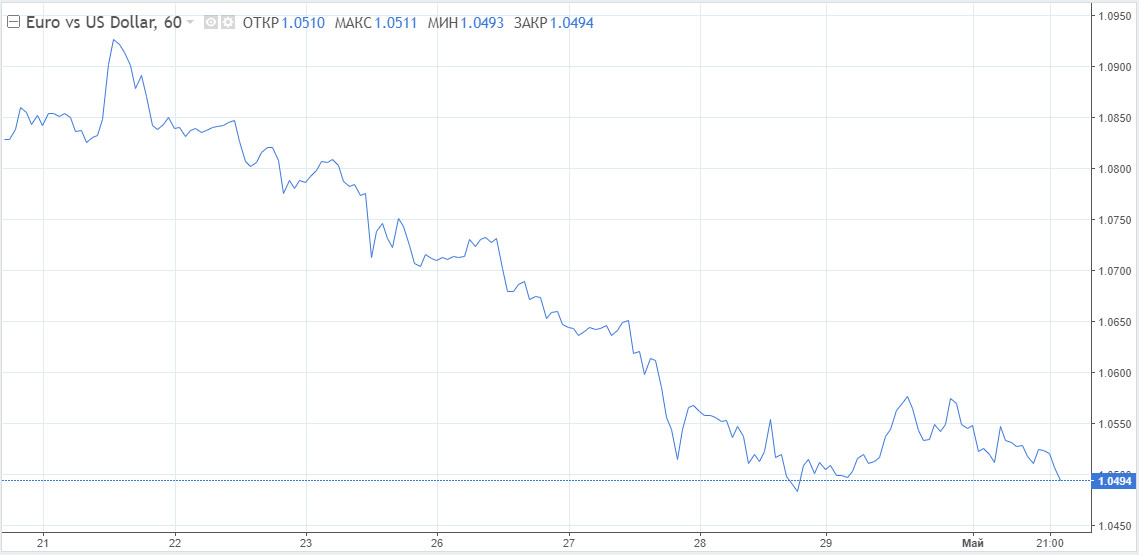

The euro is balancing around the 1.0500 mark and remains committed to the devaluation mood against the background of fundamental indicators. Nevertheless, the 5th figure remains stable. Now traders are interested in how long the single currency will be able to hold out in this area before falling to new lows.

Analysts consider breaking down the 1.0500 mark to be rather inevitable. Growth prospects in the eurozone are weak, and the dollar has not yet exhausted its growth and may rise stronger after the Federal Reserve meeting.

At the moment, the EUR/USD pair looks oversold, so growth in the 1.0570 area is not excluded, then the 1.0600 zone may be broken through, and bulls will aim for the 1.0650 level at some point. In general, this will not affect the future forecast in any way.The bears aim to drive the EUR/USD pair under the cyclical low of 1.0470. This mark acts as a key support, followed by testing 1.0340.

"We continue to forecast testing of the January 2017 low in the area of 1.0340. If this level is broken, we will have to start talking about the level of parity and lower values," VVN economists comment.

Support levels are marked at 1.0500, 1.0470, 1.0415. Resistance levels are at 1.0560, 1.0605, 1.0650.

Stocks in Europe showed negative dynamics today. The focus is still on the tension in relations with Russia. The German Economy Minister noted that there is still no unity among European countries on the oil embargo. As for Germany itself, the official said on Monday that Russia could supply gas to the country, as it was in the situation with Poland. Germany, according to him, is not against the ban on the import of Russian oil.

Earlier in the day, the German Economy and Climate Minister announced his readiness to support the embargo on oil from Russia. These comments provoked a pullback in the euro's movement, which sought to settle above the 1.0550 mark today.

The statement of the vice-president of the European Central Bank also served as a negative for the euro. Luis de Guindos called a rate hike in July unlikely. News from Europe does not contribute to the euro's revival, which may accelerate the decline this week.The dollar index is trading in positive territory on Monday, slightly above Friday's closing levels. At the same time, the indicator is just below the 20-year highs reached at 103.95 last week on Thursday. This week, the focus of market participants is on the Fed's decision on rates, which will be announced on Wednesday.

Investors are counting on a 50 basis point rate hike. Federal Reserve Chairman Jerome Powell's speech will be of the greatest interest. Market players are trying to understand how hawkish the tone of the Fed chairman's comments will be. Now they are being laid down for an aggressive tightening of the central bank's policy, which is trying to tame high inflation.

The dollar index has interrupted the recent pullback and is bullish. The initial target at the highs of April 28 of this year, traders were just a little short of testing the value of 104.00. Next, the target will be taken to the level of 105.63, the acting high of December 11, 2002.