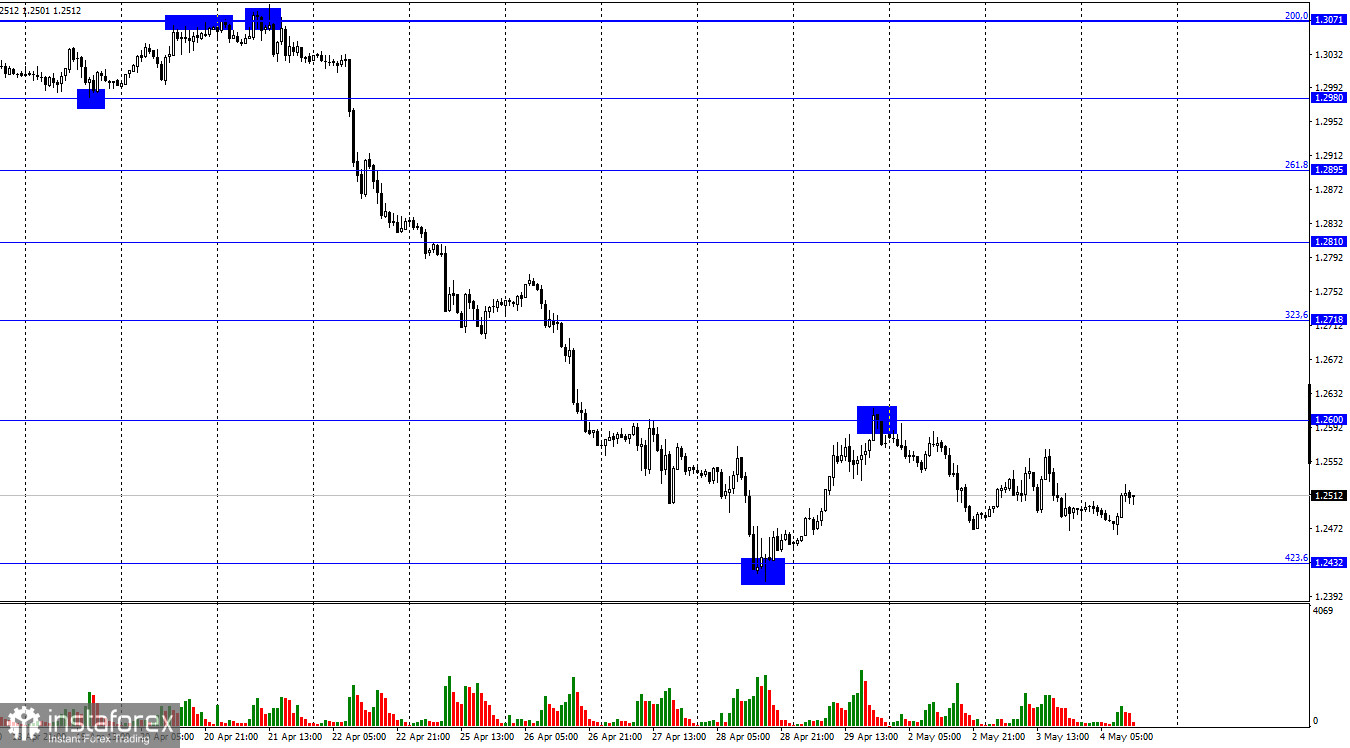

According to the hourly chart, the GBP/USD pair continued the process of falling towards the corrective level of 423.6% (1.2432) on Tuesday. On Wednesday, the decline slowed down a bit, but in general, only 80 points remain at this level. And the specified level is the low of the current year and last year, too. That is, this is the minimum exchange rate of the pound for several years, and bear traders do not feel any discomfort about this. Bull traders retreated from the 1.2600 level, showing that it makes no sense for the British to expect growth at this time. As I have already said, the evening summing up of the Fed meeting can greatly affect the mood of traders. So far, I expect to see a surge in activity that will end in a few hours and after which the pair will remain approximately where it was before this event. This is because the Fed's decision with a 90% probability has already been made and is known to traders. Thus, it is unlikely that unexpected information will arrive in the evening. Jerome Powell's rhetoric will be of the greatest interest, as traders usually react very sensitively to its change.

For example, if the Fed president said that the economy weakened in the first quarter, so perhaps in the future the rate will rise at a slower pace than previously stated, this could hit the dollar. Conversely, if Powell does not pay any attention to the weak GDP report, then the US currency may continue to show growth over the next weeks and months. The same applies to the meeting of the Bank of England, which will be held tomorrow. Traders are confident of a 0.25% interest rate hike, but much will depend on the rhetoric of Governor Andrew Bailey. If Bailey gives a signal to the market that the rate will continue to rise this year to slow down the growth of inflation, then the British will have a chance of growth. If not, its situation may worsen significantly.

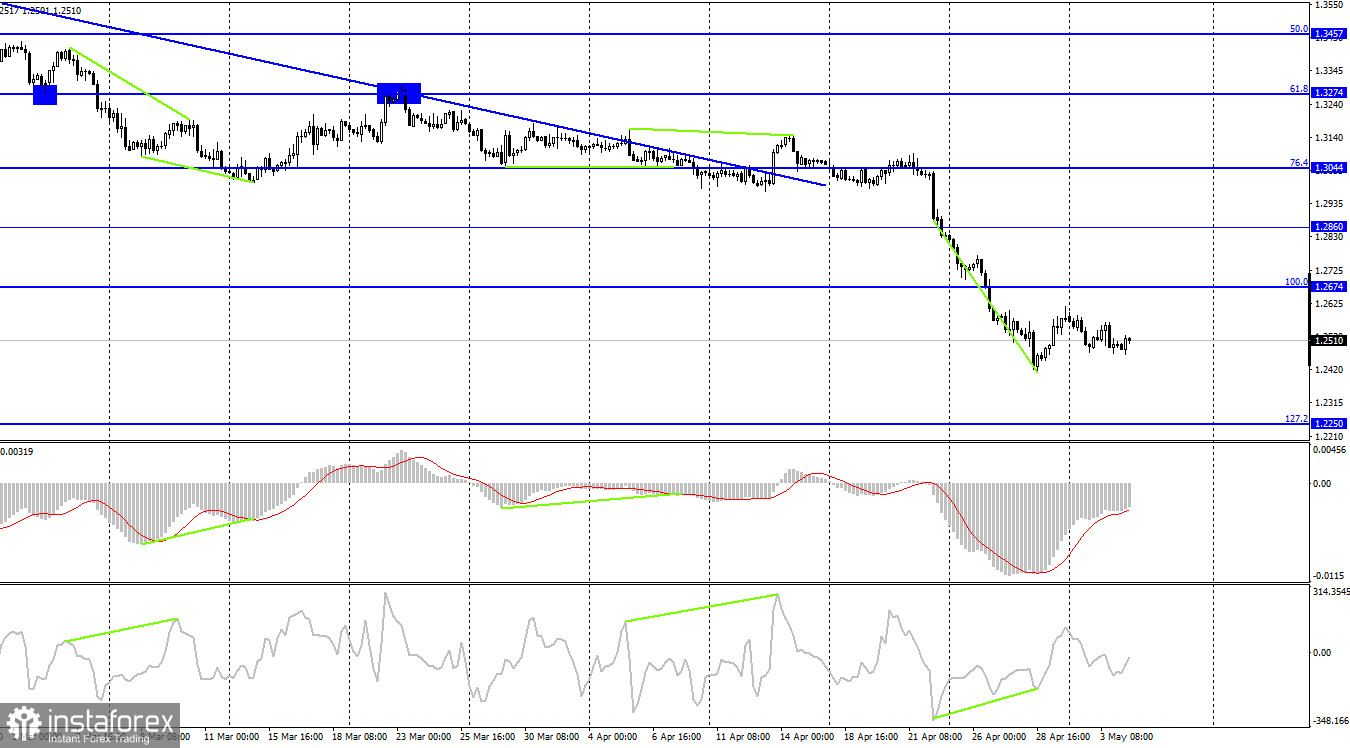

On the 4-hour chart, the pair performed a reversal in favor of the UK currency after the formation of a bullish divergence at the CCI indicator. The growth process began in the direction of the corrective level of 100.0% (1.2674). But yesterday and today the pair were already falling more than it was growing, and today and tomorrow a lot will depend on the information background in the UK and the US. The mood of traders can change very much.

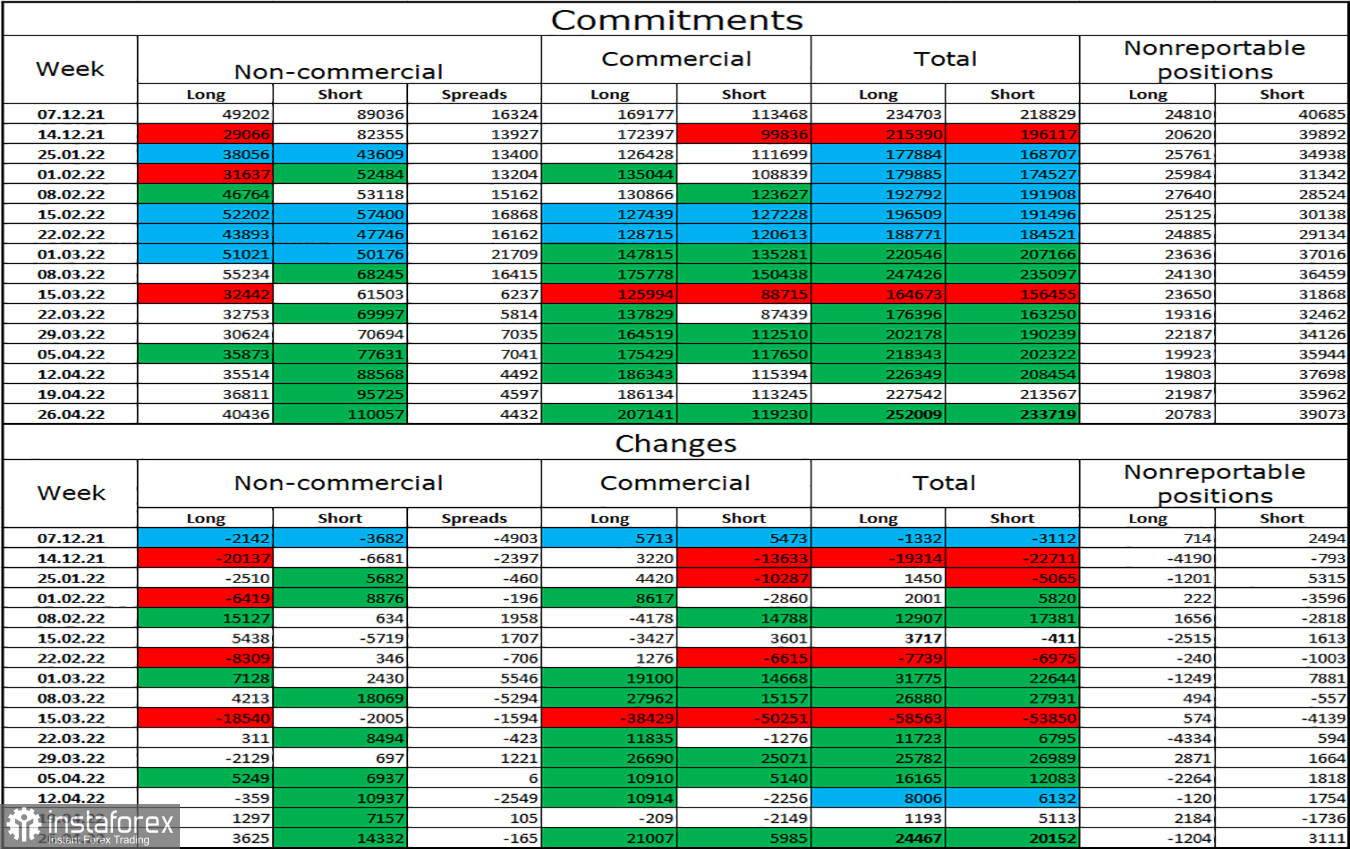

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot again over the past week. The number of long contracts in the hands of speculators increased by 3,625 units, and the number of shorts - by 14,332. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 2.5 times more than shorts (11,0057 - 40,436). The big players continue to get rid of the pound. Thus, I expect the pound to continue its decline over the coming weeks. Other factors are talking about the fall of the pound sterling, but still, the pound is a pretty strong currency, so I would not bury it hopelessly.

News calendar for the USA and the UK:

US - change in the number of employees from ADP (12:15 UTC).

US - ISM index of business activity in the service sector (14:00 UTC).

US - FOMC decision on the main interest rate (18:00 UTC).

US - accompanying FOMC statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On Wednesday, the calendar of economic events in the UK is empty. In the USA - two rather important reports, and in the evening - the results of the FOMC meeting and a press conference. None of the American reports have been released yet. All the most interesting things are ahead. The influence of the information background on the mood of traders today can be strong.

GBP/USD forecast and recommendations to traders:

I recommended selling the British with a target of 1.2432 when rebounding from the level of 1.2600. Now, these deals can be kept open until the evening (FOMC meeting). Purchases of the British can be started at a new rebound from the level of 1.2432 with a target of 1.2600.