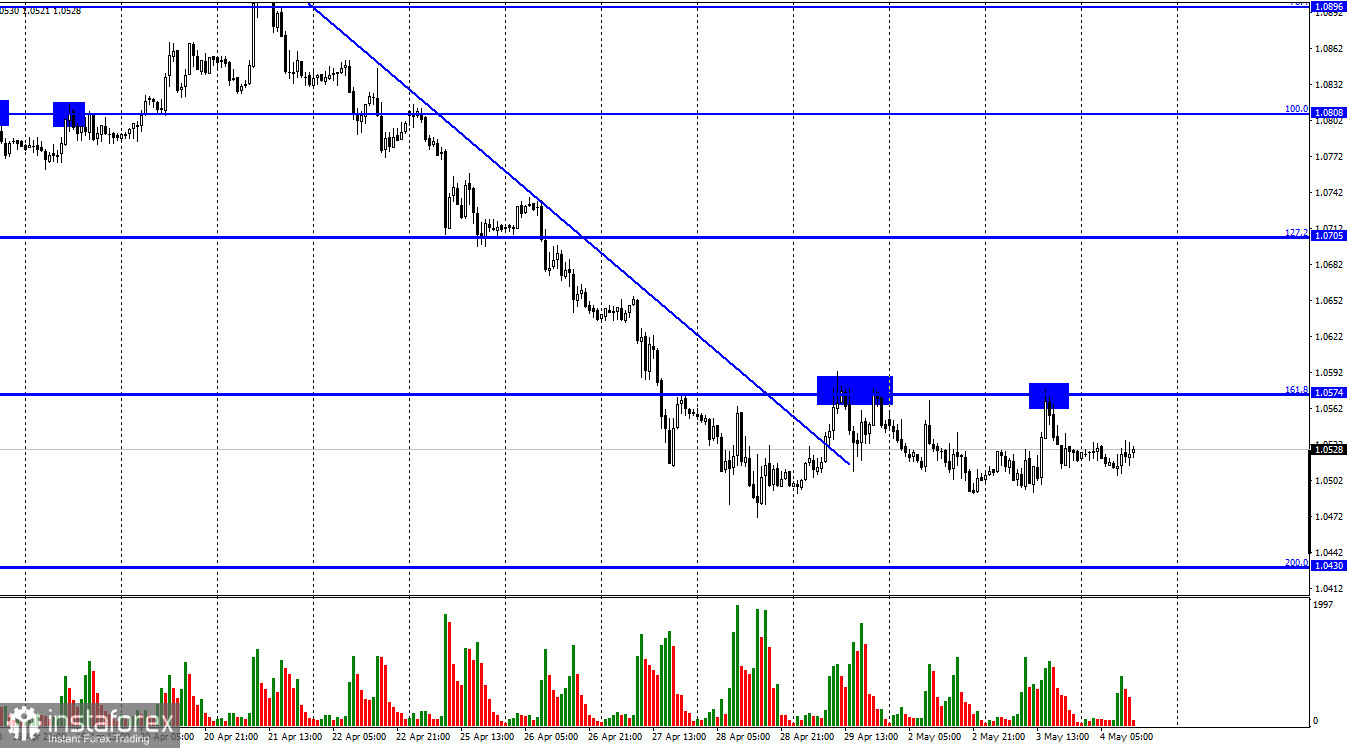

The EUR/USD pair on Tuesday performed a new growth to the corrective level of 161.8% (1.0574), rebounding from it and turning in favor of the US currency. The pair did not fall far down, and the rebound from the 1.0574 level was the third in the last three days. Thus, the quotes of the euro currency are still not far from the low of last week, which does not help bull traders at all in consolidating above the 1.0574 level. However, today the mood of traders may change dramatically. I believe that one of two options is possible: either traders will break through the 1.0574 level on the fourth attempt, as they will be disappointed in the decisions voiced by Jerome Powell, or there will be a serious surge in market activity, after which the rate will remain in its place. The Fed meeting began yesterday, and its results will be announced tonight. No one doubts that the rate will be increased by 0.50%. Therefore, any decision of the Fed that does not correspond to this will be perceived with surprise.

But I don't think that at this time the American Central Bank will unnerve the markets and raise the rate by 0.75% at once. As practice shows, a decision is usually made that is in the middle between the most "hawkish" statement and the most "dovish". Only James Bullard spoke in favor of raising the rate by 0.75%, the rest of the Fed members support an increase of 0.50%. Therefore, there will most likely be no surprises in the evening. Powell is also expected to announce the start of unloading the Fed's balance sheet, which now stands at $ 9 trillion. Today, data on business activity in the service sector and retail trade in March and April have become known in the European Union. These data turned out to be almost completely consistent with the expectations of traders. Since the pair has been moving in a very narrow area for sever

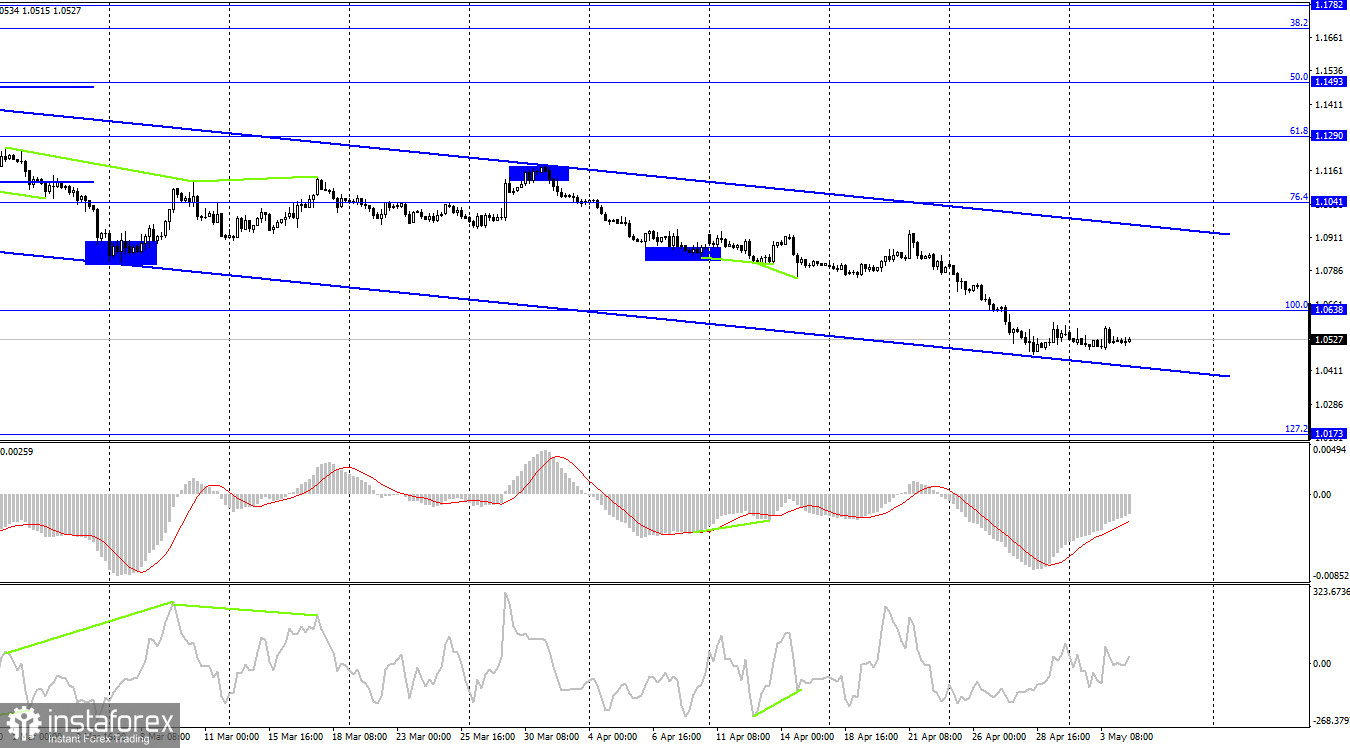

On the 4-hour chart, the pair secured under the corrective level of 100.0% (1.0638), which allows it to continue the process of falling in the direction of the corrective level of 127.2% (1.0173). The downward trend corridor still characterizes the mood of traders as "bearish". There are no signals for the growth of the pair at this time. There are no brewing divergences.

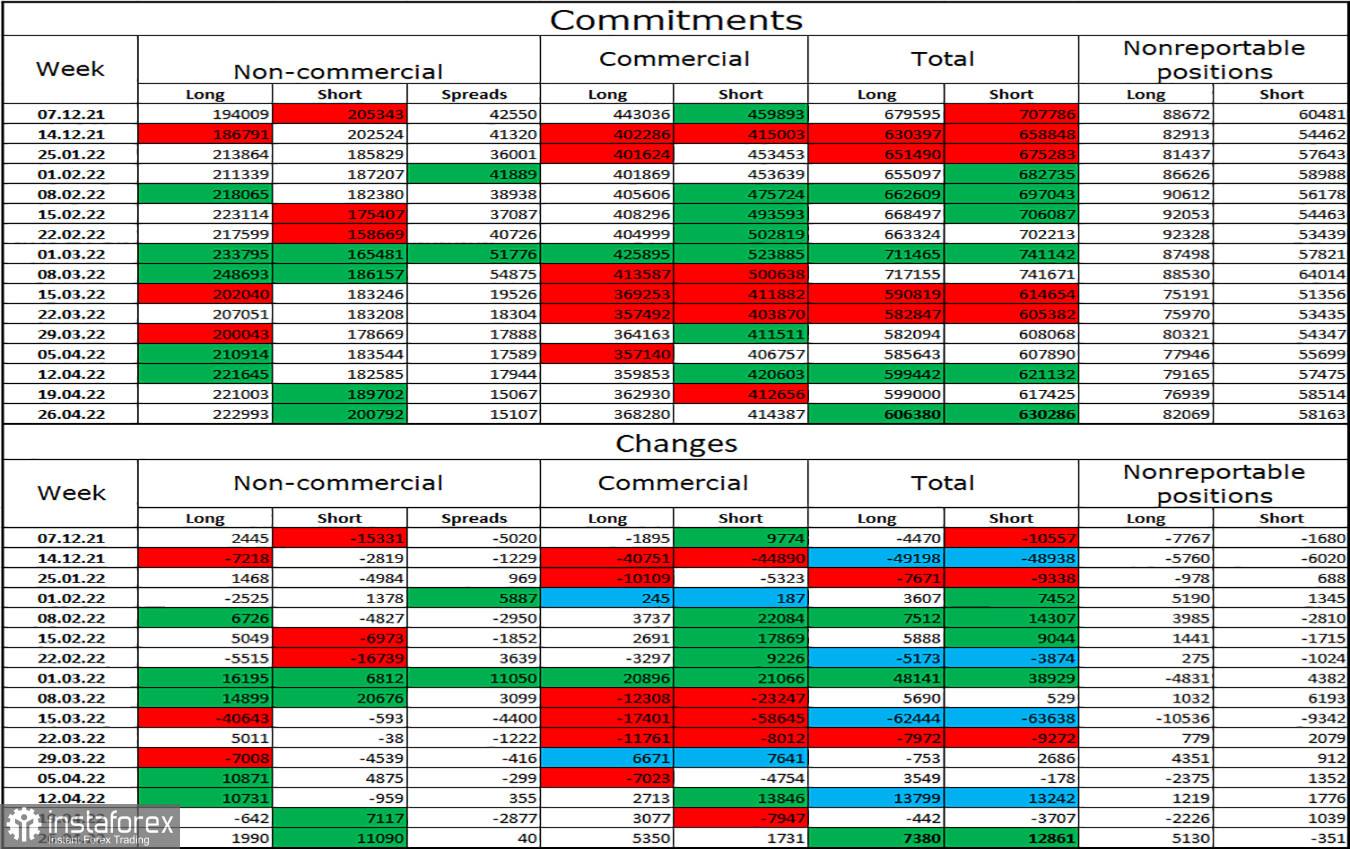

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 1,990 long contracts and 11,090 short contracts. This means that the bullish mood of the major players has weakened again, for the second week in a row. The total number of long contracts concentrated on their hands now amounts to 223 thousand, and short contracts - 201 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish", and with such data, the European currency continues its decline in pair with the dollar. As I have already said, the COT data indicate that the euro should grow, and this pattern has persisted over the past few months. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position.

News calendar for the USA and the European Union:

EU - index of business activity in the service sector (08:00 UTC).

EU - change in retail trade volume (09:00 UTC).

US - change in the number of employees from ADP (12:15 UTC).

US - ISM index of business activity in the service sector (14:00 UTC).

US - FOMC decision on the main interest rate (18:00 UTC).

US - accompanying FOMC statement (18:00 UTC).

US - FOMC press conference (18:30 UTC).

On May 4, two reports were published in the European Union, which did not arouse the interest of traders. In America, two important reports will be released in the coming hours, and in the evening, the results of the FOMC meeting will also be announced. The information background can greatly affect the mood of traders today.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair if there is a rebound from the 1.0574 level with a target of 1.0574. I recommend buying the pair if a close is made above the 1.0574 level with a target of 1.0705.