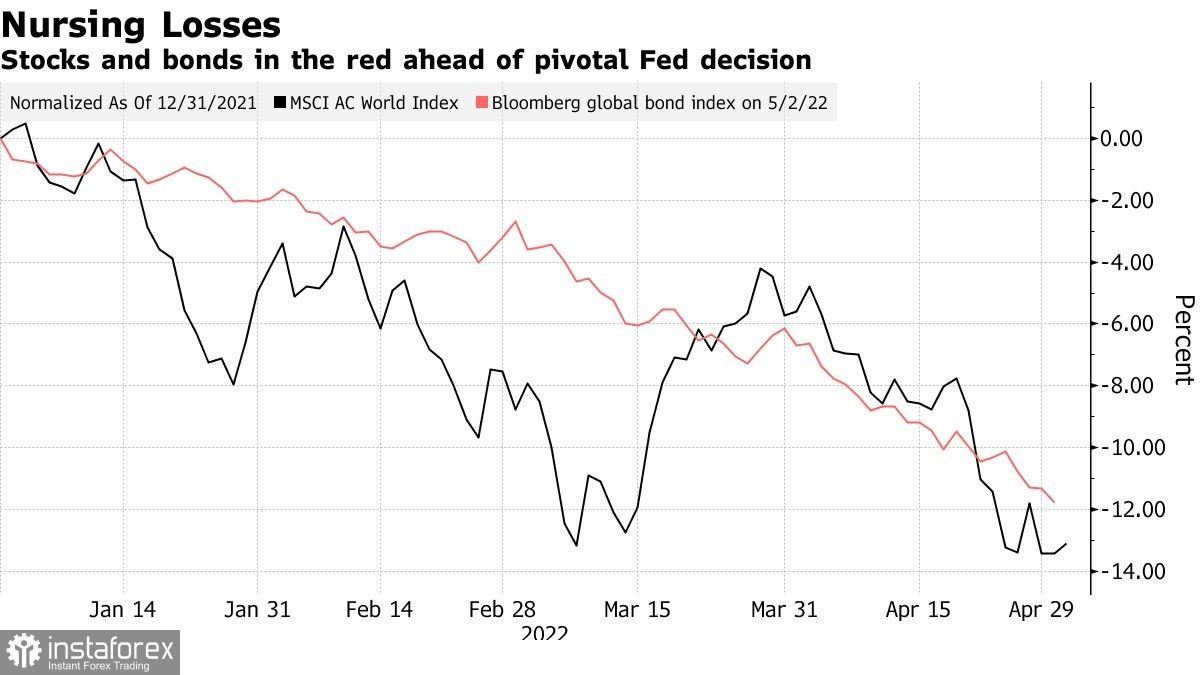

Bonds fell on Wednesday and US stock futures rose as investors braced for the Fed's biggest rate hike since 2000 and expected more hints on how aggressively it will fight inflation.Uber Technologies Inc. delivered a positive earnings outlook, unlike rival Lyft Inc. which collapsed on the premarket. Didi Global fell with Chinese tech stocks as the US Securities and Exchange Commission investigates the giant's chaotic 2021 debut in New York, while Advanced Micro Devices Inc. and Moderna Inc. rose.SNP500 and Nasdaq will see the next Fed meeting at year lows:

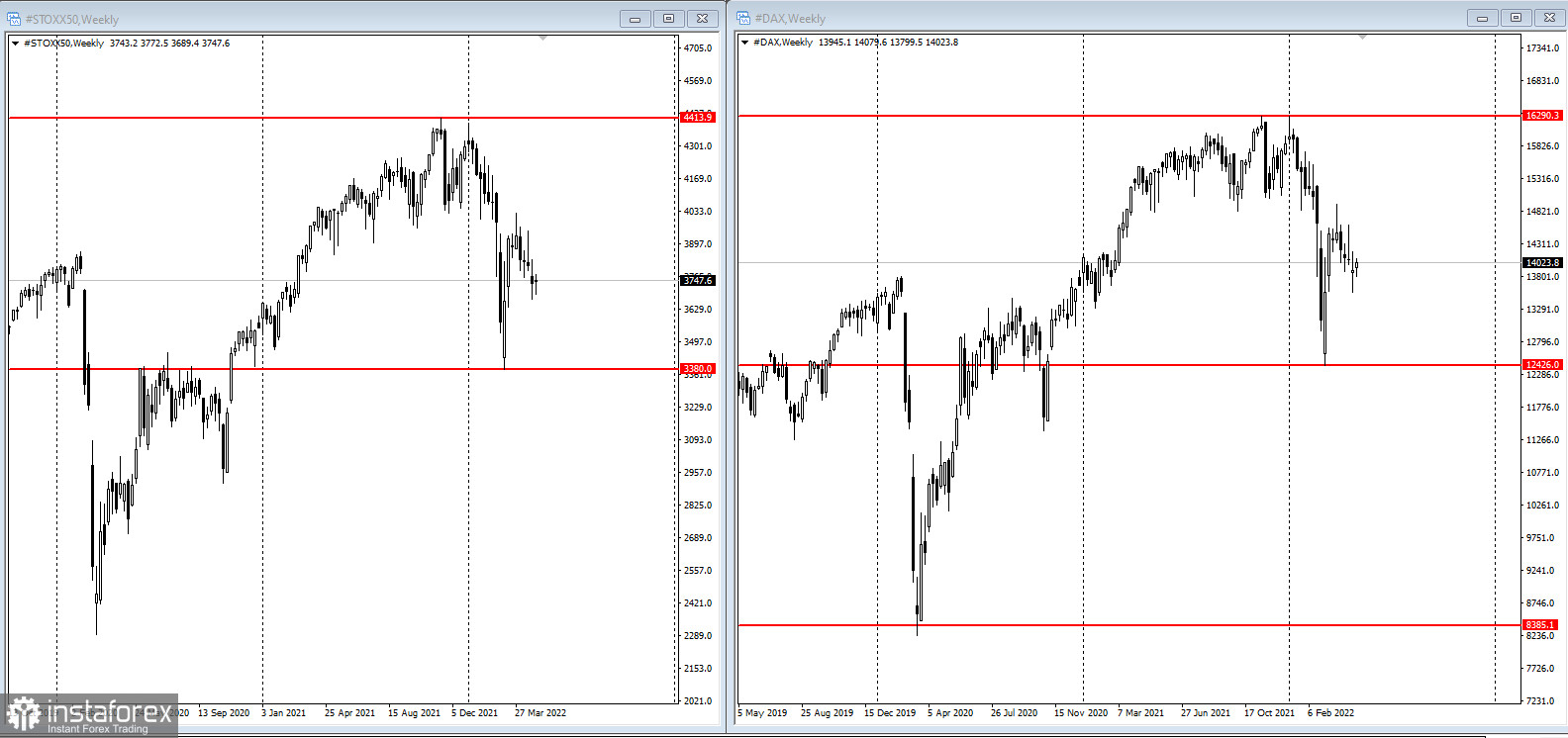

In Europe, retail sales drove the Stoxx50 index lower after Boohoo Group Plc warned that revenue growth could stall.

Global bonds are rising under a wave of monetary policy tightening, with German 10-year bond yields around 1% and the UK around 2%. Yields on sterling's safest corporate bonds climbed above their pandemic peak as the Bank of England weighed a rate hike to the highest level since the global financial crisis.In addition to tightening the outlook, European Central Bank executive board member Isabel Schnabel said it was time for policy makers to take action to tame inflation and that an interest rate hike could come as soon as July. Meanwhile, Iceland's central bank secured the biggest increase since the 2008 financial crisis and India unexpectedly raised its key interest rate on Wednesday.Treasury bonds rose slightly and a gauge of the US dollar was near two-year highs. The greenback's strength reflects caution over an array of risks spanning tightening financial conditions, China's Covid lockdowns and Russia's war in Ukraine.

The Fed is expected to raise rates by 50 basis points Wednesday and detail plans for the reduction of its balance sheet. Key for markets will be whether Chair Jerome Powell's commentary contains any hawkish surprises that could stoke concerns about the threat of US slowdown as borrowing costs climb."There is a difficult set-up in general for risk assets" as valuations remain stretched despite a drop in equities, Kathryn Koch, chief investment officer for public markets equity at Goldman Sachs & Co LLC, said. She added that "some people think stagflation is a real risk".JPMorgan Chase & Co chief executive Jamie Dimon said in an interview on Wednesday that the Fed should have raised rates faster as inflation hit the global economy. He said there was a 33% chance that the Federal Reserve's actions would lead to a soft landing of the US economy and a third chance of a mild recession."The Fed remains very focused on bringing inflation down, however, any further hawkish pivots will likely be tempered to some extent by the desire to achieve a soft landing," Blerina Uruci, US economist at T Rowe Price Group Inc, wrote in a note.Energy companies rose as oil prices surged after the European Union's plan to ban Russian oil imports and restrict Moscow's ability to sell it around the world. The EU has also proposed disconnecting Sberbank and other lenders from the international payment system SWIFT.

Key events this week:- Fed rate decision, briefing with Chair Jerome Powell, Wednesday

- EIA crude oil inventory report, Wednesday

- Bank of England rate decision and briefing, Thursday

- OPEC+ convenes virtually for a regular meeting, Thursday

- US April jobs report, Friday