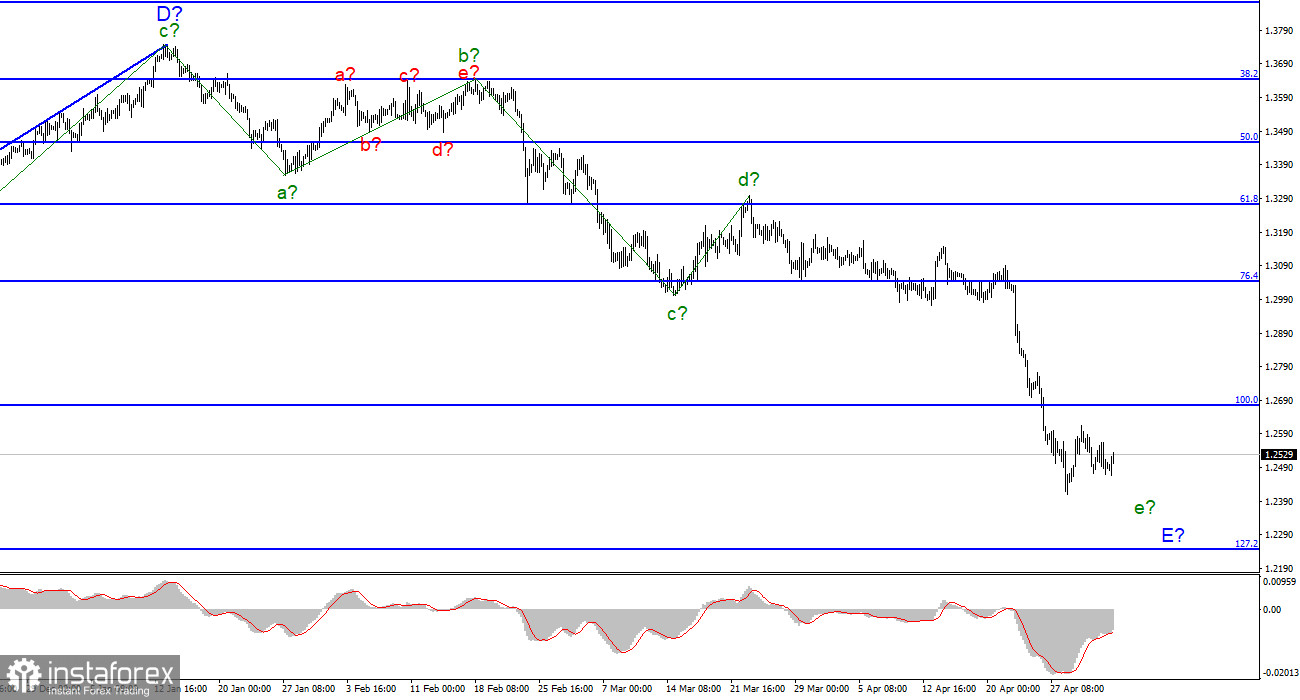

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of the wave e-E, and its internal wave marking looks quite difficult - correction waves are practically not visible in it, so it is very difficult to determine which internal wave is being built at this time. Presumably, wave 4-e-E. If this is true, then we get almost the same wave markings for the British and the Europeans. The current wave is the last wave of the current downward trend segment. The entire site is either nearing completion of its construction, or it will have to take a much more complex and extended form. Everything will depend on the news background, which is now clearly divided into geopolitical and economic. The military conflict between Ukraine and Russia, according to many military analysts, may persist not just for months, but for years. The consequences for the British economy could be serious. From an economic point of view, the meetings of the Bank of England and the Fed will be held this week, which can greatly affect the mood of the market.

The British pound is dreading a two-day marathon

The exchange rate of the pound/dollar instrument increased by 25 basis points on May 4. The range of movements was very weak, but I have reason to assume that activity will increase this evening. And it may remain high for the next two days. The results of the meeting of the British Central Bank will be announced tomorrow, and important data on unemployment in the United States and the labor market will be released on Friday. Thus, the demand for the British may decrease even more in the coming days and may grow significantly. Now it is very difficult to guess exactly how the demand for the tool will change. Hardly anyone can say now what Andrew Bailey or Jerome Powell will tell the market, what decisions will be made by regulators, as well as what will be the value of payrolls in the United States on Friday. Thus, the movements in the coming days can be almost any. They cannot be predicted.

From my point of view, a strong corrective wave 4 can now be built. This wave can be almost any size since the previous third wave was more than 700 basis points. At the same time, this wave may have already been completed, since wave 2-E-E was also very small. Even the current wave marking cannot help with which direction the movement will be today, Thursday, and Friday. However, in general, I am waiting for a new decline in the British dollar in the expectation of building a fifth wave, which may become the final one for the entire downward trend segment.General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2246 mark, which corresponds to 127.2% Fibonacci, according to the MACD signals "down". However, I don't see a pound below this mark yet. From my point of view, the construction of a downward trend section is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it.

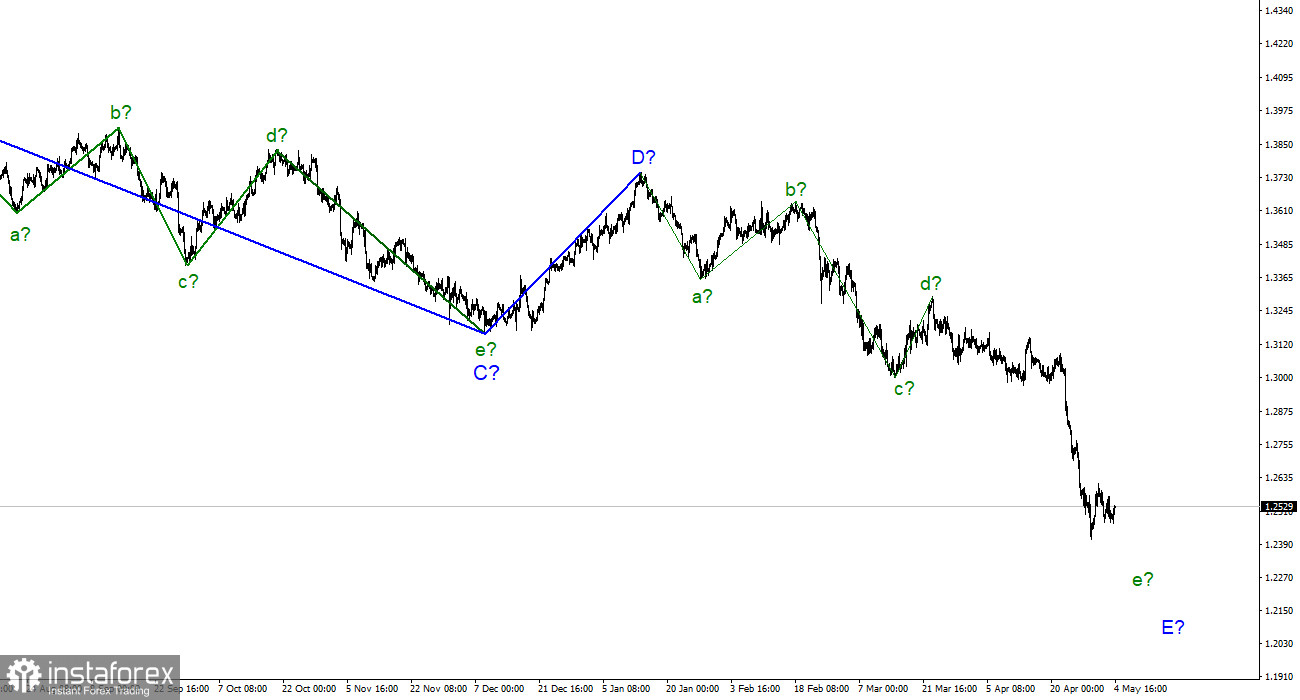

At the higher scale, wave D looks complete, but the entire downward trend section does not. Therefore, I still expect a continuation of the decline of the instrument with targets located around the 22nd figure. Wave E takes on a five-wave appearance but still does not look fully equipped. However, it already takes a little time to complete the complete set.