GBP/USD 5M

The GBP/USD currency pair was traded in different directions all day on Wednesday. In general, you can even call this movement a flat, but it is such on higher timeframes, for example, on an hourly one. It still looks more like a "swing" on the 5-minute frame. This nature of the movement did not bode well for traders, but one should take into account the fact that the results of the Federal Reserve meeting will be announced in the evening and the market may be nervous. There were no important statistics in the UK yesterday, and macroeconomic reports in the US did not affect the pair's movement in any way. The US dollar showed movements that absolutely did not coincide in time with the release of reports. Thus, now it remains to wait for the market to fully work out the results of the Fed meeting, and then the results of the Bank of England meeting. After this happens, the pound may be very far from the current price values. Or maybe even stay with them. In general, it is very difficult to predict. And even more so to trade at this time.

There were only three trading signals on Wednesday, but they were no better than trading signals for the euro/dollar pair. The price crossed the critical line three times, and all the signals (except the last one) were extremely inaccurate. However, one should not have tried to work out the last signal, since the previous two were false. And these signals can even be considered as one, because there was no clear consolidation below the critical line. As a result, the pair went up 18 points, which did not allow traders to even set Stop Loss to breakeven. There was a small loss on the trade.

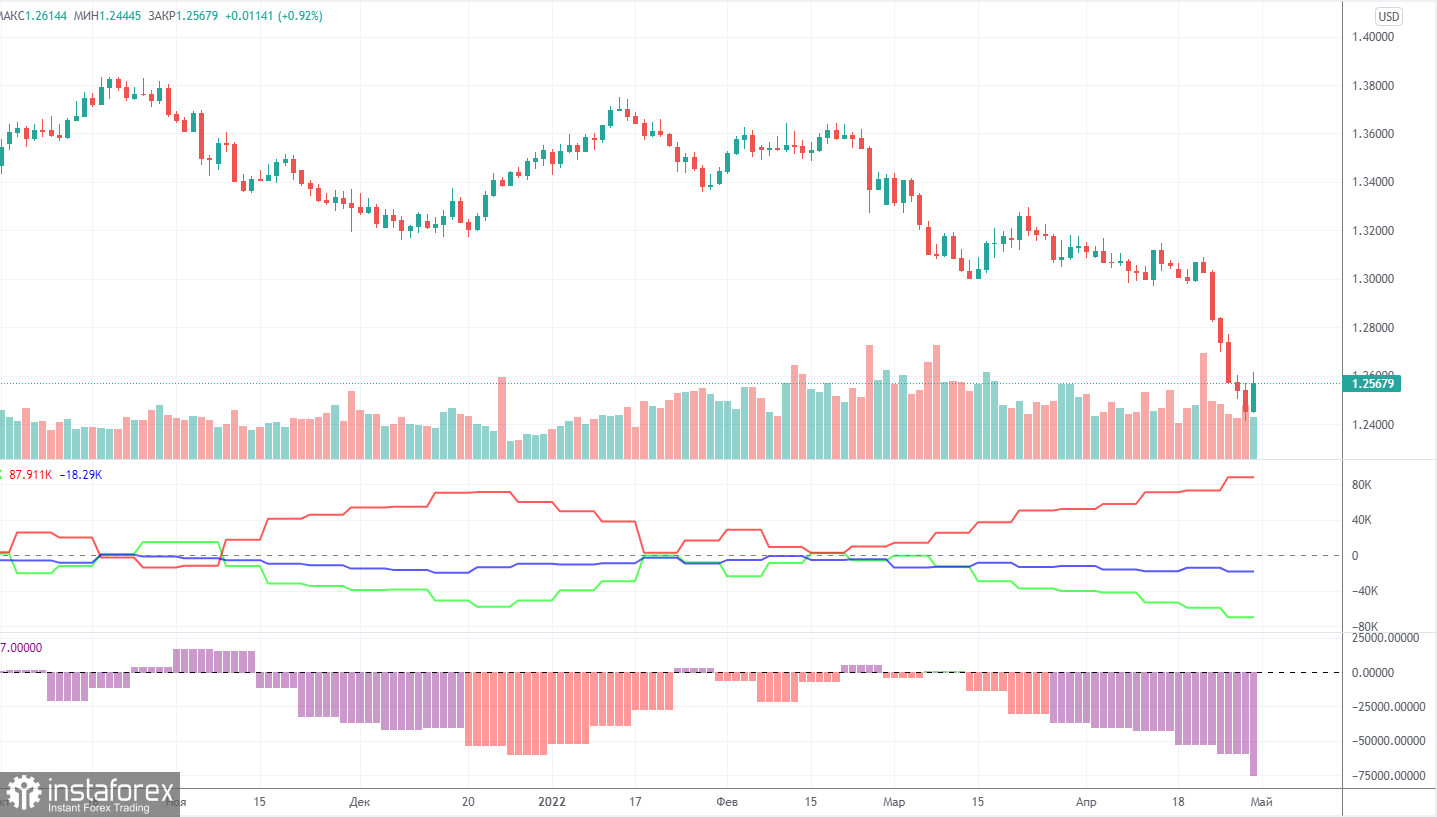

COT report:

The latest Commitment of Traders (COT) report on the British pound has witnessed a new increase in bearish sentiment among professional traders. During the week, the non-commercial group opened 3,600 long positions and 14,300 short positions. Thus, the net position of non-commercial traders decreased by another 11,000. Such changes are significant for the pound. The non-commercial group has already opened a total of 110,000 short positions and only 40,000 long positions. Thus, the difference between these numbers is almost threefold. This means that the mood among professional traders is now "pronounced bearish" and this is another factor that speaks in favor of the continuation of the fall of the British currency. Note that in the pound's case, the data from the COT reports accurately reflects what is happening in the market. Traders are bearish and the pound is falling against the US dollar. We do not see any reason to assume the end of the downward trend. COT reports, foundation, geopolitics, macroeconomics, technique, all speak in favor of the fall of the pound and the rise of the dollar. Of course, the fall of the pound/dollar pair cannot continue forever, there must be at least upward corrections, but so far, based on COT reports, we cannot assume when the downward trend will end.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 5. The European Union is preparing an oil embargo, but Europe is not sure about the effectiveness of this measure.

Overview of the GBP/USD pair. May 5. The UK is heading for nuclear power.

Forecast and trading signals for GBP/USD on May 5. Detailed analysis of the movement of the pair and trading transactions.

GBP/USD 1H

It is clearly seen on the hourly timeframe that the pound didn't even manage to correct normally after a strong fall. The pair was smoothly sliding down after the price bounced off the 1.2601 level, and it is impossible to predict where it will be by tonight. Therefore, we do not draw any conclusions now, except that the downward trend continues. We are waiting for the results of the BoE meeting. We highlight the following important levels on May 5: 1.2251, 1.2410, 1.2601, 1.2674, 1.2762. Senkou Span B (1.2749) and Kijun-sen (1.2512) lines can also be sources of signals. Signals can be "rebounds" and "breakthrough" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. As already mentioned, the results of the central bank meeting will be announced in the UK on Thursday, and we also have BoE Governor Andrew Bailey's speech. Obviously, these events can greatly affect the pair's movement. Nothing interesting in America today. But even without this, the pair can be traded very volatile during the day.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.