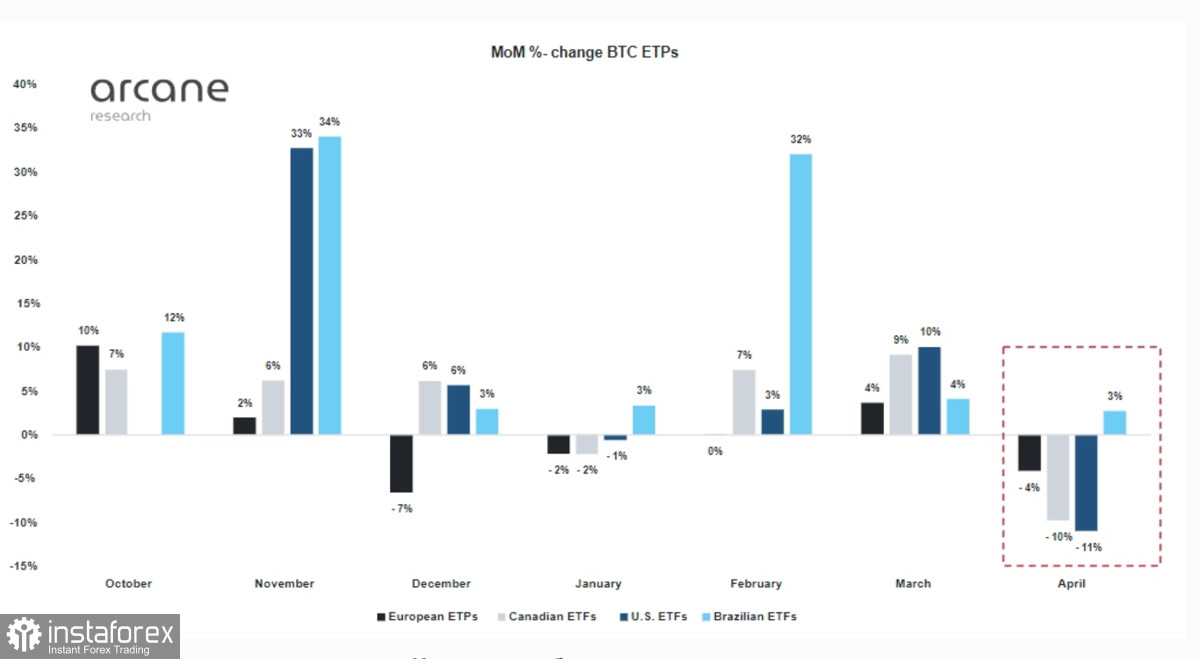

The Fed's decision locally eased the pressure on the stock market, thanks to which cryptocurrencies also began to grow. Over the past day, the total capitalization of digital assets increased by 4%. At the same time, the global situation remains disappointing for cryptocurrencies and Bitcoin. In April, the largest outflow of funds from crypto funds in history was recorded. At the same time, there is a massive profit-taking by long-term investors who are ready to break even for the sake of capital preservation.

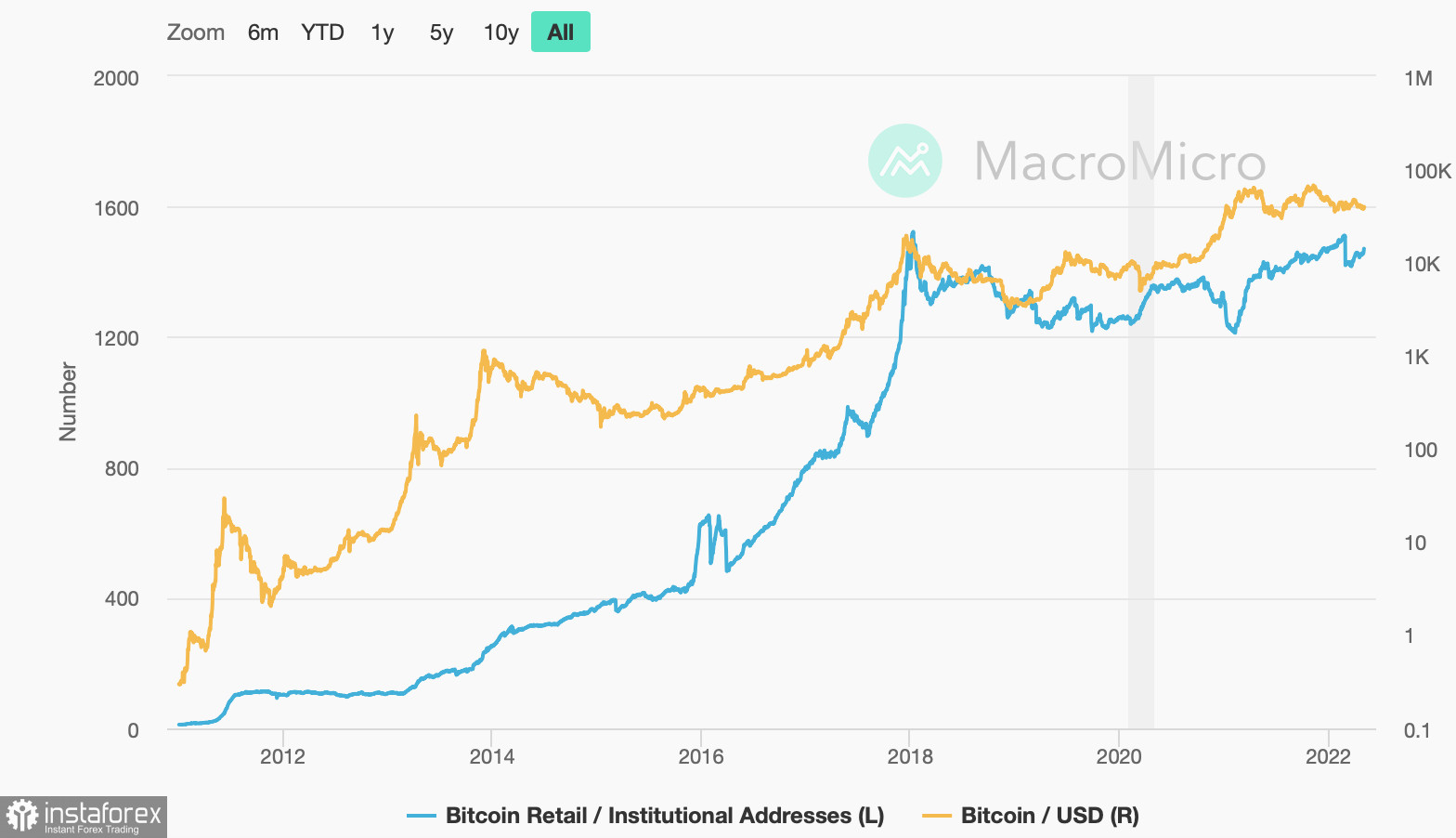

All these factors indicate that at the current stage, large investors are not attracted to investing in cryptocurrency products. The main focus of the institutional investors is on precious metals and products pegged to the US dollar. However, despite the frankly negative period in the history of cryptocurrencies, Bitcoin quotes remain above the key support zone of $37.4k. Over the past two years, we have become accustomed to the fact that the main driving force behind the bullish rally in Bitcoin is large institutional investors. And rightly so, because the dawn of the period of large investments in the crypto market coincided with the coronavirus crisis.

Between 2019 and 2021, the Fed issued significant amounts of US dollars to support the economy. During this period, about a third of all USD that is in circulation appeared on the markets. This led to a significant increase in the stock market, the capitalization of which exceeded the US GDP by 300%. The crypto market has also become a beneficiary of the Fed's policy, as the capitalization of all assets for the first time exceeded the $3 trillion level, and Bitcoin updated its maximum at $69k.

All of these facts suggest that the high-risk asset markets have been overinvested by the Fed's printing press. And in the middle of 2022, it is the stock and cryptocurrency markets that are paying for the uncontrolled level of inflation of the US dollar.

April became the apotheosis of the policy of reduction and redistribution of capital by large investors. According to Arcane Research, in April, the outflow of funds from crypto funds amounted to 14.3k BTC. This was the largest outflow of funds in history. However, despite this, Bitcoin is not flying headlong to the $30k mark. Instead, the cryptocurrency is holding solidly above the key $37.4k support zone. The strength of Bitcoin's position is associated with the increased presence of retail traders who hold cryptocurrency quotes. If we analyze the last bullish candles, we can see that the recovery volumes are extremely small, and this is directly related to the passivity of big capital.

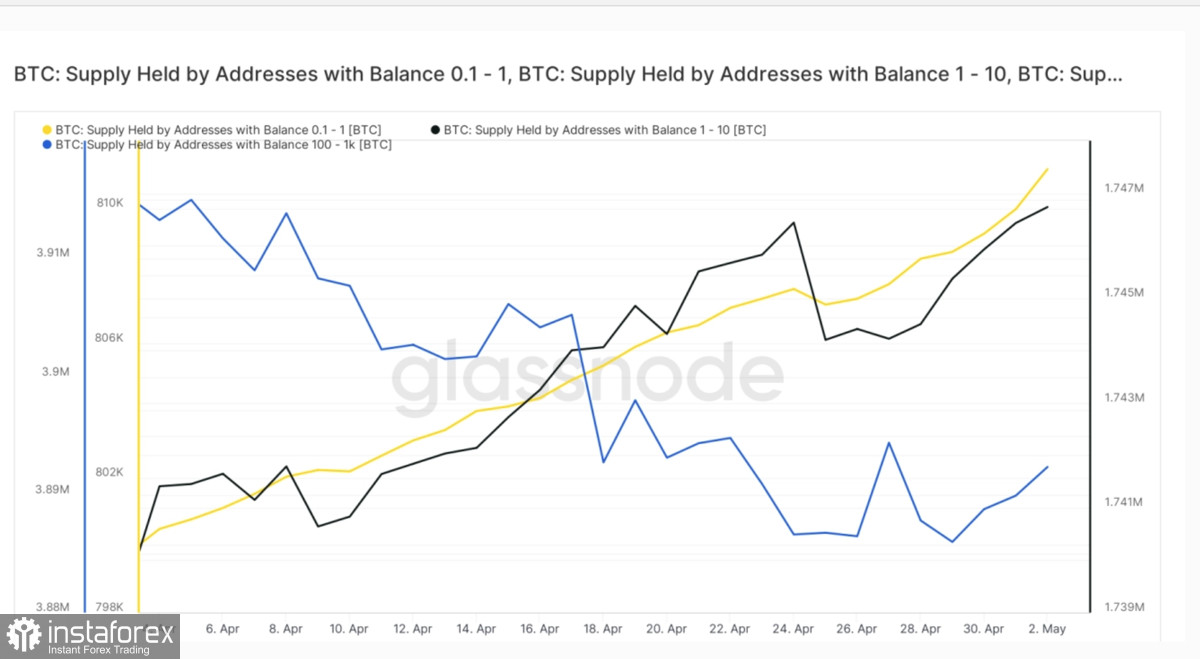

Retailers are trying to compensate for the outflow of funds from Bitcoin. Unlike big businesses, individual traders with balances between 0.1 BTC and 10 BTC increased their holdings in April to 2.5 million Bitcoins. This suggests that retail traders are actively using the main qualities of the coin in the current geopolitical and macroeconomic situation.

Taking into account the decisions taken by the Fed and the suspension of the current policy of large investors, it can be assumed that the current trend towards the accumulation of BTC on the balance sheets of all groups of investors will continue. However, a program to withdraw liquidity will start in June, which will have a negative impact on the institutional component of investments. In this case, retail traders will remain the only obstacle to updating the local bottom.

However, as of April 5, the market is breathing out due to the liberal rate hike and the postponement of the start of the quantitative tightening program. The asset has formed a "bullish engulfing" pattern and is trying to break through the $40k level and gain a foothold above it. On the 4-hour chart, BTC/USD is trading around $40k but is losing momentum.

The RSI and the Stochastic Oscillator turned sideways, indicating increased selling pressure in the $40k area. Despite this, the 4h MACD has formed a bullish crossover and is moving in the green zone, which is a positive signal. However, this metric on the daily timeframe moves without changes, which indicates the absence of a short-term trend development. This means that the impulsive breakthrough against the backdrop of a positive outcome of the Fed meeting will soon be exhausted.