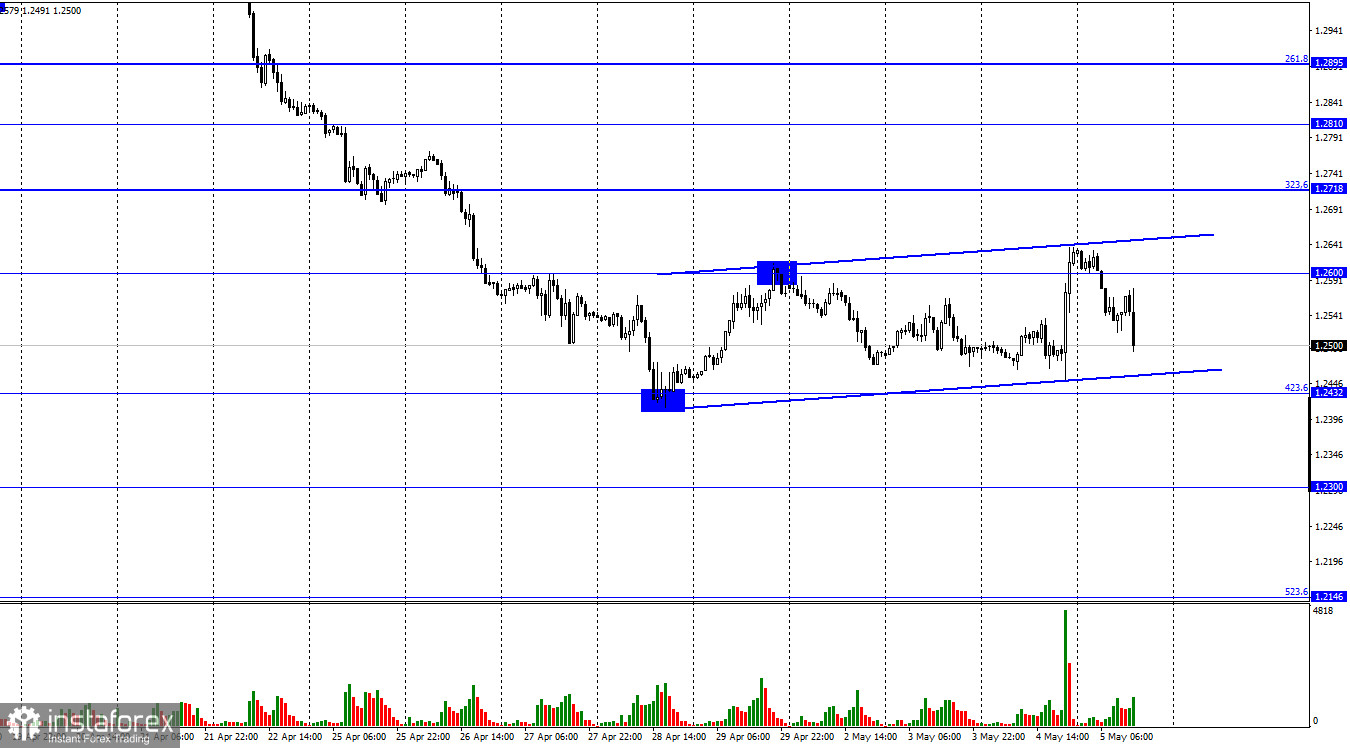

According to the hourly chart, the GBP/USD pair on Wednesday performed an increase to the level of 1.2600 and even fixed above it as part of the reaction to the results of the FOMC meeting. Already today (even before the results of the Bank of England meeting), the pair performed a reversal in favor of the US currency and began a new fall in the direction of the corrective level of 423.6% (1.2432). And when it became known about the interest rate increase for the fourth time in a row, the British collapsed. As a result, we have two rate hikes from the Fed and the Bank of England, and each time the currency reacted to this tightening of the PEPP by falling, which is illogical. Unfortunately, such situations happen in the market. Last night, the dollar had no reason to fall, since Jerome Powell's rhetoric cannot be called "dovish". There was no reason for the pound to fall today, as the Bank of England tightened the PEPP. Therefore, traders have been trading the pair on the last day, not as the majority expected.

On the other hand, if everything were logical, the dollar would have grown yesterday, and today the British would. And in general, we would get approximately the same picture as we are seeing now. I would like to note that the fourth consecutive rate hike by the British central bank was not a surprise to anyone, since this was the decision that traders were waiting for. Thus, it is difficult to say why the British fell by 150 points in half an hour (that's how much at the time of writing the review). But we were all waiting for the high activity of traders on Wednesday and Thursday. What we waited for, we got. Today, it became possible to form an upward trend corridor, but within the next hour, quotes can consolidate under it. And at the same time, under the corrective level of 423.6%, near which the fall ended last time. Thus, both the euro and the pound may continue the process of falling in the near future. At least, that's what it's all about now.

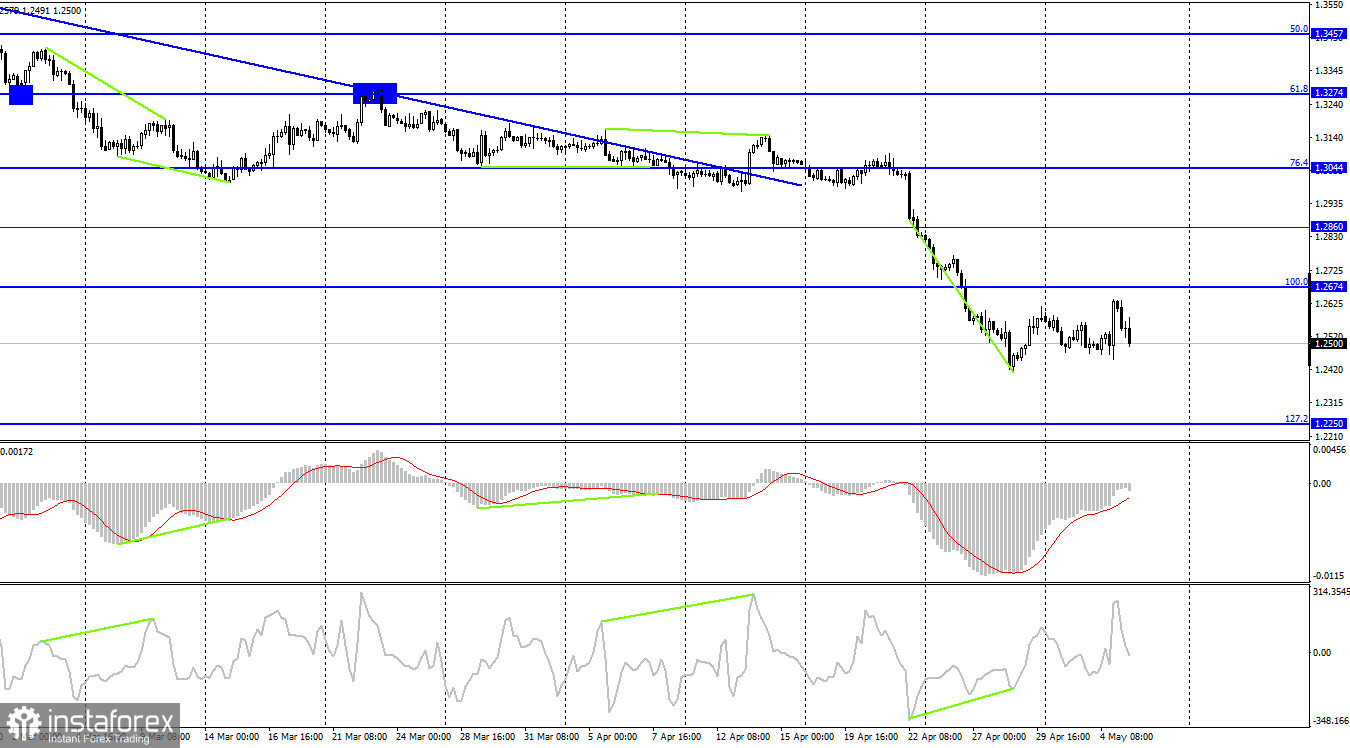

On the 4-hour chart, the pair performed a reversal in favor of the US currency and began a new process of falling towards the corrective level of 127.2% (1.2250). As part of the latest growth, the British failed to grow even to the nearest level of 100.0% (1.2674). Two meetings of central banks did not confuse the cards for traders, they just led to strong volatility. But now everything is slowly returning to its place.

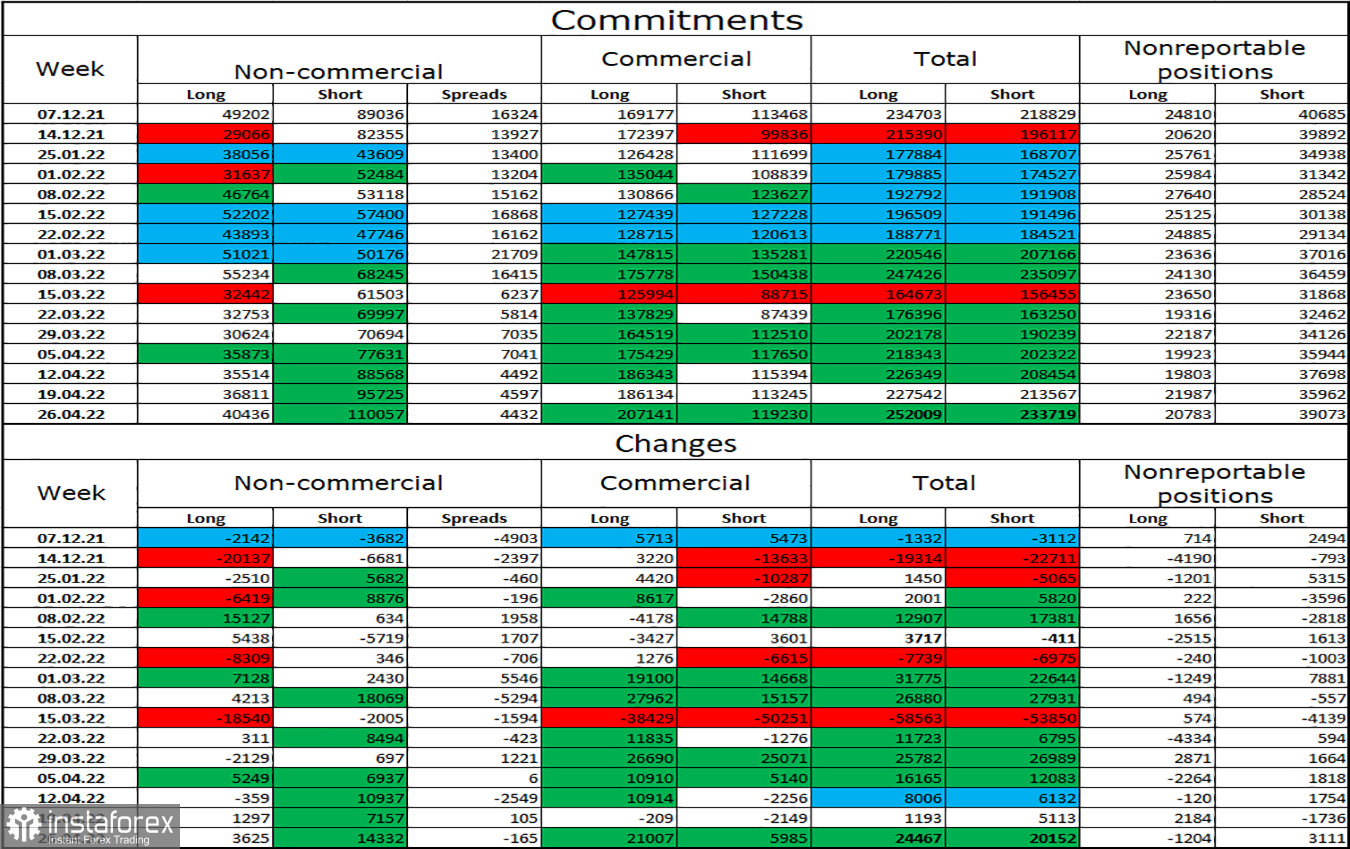

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot again over the past week. The number of long contracts in the hands of speculators increased by 3,625 units, and the number of short - by 14,332. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 2.5 times more than shorts (11,0057-40,436). The big players continue to get rid of the pound. So I expect the pound to continue its decline over the coming weeks. Other factors are talking about the fall of the pound sterling, but still, the pound is a pretty strong currency, so I would not bury it hopelessly.

News calendar for the USA and the UK:

UK- the decision on the main interest rate of the Bank of England (11:00 UTC).

UK - summary of monetary policy (11:00 UTC).

UK - Bank of England Governor Andrew Bailey will deliver a speech (11:30 UTC).

On Thursday, the results of the Bank of England meeting were already announced in the UK. The pound has already fallen by 150 points. Now it remains to wait for Andrew Bailey's speech, but now we can say that the information background has had a very strong impact on the mood of traders today.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British with a target of 1.2300 at a close below the level of 1.2432 on the hourly chart. Purchases of the British can be started with a clear rebound from the level of 1.2432 with a target of 1.2600.