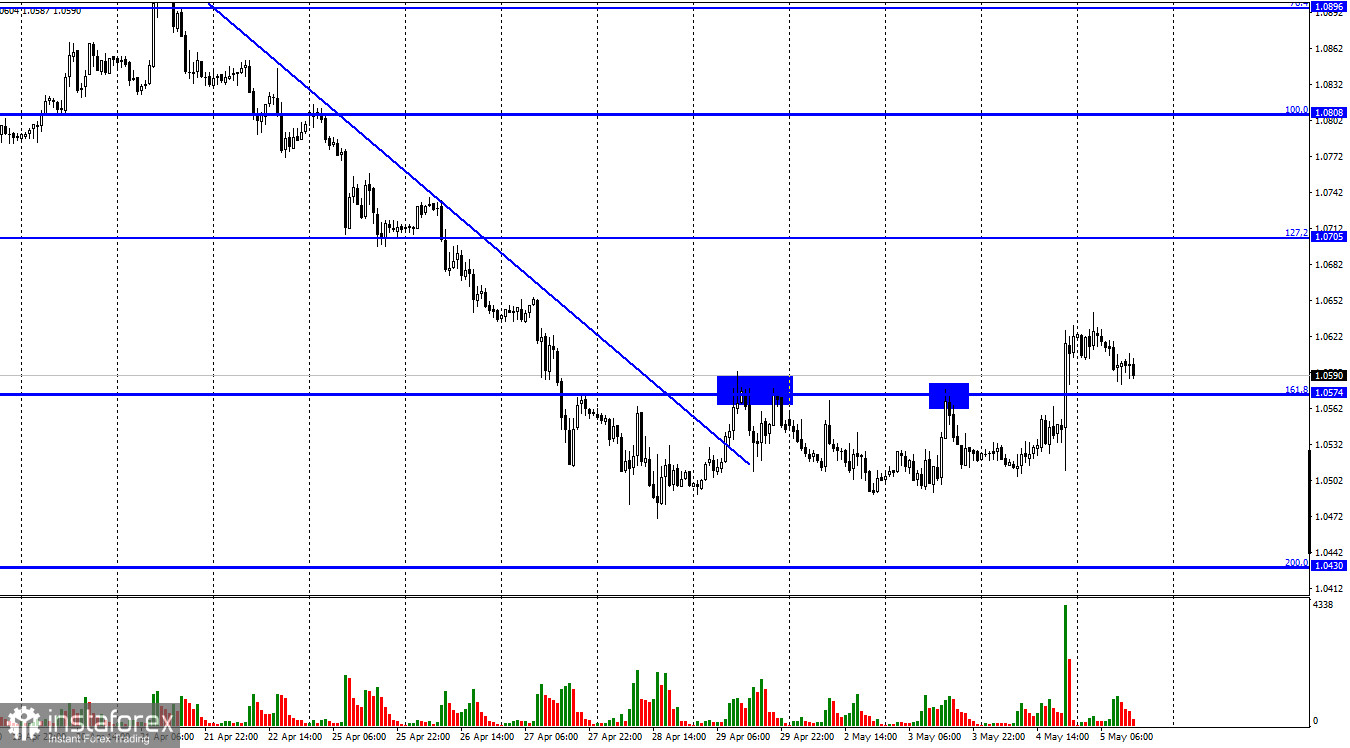

The EUR/USD pair on Wednesday evening performed a consolidation above the corrective level of 161.8% (1.0574) and a slight increase. However, this morning, a reversal was made in favor of the US currency, and the process of returning to the level of 1.0574 began. Consolidation under it will increase the probability of a new fall of the euro in the direction of the corrective level of 200.0% (1.0430). It remains only to figure out why there was growth yesterday because it was yesterday evening that the FOMC announced the results of the meeting. I should immediately note that, from my point of view, there was no logic in the behavior of traders. The Fed raised the interest rate by 0.50%, which was fully in line with traders' expectations. The decision to gradually unload the Fed's balance sheet, which has grown to almost $ 9 trillion during the pandemic, was also announced. This is exactly the kind of decision that traders were counting on. And these decisions should be recognized as "hawkish". Let me remind you that the Fed has not raised the rate by 0.50% since 2000.

Moreover, Jerome Powell said that in June and July, the regulator will also consider the possibility of an increase of 0.50% at once, without excluding the option of an increase of 0.75%. If these are not "hawkish" decisions and not "hawkish" rhetoric about the Fed president, then what? What did the traders expect? The fact that the rate will be raised immediately by 1% and promise to raise it by 1% at the next two meetings? After all, the rate is not a QE program. It cannot be raised constantly or very quickly. Imagine if, at the very beginning of the pandemic, the Fed immediately printed $ 4 trillion and threw it on the market. That's the whole point, that it is necessary to change the parameters of the monetary policy carefully so that the markets can adjust to the new conditions and not experience a shock. The stability of markets is also one of the tasks of the central bank. But traders reacted as if the Fed had promised to raise the rate by 1% immediately over the past month, and then abandoned this option. Thus, I believe that the fall of the euro currency will resume today or tomorrow, and the pair will return to its low, which is visible in the picture above.

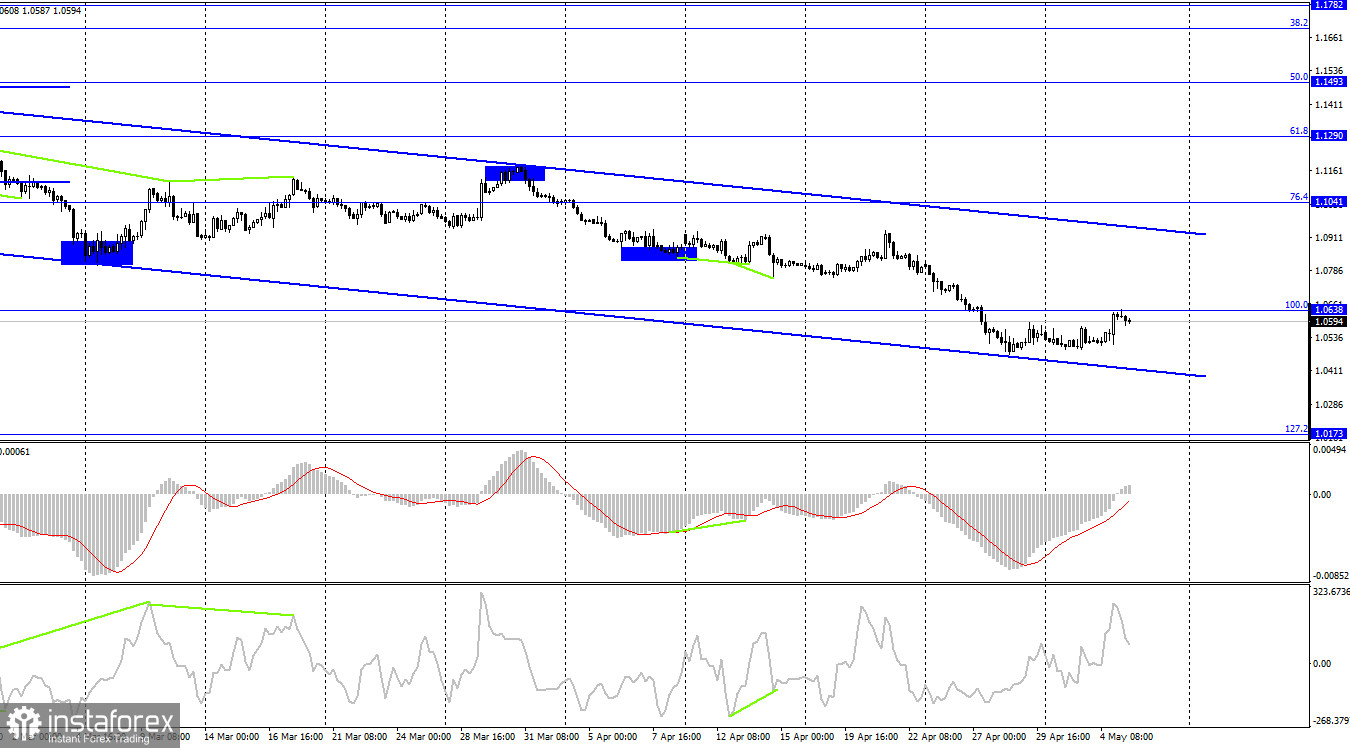

On the 4-hour chart, the pair performed a return to the corrective level of 100.0% (1.0638). A rebound from this level will work in favor of the US currency and the resumption of the fall in the direction of the Fibo level of 127.2% (1.0173). From my point of view, the probability of a rebound is very high. Yesterday's "strong" growth is almost invisible on the 4-hour chart. The downward trend corridor continues to characterize the mood of traders as "bearish".

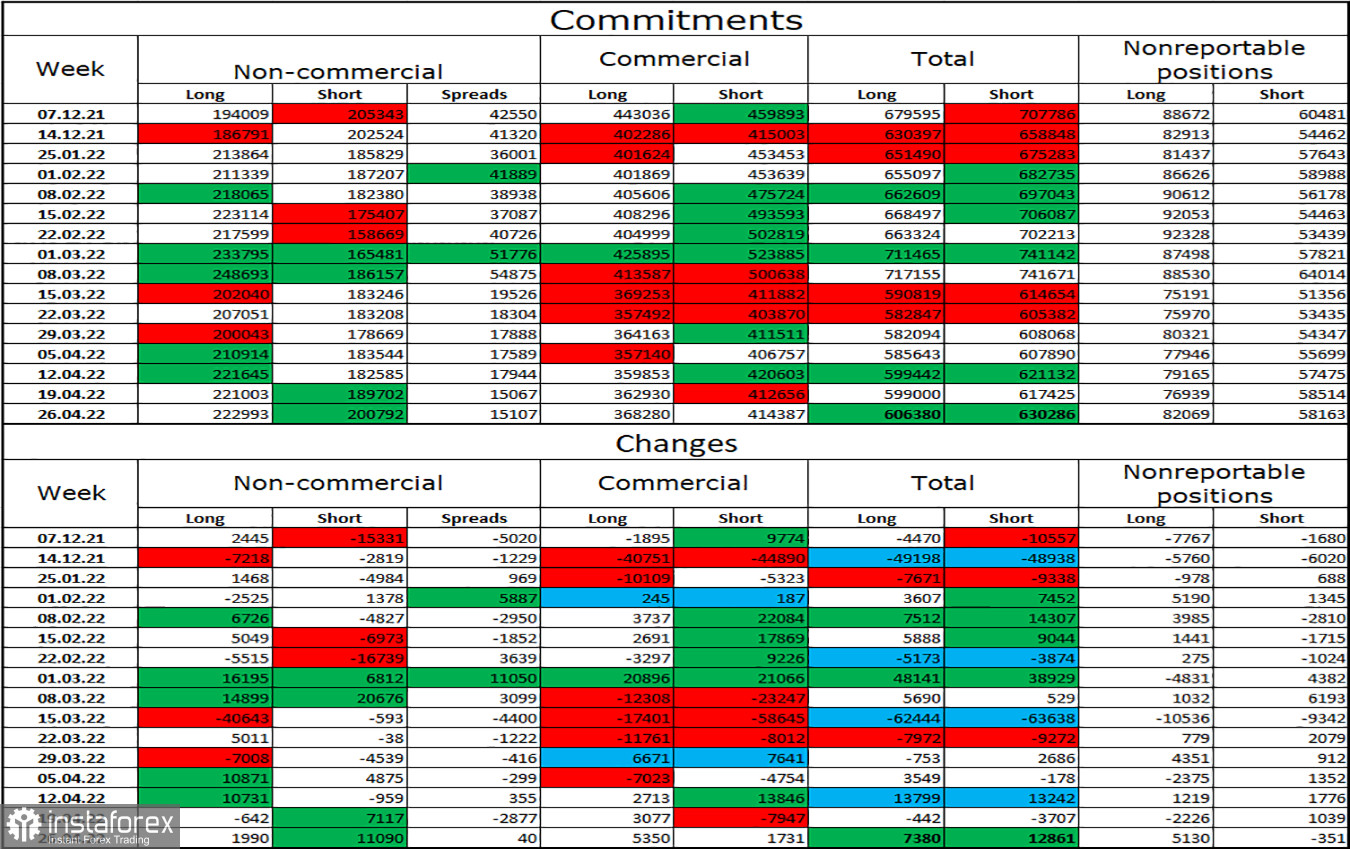

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 1,990 long contracts and 11,090 short contracts. This means that the bullish mood of the major players has weakened again, for the second week in a row. The total number of long contracts concentrated on their hands now amounts to 223 thousand, and short contracts - 201 thousand. Thus, in general, the mood of the "Non-commercial" category of traders is still characterized as "bullish", and with such data, the European currency continues its decline in pair with the dollar. As I have already said, the COT data indicate that the euro should grow, and this pattern has persisted over the past few months. Thus, it is impossible to draw adequate conclusions from the COT reports now. A very strong influence on the mood of traders is the possible continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position.

News calendar for the US and the European Union:

On May 5, the calendars of economic events in the United States and the European Union are empty. The information background today will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if a close is made under the 1.0574 level on the hourly chart with a target of 1.0430. I recommend buying a pair if there is a rebound from the 1.0574 level with a target of 1.0705.