Markets will continue to evaluate the US central bank meeting and Federal Reserve Chairman Jerome Powell's comments in the coming days. In principle, nothing unexpected happened – neither in the decision on the rate (a decrease of 50 bp), nor in Powell's final speech. The fact that the Fed will not lower rates more aggressively at the next meetings confused traders a little, hoping for a rate increase of 75 bps at the next meeting, hence this first reaction in the dollar – a decline.

Why did the Fed start sounding softer? Perhaps the weak quarterly GDP data acted as a deterrent. It is possible that officials are alarmed by the swelling foreign trade deficit, and this may be perceived as evidence of a decline in the competitiveness of American goods. There may be many reasons, the markets have only to guess about their existence.

In the meantime, investors will use the fact itself, that is, a softer approach by the Fed than previously announced. Against this background, US stocks and bonds are likely to adjust after the collapse of April, when the central bank's tough scenario was put into prices.

Has the Fed really become softer? This is also an open question, depending on which side to look at it from. In general, the Fed was not particularly tough initially, the markets were just waiting for a more aggressive attitude from the central bank. Expectations were so strong that at the moment investors began to perceive them almost as a fait accompli. At the same time, the Fed remained methodically soft. This is a moderately positive factor for the stock market.

The dollar is more difficult. It's not just a matter of raising the rate, which is fully embedded in the quotes, and less aggressive rhetoric of the central bank. The position of other central banks in the world in comparison with the Fed is important. The picture here is as follows: the US central bank remains tougher than its main competitors – the European Central Bank, the Bank of Japan and the Bank of England. By the way, the latter today is expected to raise the rate by 25 bps, despite commensurate inflation and a fairly strong labor market.

Thus, a symbolic pullback in the dollar index will again be followed by a growth momentum. This is noticeable already in the current session, the greenback almost played back the fall of Wednesday. Other major world currencies are unlikely to be able to outpace the dollar until their countries gain a similar or greater speed compared to the Fed.

The resumption of the growth of the US currency index may lead to a retest of the peak of 2022. On Thursday, the indicator is hovering around 103.50. The price movement indicates some consolidation before a potential breakthrough of the peak level. The next barrier is the mark just below 104.00, then the high on December 11, 2002 at 105.63.

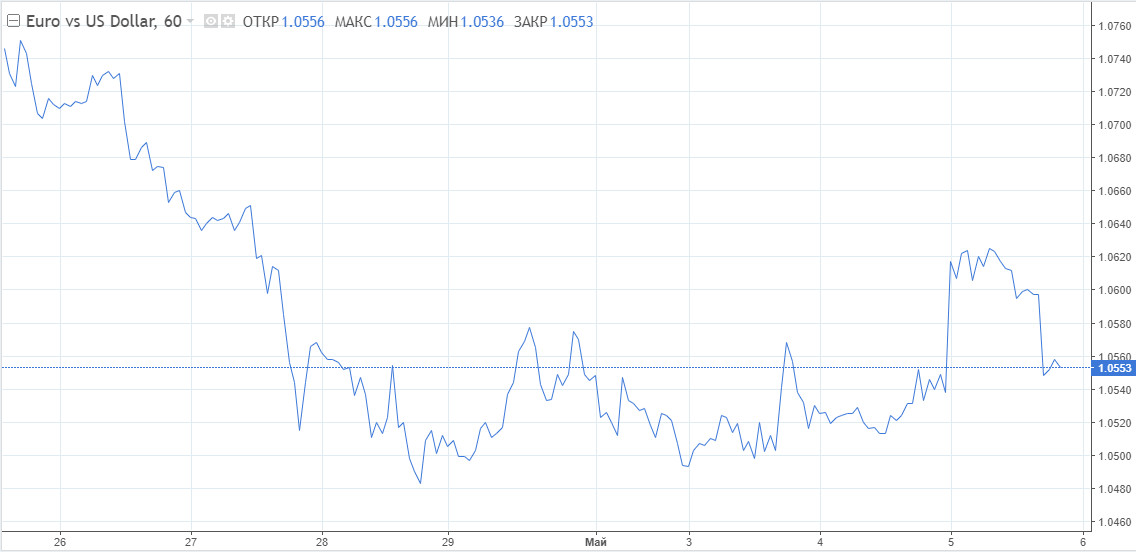

The EUR/USD pair, in the context of yesterday's dollar decline, began to count on a recovery above the 1.0600 mark. The quote partially rolled back on Thursday, approaching the levels at which it was before the Fed meeting.

In general, the resumption of an upward correction in the short term should not be ruled out. If the main Wall Street indices suffer big losses at the end of the trading day, the dollar will rise further, offsetting the possibility of EUR/USD growth. In the absence of risk aversion in the markets, it will not be easy for the dollar to attract investors.

The main short-term support is the 1.0560 mark. If the pair stays above this level, the next recovery target can be considered 1.0660, and then 1.0700.

Thursday's close below 1.0560 is seen as a negative signal for the euro, and next week the EUR/USD pair will resume its decline to the 1.0500 mark to begin with.

A bearish scenario still looks more likely. After falling to the 5th figure, one should not rule out another test of the 2022 low around 1.0470. Next, there may be a breakthrough towards the value of 1.0340. This is the low of April 2017.