The main data in the US labor market will be published on Friday. In the light of recent events, Nonfarm is of particular importance - perhaps it will help the dollar recover faster after yesterday's failures. After all, despite the hawkish results of the Federal Reserve meeting, the greenback sank throughout the market, becoming a victim of traders' overestimated expectations. In particular, the EUR/USD jumped to 1.0640 (the Tenkan-sen line on the daily chart), reflecting the general weakening of the US currency. However, the upward momentum quickly faded away. Today, the price is slowly slipping to the previous price levels, so far - to the middle of the 5th figure. Tomorrow's Nonfarm may significantly increase the pressure on the pair.

Let me remind you that at the final press conference, Fed Chairman Jerome Powell spoke not only about inflation. He paid a lot of attention to the US labor market, especially the salary issue. According to him, "wages are quite important, so it is very important that they grow." Indeed, according to previous Nonfarm, the level of average hourly wages rose in March to 5.6% (on an annualized basis) and to 0.4% (on a monthly basis). Both components came out in the green zone. And according to the forecasts of most experts, the April "salary" figures will also please the dollar bulls. The level of average hourly wages following the results of last month should rise to 5.7% year on year. On a monthly basis, the indicator should remain at around 0.4%.

If Nonfarm comes out at least at the predicted level in this part (not to mention the green zone), the dollar may receive significant support. Again, returning to Powell's statements, we should highlight his phrase that "wages are an eloquent illustration of how high the demand in the labor market is."

However, the April unemployment rate should also please the EUR/USD bears. According to most economists, this figure will fall to 3.5%. Compared to the March indicator, the decline is minimal (the previous value was 3.6%), but the trend itself is important here: the indicator has been declining for many months, reaching two-year lows (at 3.5% unemployment was in January 2020 ). Let me remind you that when even a five percent level is reached, the employment situation in the United States is traditionally considered favorable.

In other words, if unemployment and wages come out tomorrow at least at the predicted level, the US currency will more than regain the lost points. And above all - against the euro, which is under the yoke of "its own" problems.

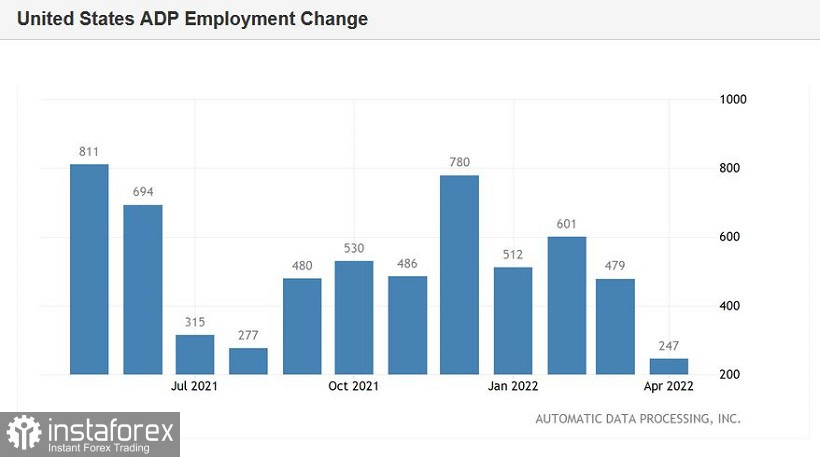

At the same time, the increase in the number of people employed in the non-agricultural sector may be in the red zone. According to preliminary forecasts, 390,000 jobs were created in this area in April. In the private sector of the economy - 400,000. But here it is necessary to make a reference to the report from the ADP agency, which was published just yesterday. According to their data, the US economy has created only 247,000 jobs in the private sector. The ADP report, as you know, is a kind of "petrel" in anticipation of the release of official data. Therefore, this component of Nonfarm may disappoint tomorrow.

Nevertheless, if the other key components of the official report (unemployment rate, wage growth) do not fail, then traders may well turn a blind eye to the relatively weak increase in the number of employees in April. By the way, here we need to remember another comment from Powell, which is quite interesting in the light of tomorrow's Nonfarm: "the central bank needs to balance the demand for labor and its supply, we do not have a specific goal for the "correct" number of vacancies."

Thus, tomorrow's release may provide significant support to the US currency - but on condition that the main components of the report come out at least at the forecasted level. In this case, the likelihood of another 50-point Fed rate hike (in June) will increase significantly.

Meanwhile, the European Central Bank continues to demonstrate its hesitant stance on raising interest rates. In particular, today ECB Governing Council member Fabio Panetta said that "it would be extremely imprudent to make a decision on rates before we see data for the second quarter of this year." Over the weekend, a similar position was voiced by ECB Vice President Luis De Guindos. In turn, the chief economist of the central bank - Philip Lane - completely refused to talk about the time frame, saying that "the exact timing of the rate increase is not so important now." In general, the majority of ECB representatives are not ready to force things, although some of them call for an increase in the interest rate following the results of the July meeting. But even in this case, the divergence of the positions of the ECB and the Fed will not go anywhere, putting pressure on the EUR/USD pair.

Summarizing what has been said, it should be noted that at the moment it is still risky to go into longs or shorts: Nonfarm can bring surprises, strengthening the tactical position of one side or another. But if tomorrow's report does not disappoint (especially in terms of unemployment and wages), the downward outlook for EUR/USD will sparkle with new colors, at least in the context of settling within the 1.0450-1.0550 range.