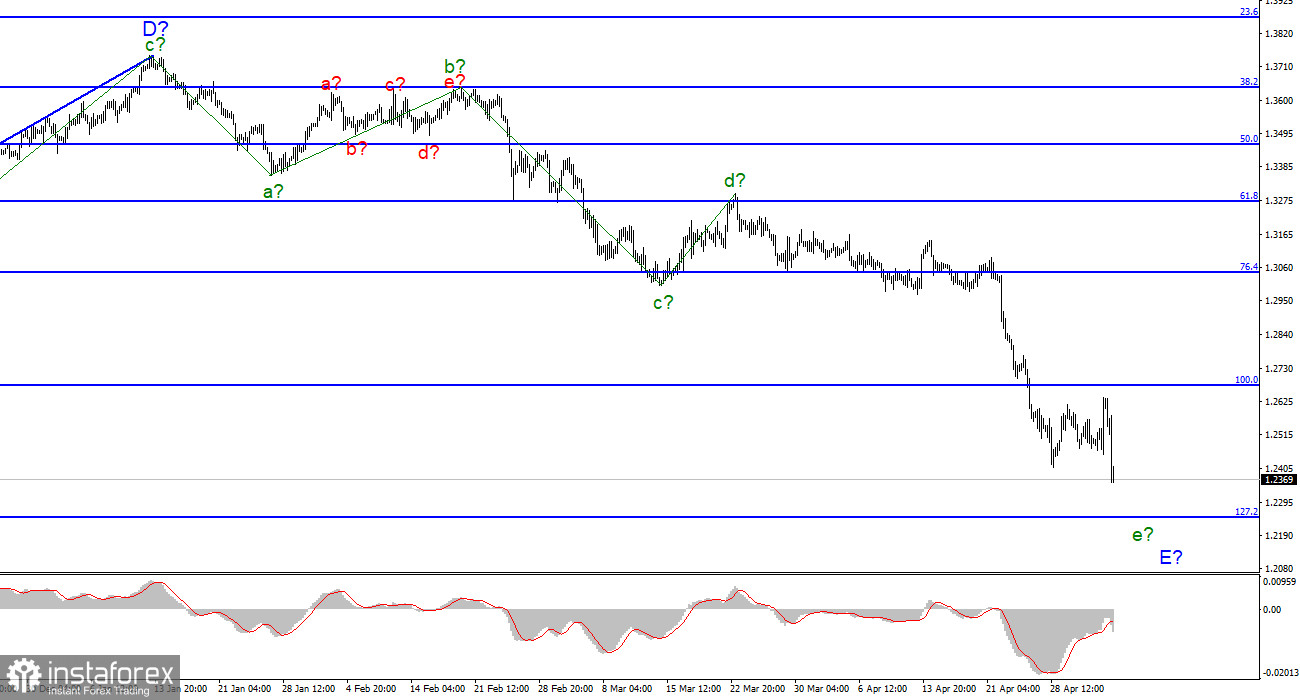

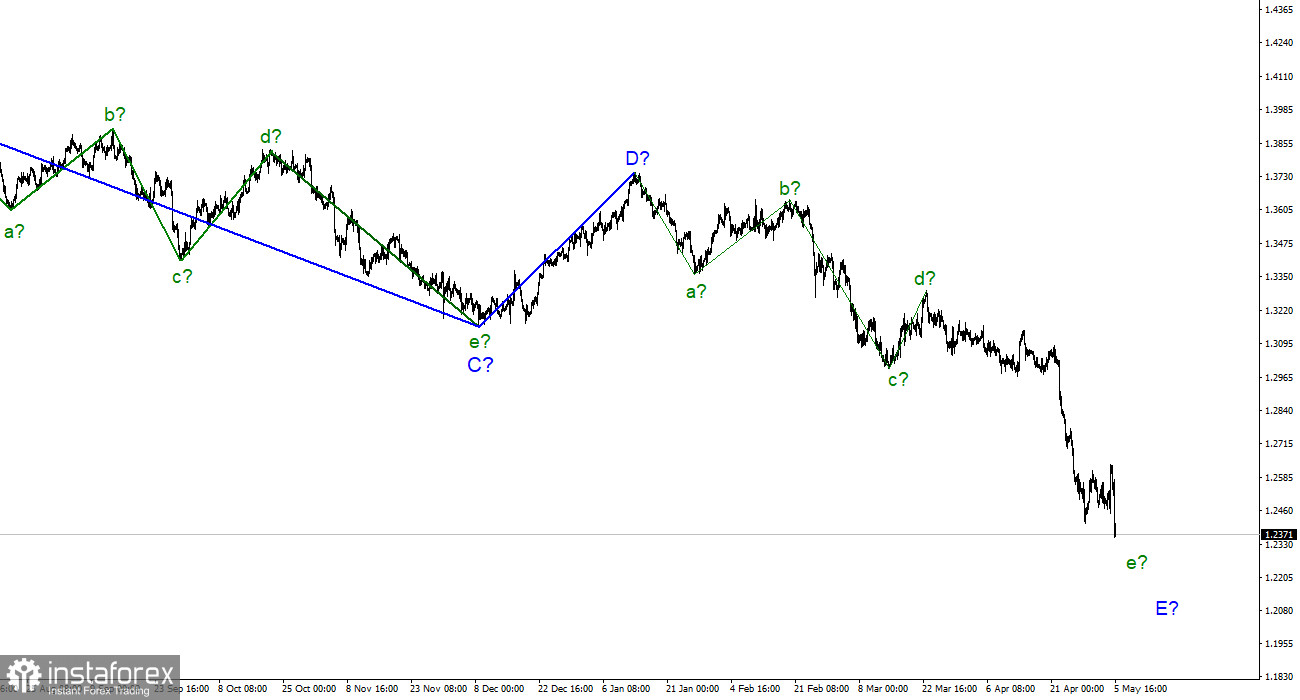

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend continues its construction within the framework of the wave e-E, and its internal wave marking looks quite difficult - correction waves are practically not visible in it, so it is very difficult to determine which internal wave is being built at this time. Presumably, the construction of wave 5-e-E has begun today, which may be the last for the downward trend segment. If this is true, then we get almost the same wave markings for the British and the Europeans. The entire site is either nearing completion of its construction or will have to take a much more complex and extended form. The meetings of the Bank of England and the Fed as a result led to a new decline in demand for the British. The geopolitical background remains difficult, but if the current wave marking does not become more complicated, then the decline in the British dollar may end within a week.

For the pound, everything started well but ended badly

The exchange rate of the pound/dollar instrument decreased by 265 basis points on May 5, although it increased by 135 a day earlier. The amplitude of movements was very high these days. The pound had a good chance of a further increase, as the Bank of England decided to raise the interest rate to 1%. Nevertheless, the demand for the pound has dropped very much today, which looks strange from the news background, but is correct from a wave point of view. I would also like to mention Andrew Bailey's speech, most of which was devoted to inflation issues. The governor of the Bank of England said that the Ukrainian-Russian conflict and lockdowns in China worsen the already bad situation with supply chains, and increase the growth of prices for food, and energy resources, which pull up prices for all other categories of goods and services. Thus, it is unlikely to expect a significant decline in inflation in the coming months, although both Powell, Lagarde, and Bailey are talking about a slowdown to one degree or another.

Tomorrow, we will all have an equally interesting day. If there is almost no news in the UK and the European Union, then an important report on the labor market will be released in America - Nonfarm Payrolls. There will also be data on the unemployment rate and wages. I can't say what the movement will be tomorrow (although according to the wave marking, it is a decrease), since the reports are very important, and it is impossible to predict what their values will be. You should also take into account the strong decline in the quotes of the instrument today, which on Friday may lead to an upward pullback. One thing is for sure - the market activity will probably be very high again. Starting today, the construction of a downward trend section can be completed at any time. However, while the demand for the pound is only decreasing, and if American statistics are better than market expectations tomorrow, the instrument may fall by another 100 points.

General conclusions

The wave pattern of the pound/dollar instrument still assumes the construction of wave E. I continue to advise selling the instrument with targets located around the 1.2246 mark, which corresponds to 127.2% Fibonacci, according to the MACD signals "down". I don't see a pound below this mark yet. From my point of view, the construction of a downward section of the trend is nearing its completion and the mark of 1.2246 looks very good for the trend to end right around it.

At the higher scale, wave D looks complete, but the entire downward section of the trend does not. Therefore, I still expect a continuation of the decline of the instrument with targets located around the 22nd figure. Wave E takes on a five-wave appearance but still does not look fully equipped. However, it already takes a little time to complete the complete set.