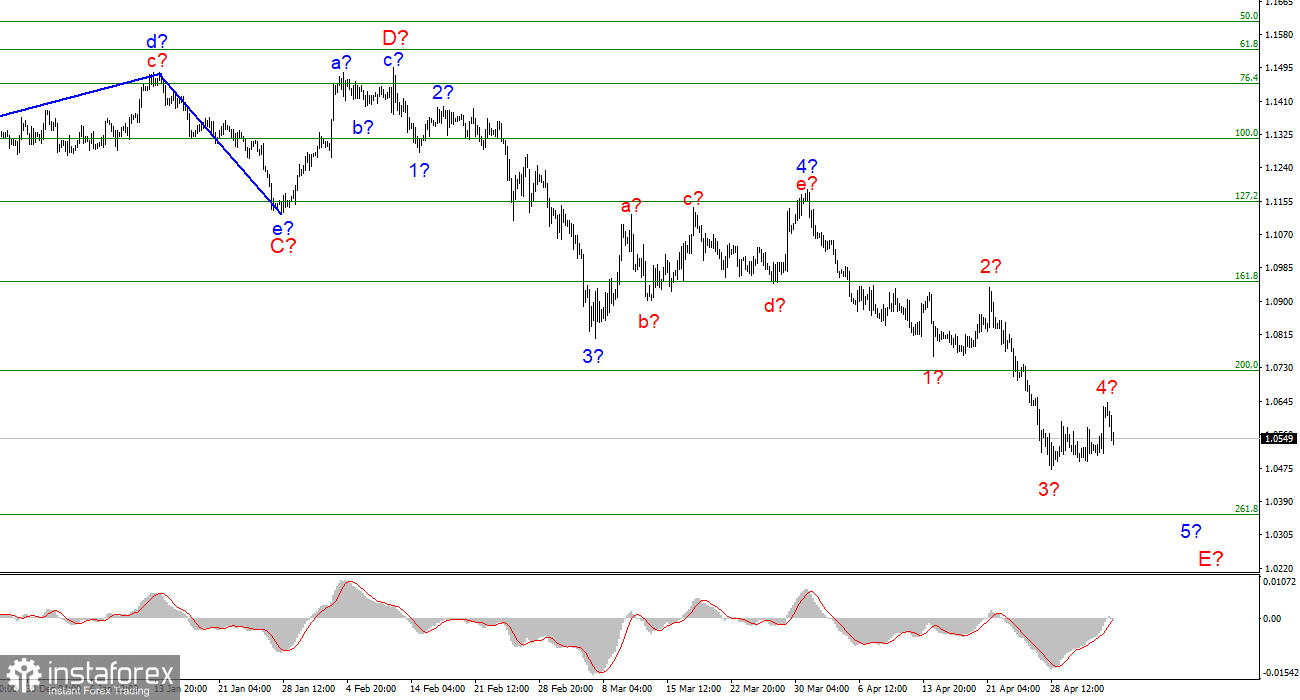

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may continue for another week, since this wave turns out to be a five-wave in its internal structure. At the moment, four internal waves are visible inside this wave, so I'm counting on building another pulse wave. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and there only 350 basis points will remain to price parity with the dollar. Presumably, the construction of the current downward wave and the entire downward section of the trend can be completed near this mark. If the breakout attempt of 1.0355 turns out to be successful, the instrument will further complicate its wave structure and continue to decline.

The results of the FOMC meeting did not help the dollar immediately, but a corrective wave was built.

The euro/dollar instrument rose by 100 basis points on Wednesday. Most of this movement occurred in the evening when the results of the meeting of the Fed's monetary policy committee became known in America. As the market expected, the interest rate was raised by 50 basis points. It was announced that starting from June 1, the Fed's balance sheet will be reduced by $ 47.5 billion per month. In three months, the quantitative tightening program will be accelerated to $ 95 billion per month. Although these results can hardly be called "dovish", the demand for the US currency has decreased. But, as it turned out today, not for long. On Thursday, the instrument declined by 75 basis points, having won back almost all the losses of the previous day. Therefore, from the wave point of view, everything turned out almost perfectly. Now wave 4 is very clearly visible, and the instrument is ready to build the fifth pulse wave. Thus, practically nothing has changed for the US currency.

I assume that the decline in demand for the dollar on Wednesday evening was because the market expected a faster transition to quantitative tightening. Over the past month, a reduction of $ 95 billion per month from June 1 has been actively discussed. However, the Fed decided not to rush into bond sales and halved the estimated volume. Whatever it was, the demand for the dollar has recovered anyway, so it doesn't matter now. It is important that the FOMC has not retreated from its plans to tighten monetary policy. Jerome Powell said that the interest rate could be raised in June and July by another 1%. That is, in the middle of summer, it may already be 2%. And by the end of the year to exceed 2.5%, which is now considered neutral. Securities from the Fed's balance sheet will also be actively sold off. At almost the same pace (after 4 months) as they were previously bought up. All this should lead to a slowdown in inflation, but many analysts doubt that inflation will fall at the same pace as the Fed tightens the PEPP.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". The construction of the proposed wave 4-5-E may have already been completed.

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which turns out to be as long as wave C. The European currency will still decline for some time.