The market rally after the Fed meeting faded quickly after the Federal Reserve announced that it is not considering a 75 basis point rate hike at the June meeting.

The yield on 10-year US Treasury bonds rose to 3.09%, reaching its highest level since 2018, while the US dollar index soared to 103.84 on Thursday, nearing new 20-year highs.

In response, gold lost almost all of its daily gains, and bitcoin collapsed by 7%:

Stocks also sold off, with the Dow down 3.4%:

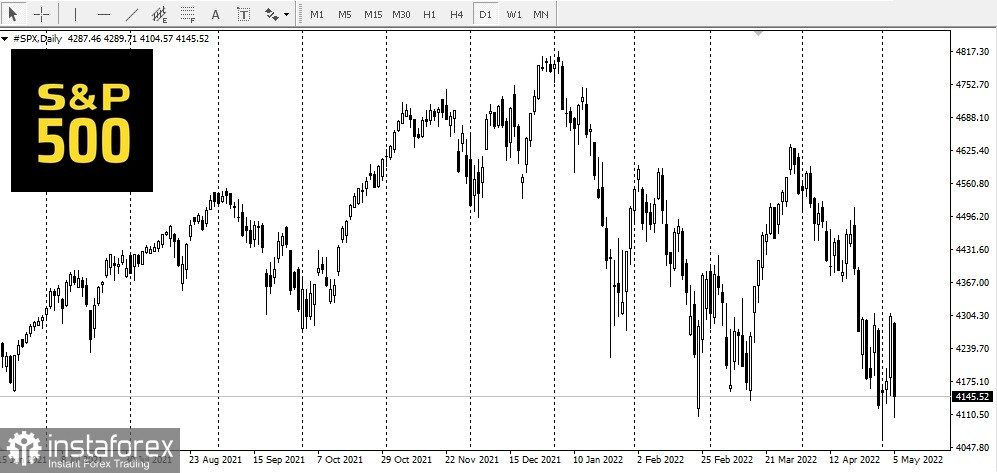

S&P 500 — by 4%:

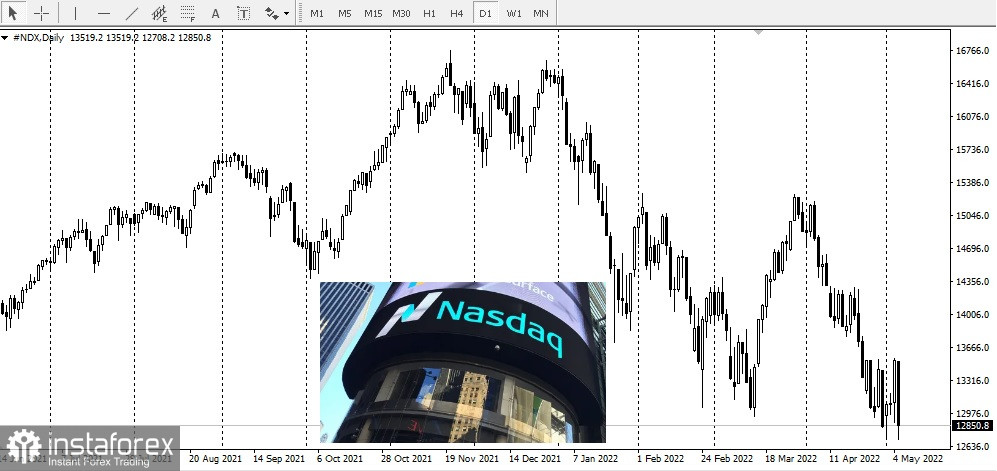

Nasdaq — by 5.2%:

Analysts say the massive sell-off was triggered by market fears that the Federal Reserve would not be able to fight inflation without triggering a recession.

On Wednesday, the Fed raised rates by 50 basis points, the biggest rate hike since 2000.

Fed Chairman Jerome Powell said the US economy has already strengthened to conduct a tighter monetary policy.

"We raised by 50 bps today, and there is a broad sense within the committee that additional 50 bps should be at the table for the next couple of meetings," said Powell.

Primarily, investors fear growth as the Fed embarks on two additional 50 basis point hikes during the first two months of the summer.

With inflation above 8% and unemployment below 4%, the Federal Reserve has finally moved into policy tightening mode, just as recession fears are mounting.

According to James Knightley, chief international economist at ING, the economic slowdown is adding to the fear of recession already in the markets and leaving traders in doubt about how far the Fed is willing to go.

The US dollar puts pressure on all risky assets.

Attention should be paid to the prospects for economic growth, especially after Powell hinted that there may be some problems and not everything was under the Fed's control.

It is worth following the upcoming speeches of the Fed, including New York Fed President John Williams, Minneapolis Federal Reserve Bank President Neel Kashkari, Atlanta Fed president Raphael Bostic, St. Louis Federal Reserve Bank President James Bullard, Federal Reserve Governor Christopher Waller, and San Francisco Federal Reserve President Mary Daly, who are all due to speak on Friday.