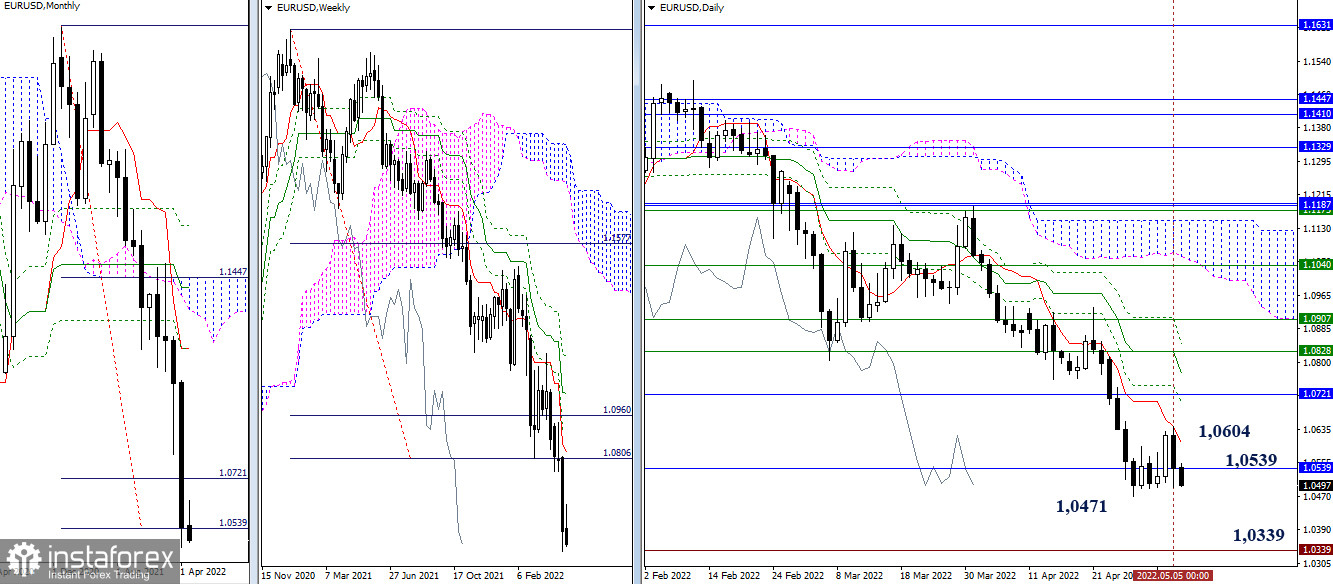

EUR/USD

Higher timeframes

As a result of the meeting with the resistance of the daily short-term trend, today located at 1.0604, a daily rebound has formed. The pair returned to the area of attraction and the influence of the level of 100% of the monthly target on the breakdown of the Ichimoku cloud (1.0539). If the corrective consolidation ends and the euro leaves the correction zone (1.0471), restoring the downward trend, then the interests of the bears will be directed to updating the 2017 bottom (1.0339).

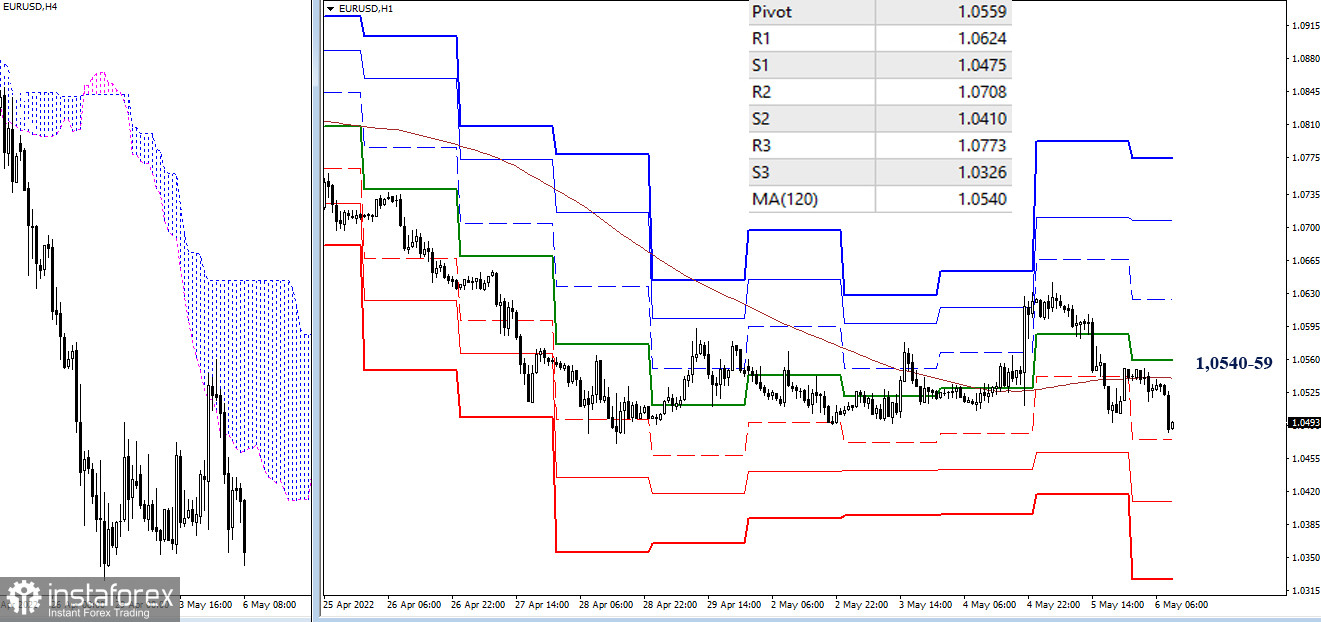

H4 - H1

The advantage of the bulls in the lower halves was short-lived, which is quite understandable by the daily consolidation. As a result, the key levels, which today are consolidating their efforts around 1.0540–59 (central pivot point of the day + weekly long-term trend), once again support the bears. The next downward references within the day are the support of the classic pivot points (1.0475 – 1.0410 – 1.0326). When priorities change, on the consolidation above 1.0540–59, the relevance will return to the resistance of the classic pivot points (1.0624 – 1.0708 – 1.0773).

***

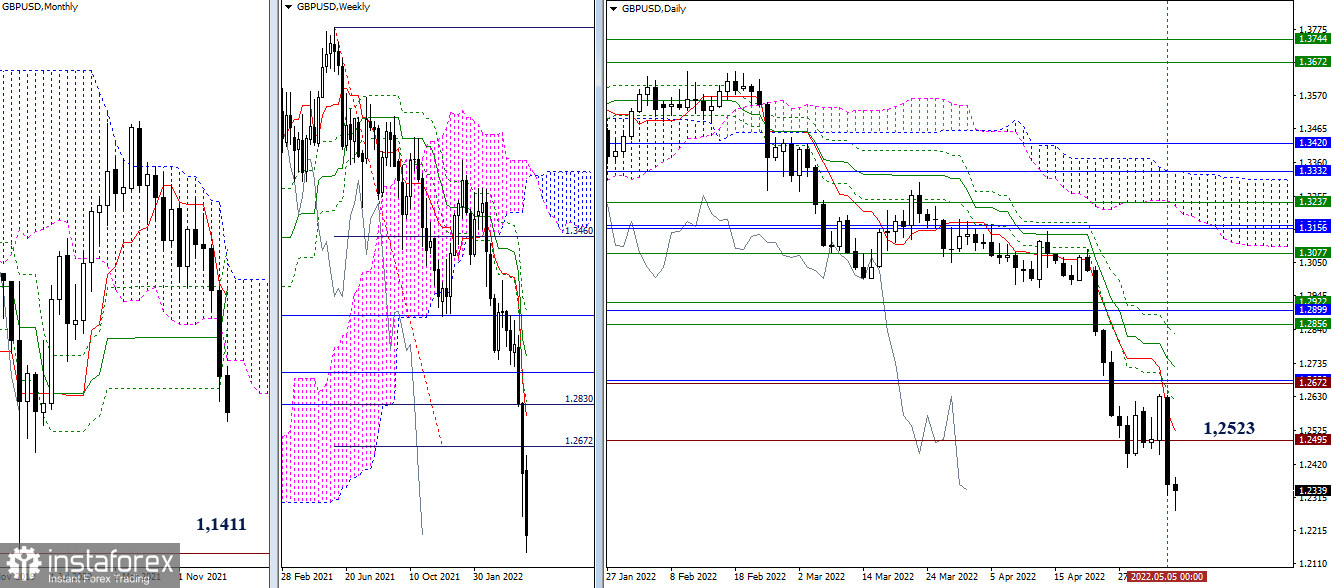

GBP/USD

Higher timeframes

The test of the daily short-term trend, which is currently at 1.2523, led to the exit from the correction zone and the restoration of the downward trend of the older halves. There are no more supports from the Ichimoku indicator and its targets. The reference point for the decline is the 2020 bottom (1.1411), located at a considerable distance.

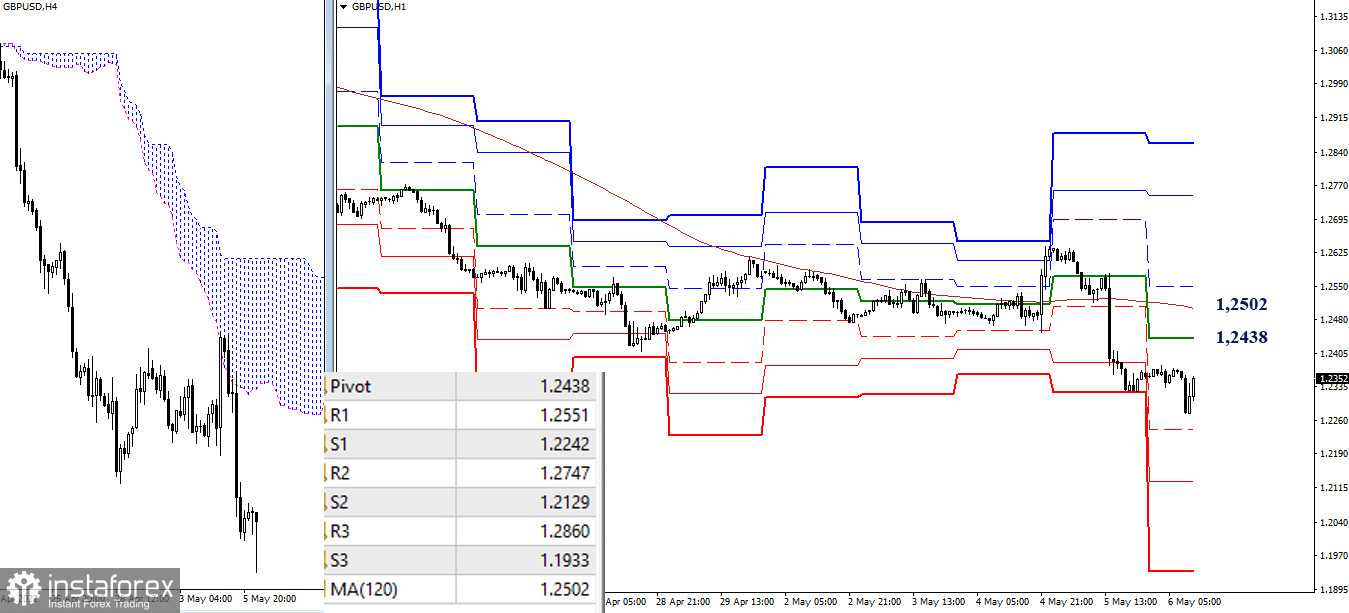

H4 - H1

After an active decline in the lower halves, the advantage shifted to the side of the bears. Their intraday reference points can be noted today at 1.2242 – 1.2129 – 1.1933 (support of the classic pivot points). Key levels are now turned into resistance. In the current situation, they are guarding bearish interests in the area of 1.2438 (central pivot point of the day) – 1.2502 (weekly long-term trend). Consolidation above will change the current balance of power.

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)