Usually, I conduct exclusively technical analysis on this EUR/GBP cross-rate, but yesterday's events related to the Bank of England's decision to raise the key interest rate by the expected 25 basis points suggest in today's article on this interesting instrument not only a technical component. So, although the decision of the British Central Bank to raise the main interest rate by 25 bps completely coincided with market expectations, the rhetoric and further steps in terms of tightening monetary policy did not appeal to market participants. Investors, and with good reason, considered the tone of the BoE too soft, which was the main reason for the pressure under which the British pound sterling fell.The disagreements of the MPC and the disappointing subsequent economic prospects led to aggressive sales of the British currency. Although the main interest rate has been raised for the fourth time since December last year, this factor does not support the sterling. Moreover, at the last meeting, two representatives of the Monetary Policy Committee expressed the opinion that the current "hawkish" attitude is "too strong and, given the economic situation in the UK, is not entirely justified. This factor also could not but have a negative impact, of course, on the exchange rate of the British currency. So, despite Friday, let's look at the weekly EUR/GBP chart and see what the prospects are for closing the current trading week.

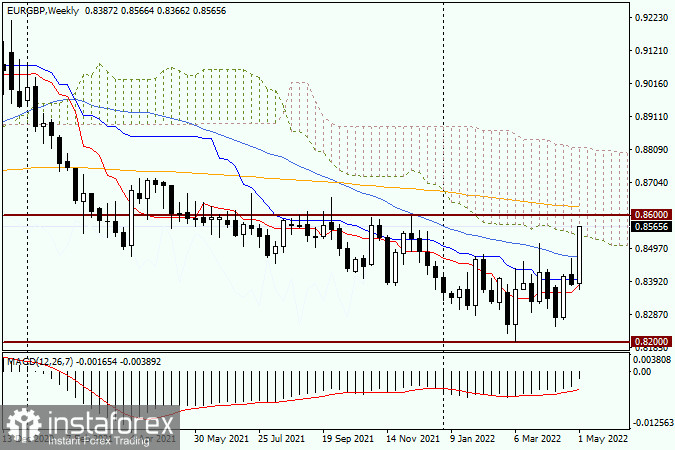

Weekly

And the prospects for the pound bulls are not rosy. At this point, a hefty bullish candle is observed on the weekly timeframe. If we analyze purely technical aspects, the euro/pound cross found strong support in the form of the Tenkan red line of the Ichimoku indicator, after which it began an active movement in the north direction. As you can see, as a result of the growth, the blue 50 simple moving average has passed, and at the moment the pair has completely entered the limits of the Ichimoku indicator cloud. I would venture to assume that the closing of the current weekly trading within the cloud will strengthen the bullish mood for this trading instrument. However, this is also very clearly visible on the chart, this is not the end of the bulls' problems with EUR/GBP at all. Next, they will have to go up a very strong technical level of 0.8600, after which they will test the orange 200 exponential moving average, which is located at 0.8627, for a breakdown. To resume the bearish sentiment on the pair, it is necessary to lower the price below 50 MA (0.8469), and then do the same for the red Tenkan line and the blue Kijun line of the Ichimoku indicator. Finally, the victory of the bears will be signaled by a true breakdown of the key support level of 0.8200. In the meantime, in my opinion, the continuation of the upward scenario seems to be the most promising.

Daily

As can be seen on the EUR/GBP daily chart, bulls at this cross-rate are the clear masters of the situation at the moment. The pink resistance line 0.8656-0.8511 has already been broken, as well as the resistance level 0.8511, where the maximum trading values were shown on March 31 and from where the pair declined significantly, which only confirmed the strength of this level. In order not to beat around the bush for a long time, I will immediately indicate my personal trading preferences, which are reduced to purchases of the euro/pound, after corrective pullbacks to the price area of 0.8515-0.8485, that is, after short-term pullbacks to the broken level of 0.8511 and the pink resistance line. I consider buying at current prices to be a risky event because, after such impressive growth, it is simply necessary to wait for the course correction. However, the growth does not stop.