Last week, the market was thrown into disarray after Bitcoin and other high-risk assets surged after the Fed meeting. The spike in long positions also indicated that the market believed in the cryptocurrency rise. However, digital assets stumbled to the bottom, while simultaneously breaking through any support areas. Over the last seven days, Bitcoin collapsed by 14.5%, and the total capitalization of the cryptocurrency market reached the support zone at $1.5 trillion.

Bitcoin reached a swing low of $33,200. The results of the Fed meeting created a favorable ground for sellers, who broke the daily trend line of support at the first attempt. Buying activity has declined to a swing low, and retail traders continued to actively get rid of BTCs. Cryptocurrencies reacted extremely negatively to the Fed's new key rate hike and hit a local bottom in just five days. However, the current situation is complicated by the fundamental background, which clearly hints at the continuation of a tough trend at least in the medium term.

Fed Chairman Jerome Powell noted two important things that would negatively affect the exchange rate quotes in the future. The first is the start of the quantitative easing program in June. It is important to understand that raising the key rate is not a permanent tool, unlike the QE program. According to the initial plan, about $45 billion will be withdrawn per month, which may primarily hit high-risk assets.

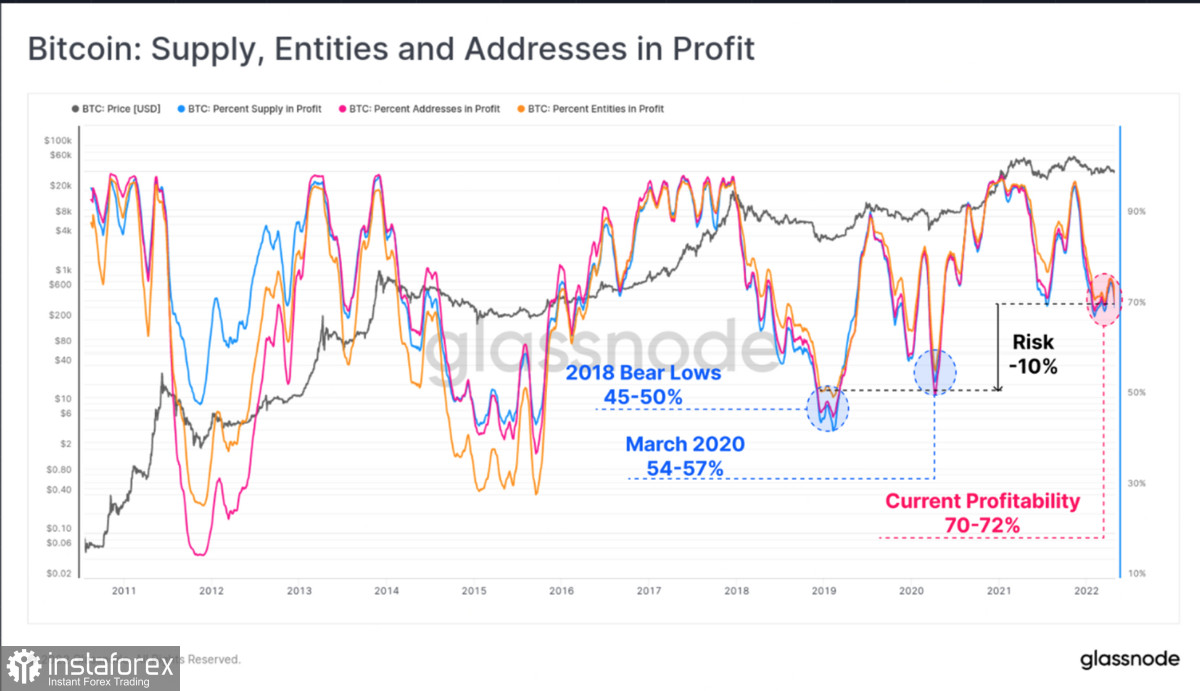

What happened in the market was traders' attempts to save their capital. As we noted above, more than 50% of the coins on wallet balances were in profit as of May 5. It is likely that if that percentage were lower, investors would not be so actively selling Bitcoin.

However, the current situation suggests two important things. First, Bitcoin continues to be considered a high-risk asset. This suggests that the market is likely to continue to lose investors and liquidity in the near future. However, it is important to take into account that long-term investors still believe in the asset, and therefore after the final formation of the local bottom, we should expect an active but long period of accumulation.

However, there is another important question. Where will Bitcoin form a local bottom, and should we prepare for a decline below $30,000? As of the morning of May 9, the cryptocurrency is trading near the upper boundary of the range of $30,000-$33,000. If this level is broken through, another sell-off may take place, which is likely to drag the price down. Technical indicators on the daily time frame confirm the cryptocurrency's bearish sentiment, so it is likely that the bottom has not been reached yet.

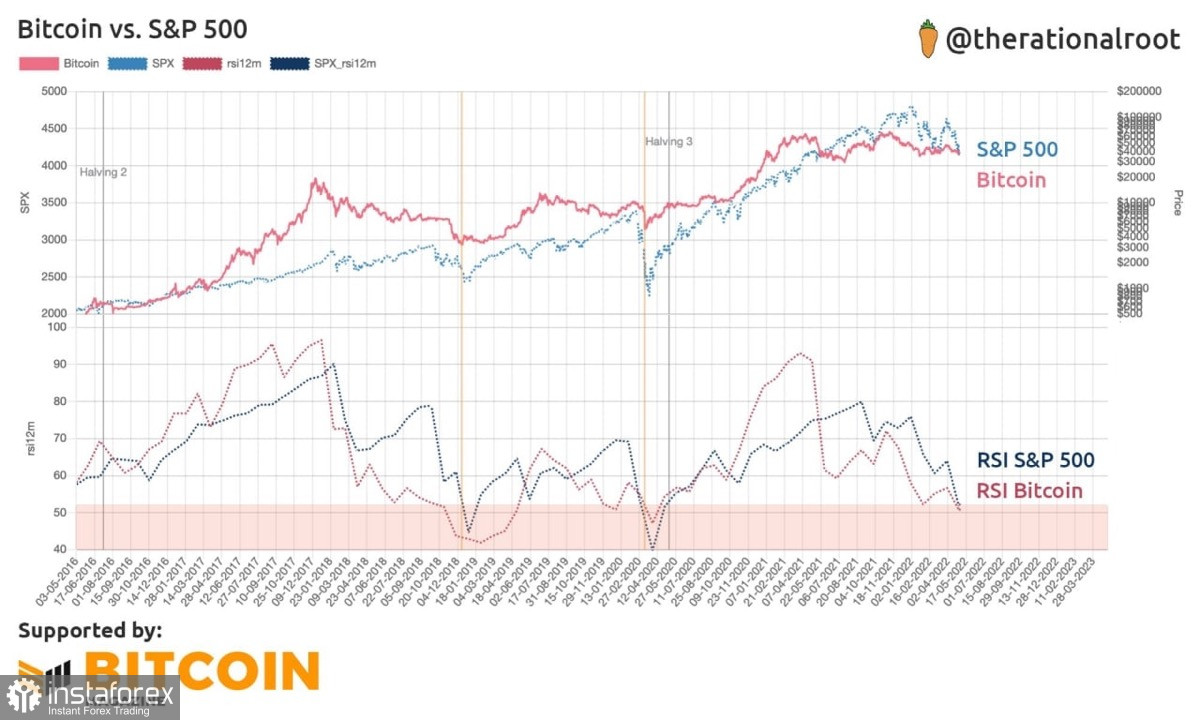

On the other hand, we see two factors that indicate the possible end of the fall. The RSI of the S&P 500 index and the RSI of Bitcoin are in the oversold zone. As it usually happens, when these indicators reach this zone, it indicates the formation of the bottom.

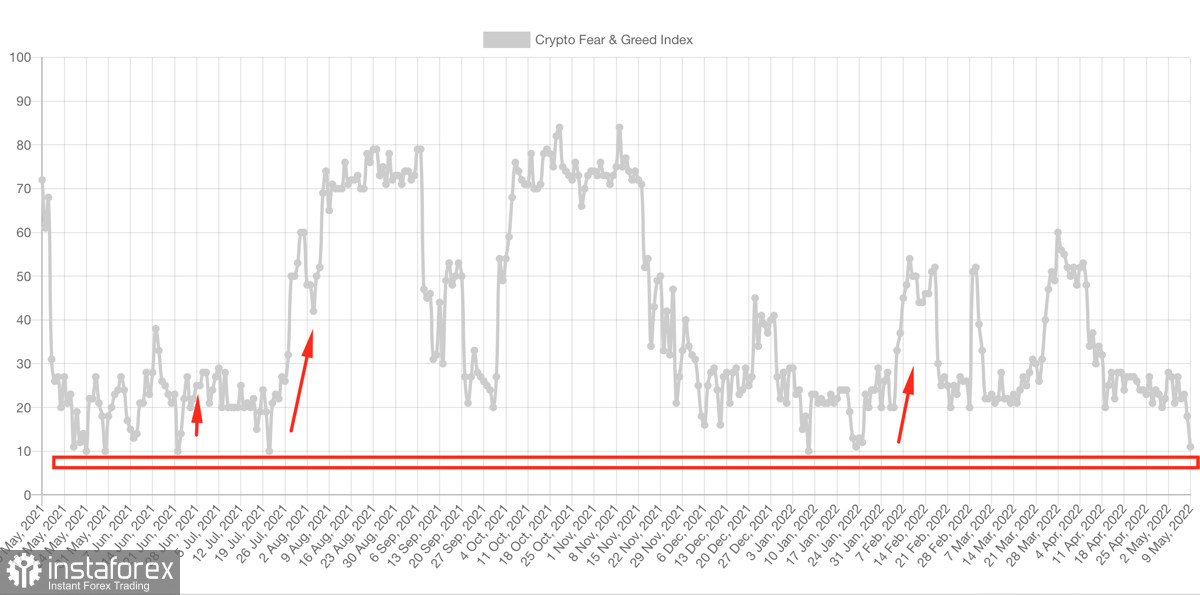

The second factor is that the Fear & Greed index has reached a local bottom at 11. Considering the historical context, we can assume that a price reversal may occur in the near future. However, as I have already noted, the current situation is different from the others. The Fed policy just begins to influence the market, and therefore it is impossible to exclude the further price decrease beyond the boundary of $30,000.