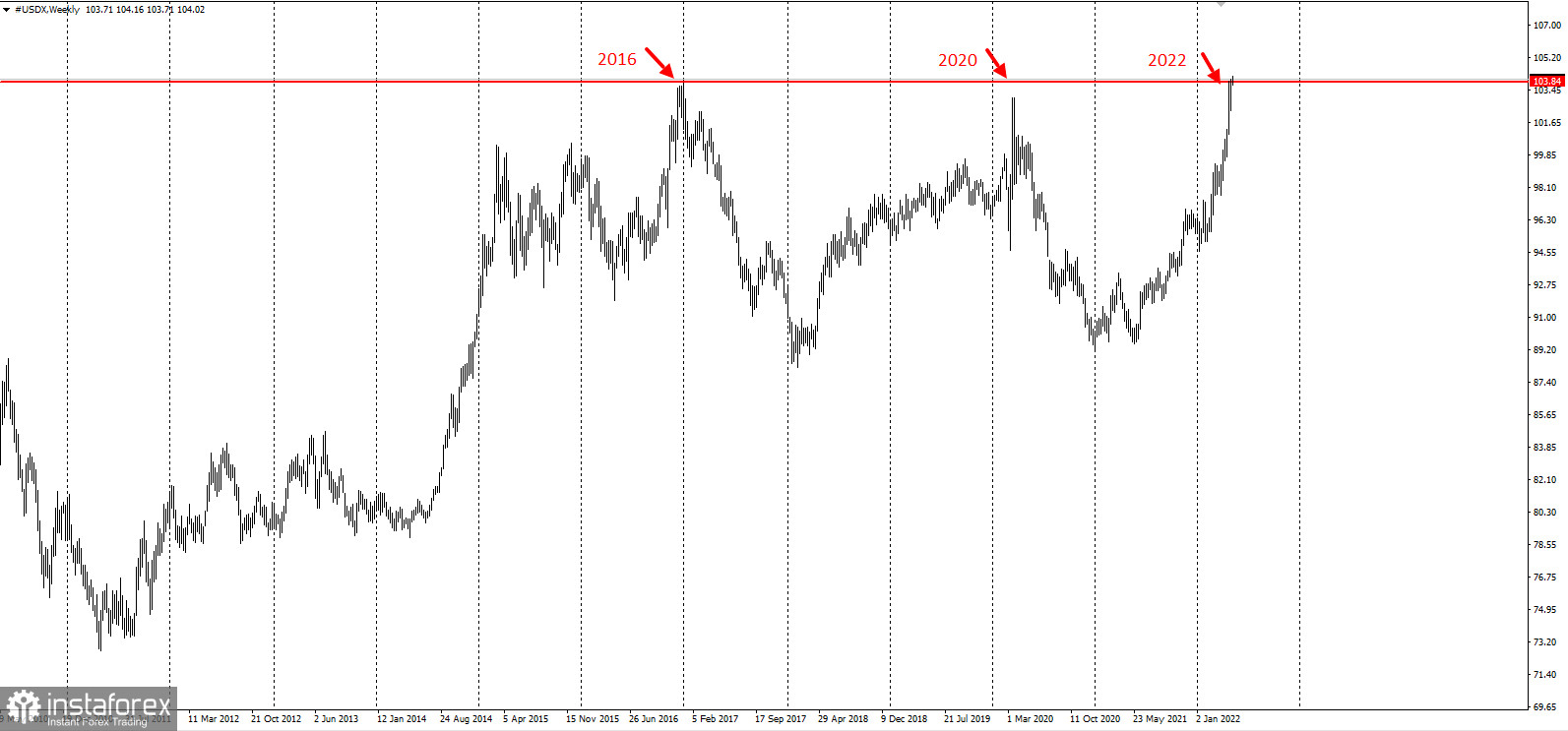

Last week, the gold market again traded sluggishly. So, the price failed to overcome the level of $1,900 a troy ounce. The metal came under selling pressure because the US dollar settled at the highest level in 20 years amid the Fed's hawkish agenda for further rate hikes.

Despite disappointing gold dynamic, a lot of analysts note that the gold market remains steady in Q1 2022, going through a consolidation stage. Over the last two months, the precious metal encountered some obstacles because the Federal Reserve brought up the issue of raising the funds rate by 50 basis points.

On Wednesday, the US central bank took the decision that met market expectations, having increased the official federal funds by 0.75% to 1%. Despite the fact that the Fed is still poised for aggressive monetary tightening, some analysts think that the central bank has reached its ultimate hawkishness. Fed Chairman Jerome Powell ruled out the scenario that the regulator could increase interest rates by 75 basis points in June.

In the summer, the central bank will go ahead with moderate rate hikes. Still, analysts believe that the environment is beneficial for gold because soaring inflation will support relatively low interest rates.

In technical terms, the overall trend of gold remains bullish.