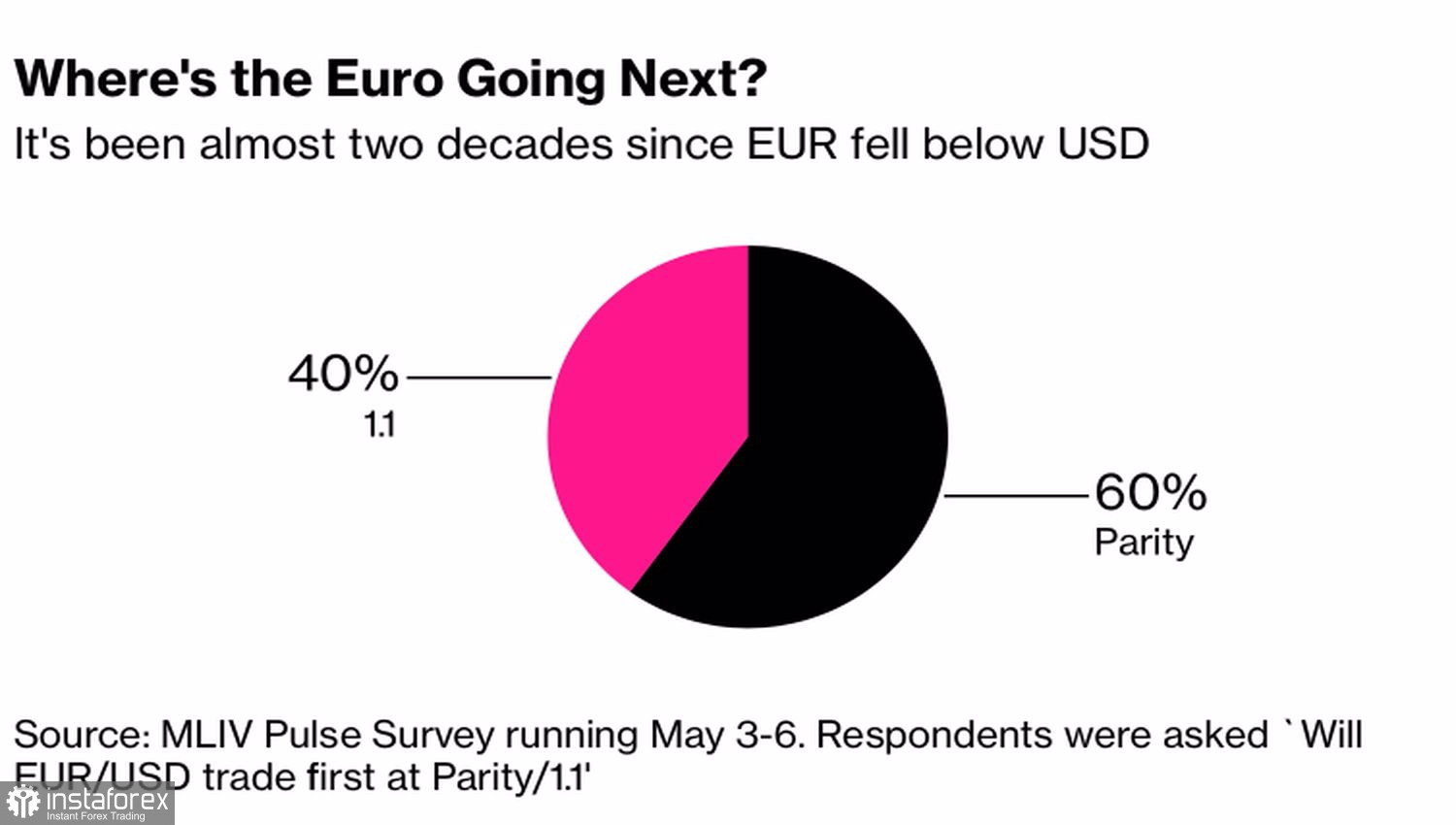

The American economy is healthy as an ox, while the European one is breathing its last. The Federal Reserve is serious about raising the federal funds rate above 3%, while the European Central Bank is only talking about raising the deposit rate in July. So far, it is in negative territory. How can one not think about EURUSD parity in such conditions? 60% of respondents to the MLIV Pulse poll, when asked whether the euro will cost the same as the US dollar or rise to $1.1, chose the first answer. Among them are economists and asset managers who see a recession (40%), stagflation (40%) or simply high inflation (20%) as the main risks for the eurozone.

Will there be parity in the EURUSD pair?

Unlike the European one, the American economy really looks like a titan. This was confirmed by the next report on the labor market. U.S. Non-farm payrolls rose by more than 400,000 for the 12th straight month, unemployment hovering around a historical low of 3.6%, and wages rising 5.5%, fueling inflation. The stronger the labor market, the more the Fed needs to do to cool it down. If the central bank, judging by the words of Fed Chairman Jerome Powell, is not actively discussing the issue of raising the federal funds rate at one of the FOMC meetings in 2022 by 75 bp today, then it is not a fact that it will not do so tomorrow.

The Fed has a very specific task - to bring borrowing costs to a neutral level as quickly as possible. The problem is that no one knows for sure where exactly this neutral rate is. It was previously assumed that at around 2.5%, but looking at the maximum inflation in 40 years, it is clearly higher.

It should be noted that the strengthening of the US dollar associated with aggressive monetary restrictions is currently playing into the hands of the Fed. According to research by Goldman Sachs, central banks in developed countries need to raise rates by an average of 0.1 percentage points to compensate for a 1% depreciation of the national currency. At the same time, we now live in a world where a stronger monetary unit is welcome. This can lead to so-called reverse currency wars. Previously, central banks sought to weaken their currencies to stimulate exports and accelerate inflation, now stronger imports and slowing consumer prices are on the agenda.

I think the ECB understands this very well. I don't know if ECB President Christine Lagarde was aware of the results of the MLIV Pulse survey, in particular about the main risks for the European economy, but the woman said that stagflation is not a base scenario for the central bank. Now is not the 1970s, the situation is completely different. Governing Council member Olli Rehn believes that the deposit rate should be raised in July.

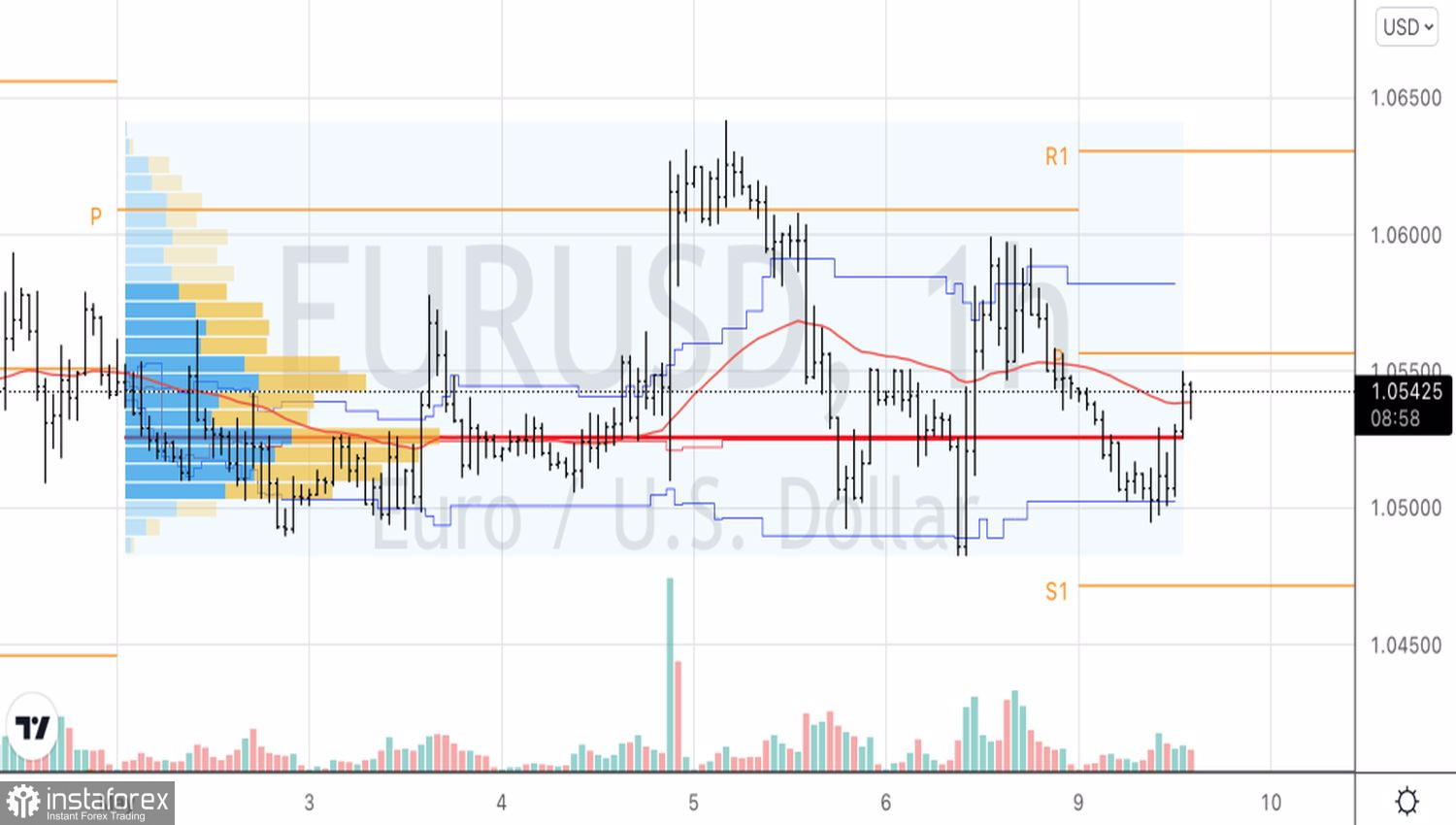

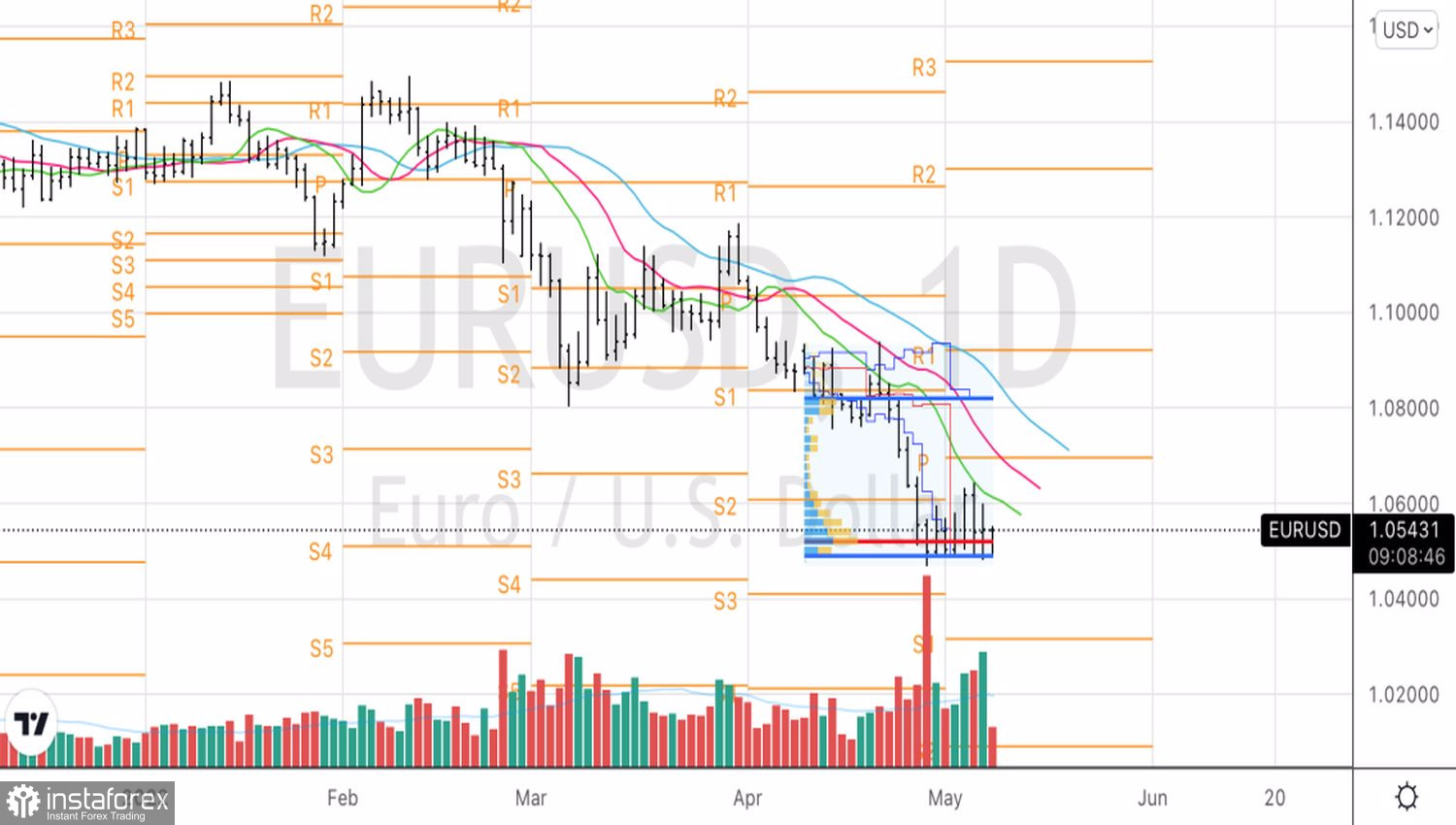

Technically, on the daily EURUSD chart, short-term consolidation continues in the range of 1.049-1.063. Going beyond it will allow you to buy or sell the euro. On the hourly time frame, there is a fight for the fair value at 1.0525. Closing below it with a subsequent drop in quotes below 1.05 and 1.049 is a reason for the formation of shorts in the direction of 1.041 and 1.031.

EURUSD, daily chart

EURUSD, hourly chart