Overview :

- Pair : EUR/USD.

- Pivot : 1.0614.

- Time frame : H1

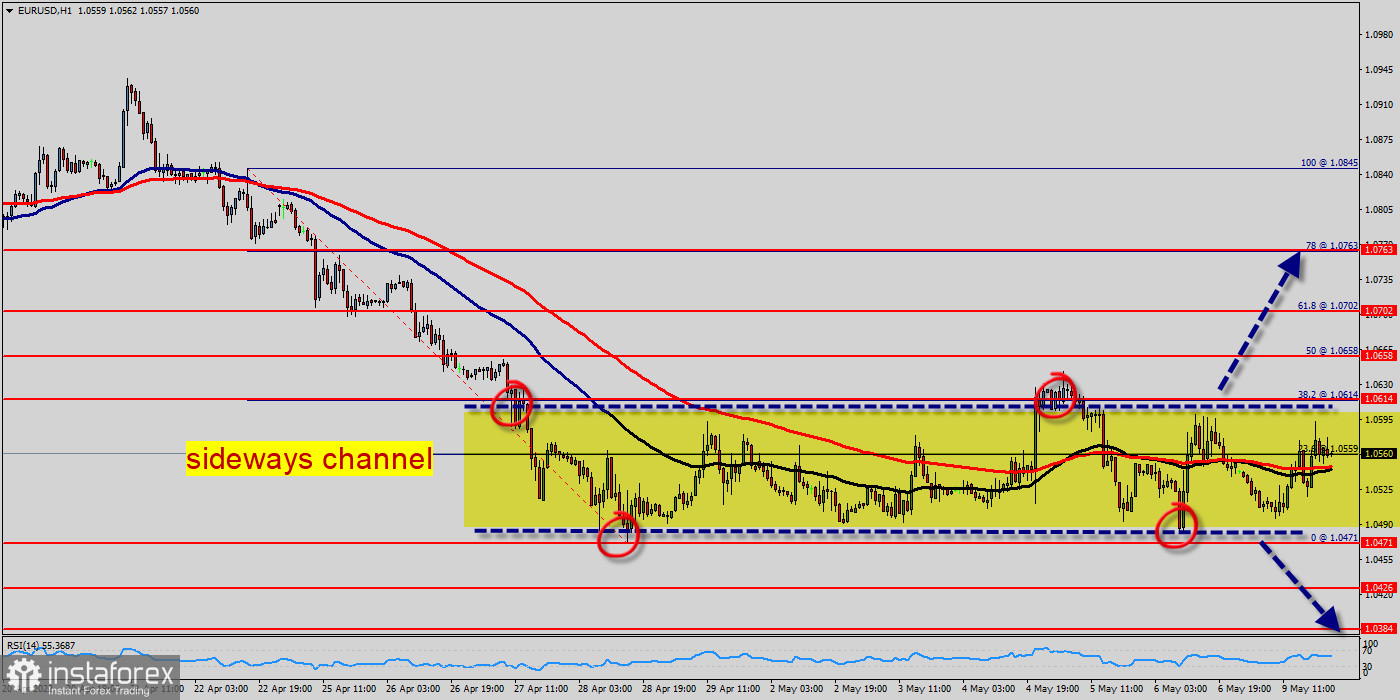

The trend of EUR/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.0471 and 1.0614.

The level of 1.0614 coincides with a golden ratio (38.2% of Fibonacci), which is expected to act as major resistance today. The Relative Strength Index (RSI) is considered oversold because it is below 70.

The RSI is still signaling that the trend is upward as it is still strong below the moving average (100). This suggests the pair will probably go down.

Also, the daily resistance and support are seen at the levels of 1.0614 and 1.0471 respectively. Range will be traded between 1.0614 and 1.0471 in coming hours.

Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed.

The market moved from its bottom at 1.0471 and continued to rise towards the top of 1.0557.

Today, in the one-hour chart, the current rise will remain within a framework of correction.

However, if the pair fails to pass through the level of 1.0614, the market will indicate a bearish opportunity below the strong resistance level of 1.0614 (the level of 1.0614 coincides with the double top too - pivot point - last bullish wave).

Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1.0614 with the first target at 1.0471.

If the trend breaks the support level of 1.0471, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0426 in order to test the daily support 2 (horizontal red line).