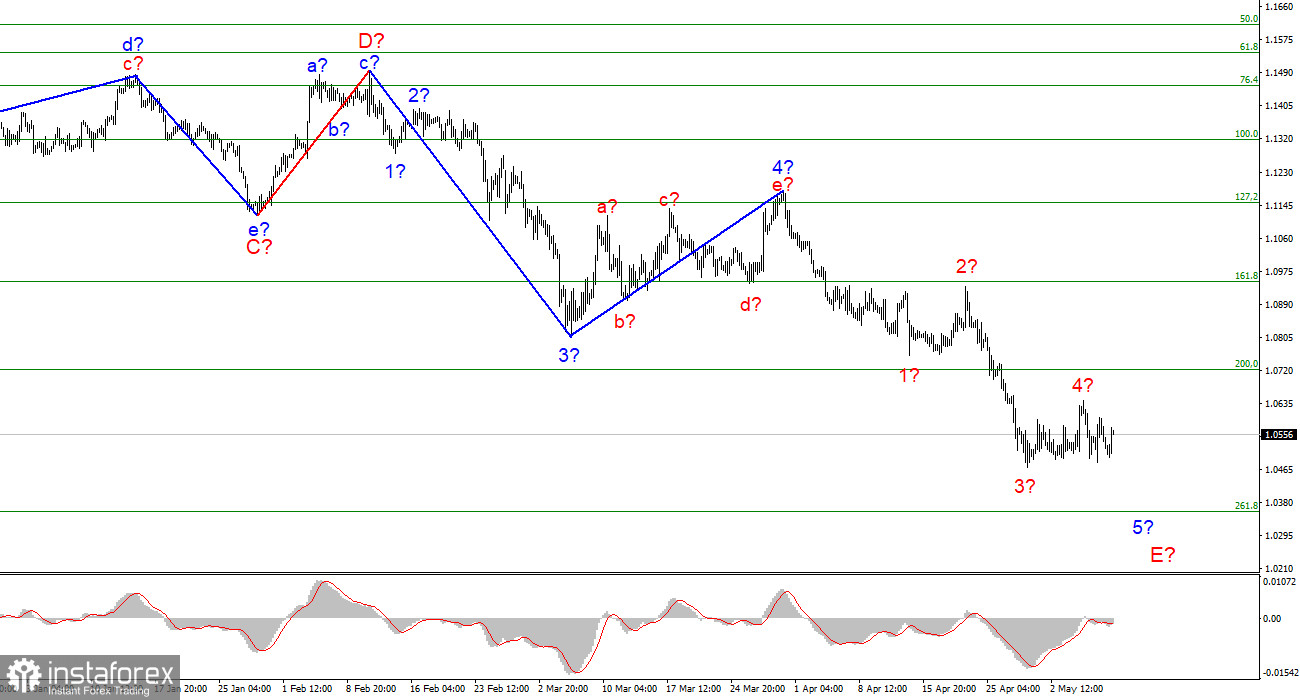

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may continue for another week, since this wave turns out to be a five-wave in its internal structure. At the moment, four internal waves are visible inside this wave, so I'm counting on building another one - an impulse one. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, near which the construction of the current downward wave and the entire downward trend section may be completed. If the breakout attempt of 1.0355 turns out to be successful, the instrument will further complicate its wave structure and continue to decline.

In anticipation of American inflation.

The euro/dollar instrument did not rise or fall by a single base point on Monday. The amplitude of the movement during the day was weak, at first, the euro currency decreased by 50 points, and then it increased by the same amount. Monday, it happens so often. Today, the news background was practically absent. All the most interesting things this week are planned for the following days. In particular, a rather important report on US inflation will be released on Wednesday, which can greatly affect the "relationship" between the euro and the dollar. Let me remind you that all the recent actions and plans of the Fed were aimed at reducing inflation, which rose to 40-year highs. In March, it was 8.5% y/y. In April, it may drop to 8.2%, which will already be a positive moment. Now the main thing for the Fed is to stop its acceleration, and after this is achieved, it will be possible to talk about its decline. The Fed has raised the rate only 1 time so far (the May increase does not count, since it certainly could not affect April inflation in any way). That is, the American Central Bank has not yet taken any measures that could seriously slow down inflation. Thus, the next steps (including a rate hike in May) may be more productive, especially if inflation slows down by the end of April.However, in almost any case, analysts are not counting on its rapid and strong slowdown now. Even FOMC members are talking about this - the task of returning inflation to 2.0% is a task for several years. However, what does it matter for the euro currency? Simple: the faster and stronger inflation falls, the less need the Fed will have to continue raising the rate, and the less demand there will be for the US dollar. If it were not for the current wave marking, which assumes the completion of the construction of a downward trend, I would say that the euro currency could decline for a very long time. The Fed intends to raise the interest rate this year and next. It may be so, but for this, the instrument needs to at least build a three-wave correction section of the trend. Before proceeding to a new reduction.

General conclusions.

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". The construction of the proposed wave 4-5-E may have already been completed.

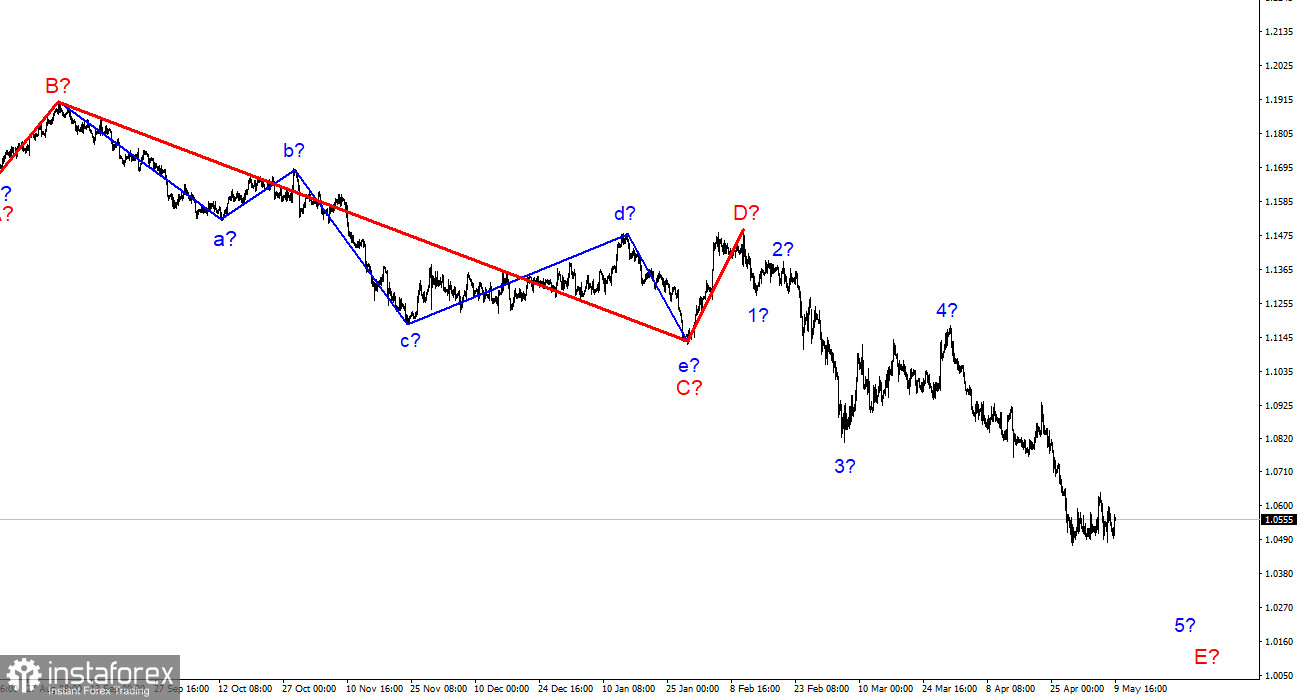

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend segment is being built, which turns out to be as long as wave C. The European currency may still decline for some time.