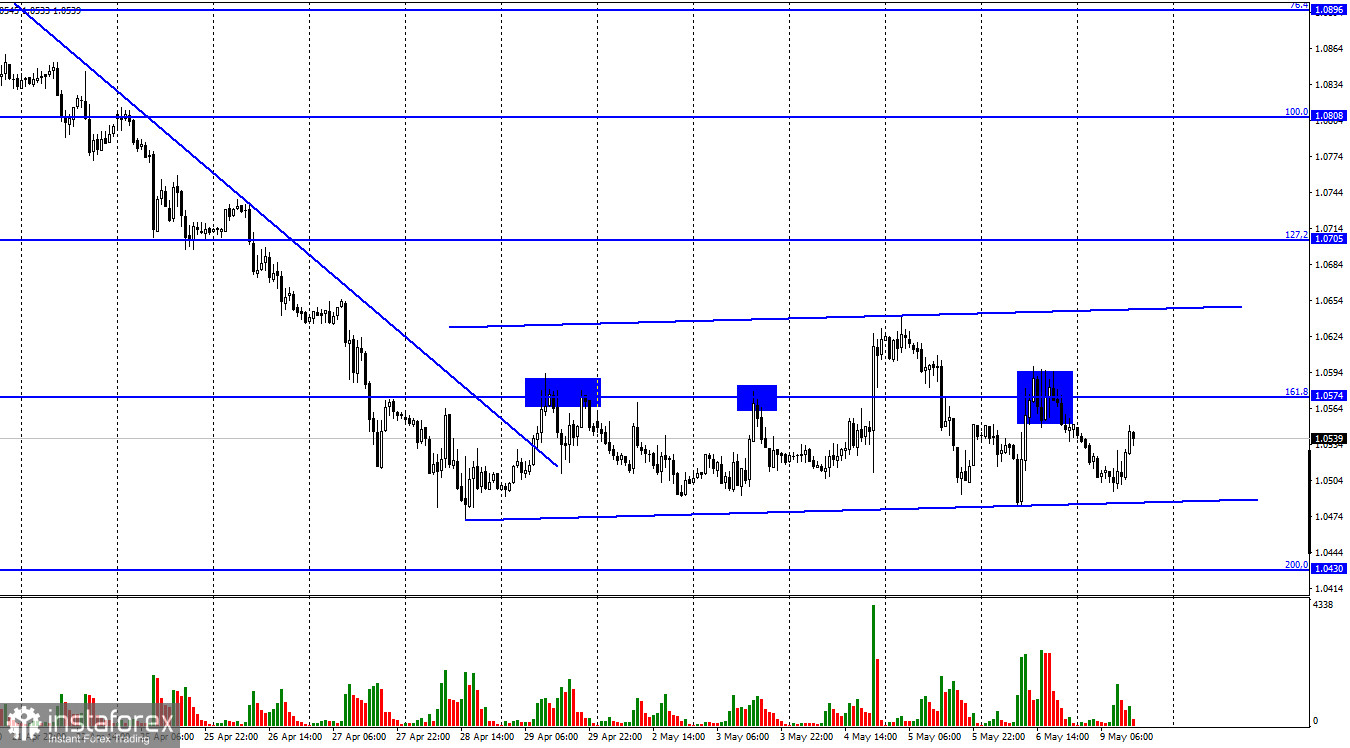

On Friday, the EUR/USD pair first performed a fall, and then a stronger increase to the corrective level of 161.8% (1.0574). The rebound of quotes from this level worked in favor of the US currency and a new fall in the direction of the lower border of the ascending trend corridor. It is ascending only formally since it is practically directed sideways. Therefore, I suggest that the current movement is considered sideways, and the mood of traders is "bearish" because there has still not been a break in the "bearish" trend. Thus, until the pair's quotes leave the designated corridor, sideways movement may continue, which is always bad for traders. This week will certainly be much more boring than the previous one. After the meetings of the Fed and the Bank of England were held, data on unemployment, wages, and the US labor market also became known. These reports came out on Friday. I can't call them resonant, strong, or weak. Rather, the word ordinary applies here. The number of Nonfarm Payrolls increased by 428 thousand, the unemployment rate was 3.6%, and wages increased by 0.3%. Traders were preparing to see approximately such figures, so the US dollar failed to show new strong growth. However, it rose on Monday morning and then began to fall. Therefore, all these movements rather correspond to a side corridor and do not relate to one or another report. The Ukrainian-Russian conflict continues, today Victory Day is celebrated in Russia and other post-Soviet countries. Russian markets are closed, and there have been no rocket attacks on Ukraine today. Thus, perhaps today will be a day off at the front, but it will not mean a weakening of the geopolitical conflict. Fierce fighting continues in the Kharkiv, Kherson, Zaporizhzhia, and Mykolaiv regions. This means that it is too early to talk about the end of the military conflict. From my point of view, the conflict will flare up and then fade depending on the achieved objectives of one side or another and on the supply of weapons to both sides.

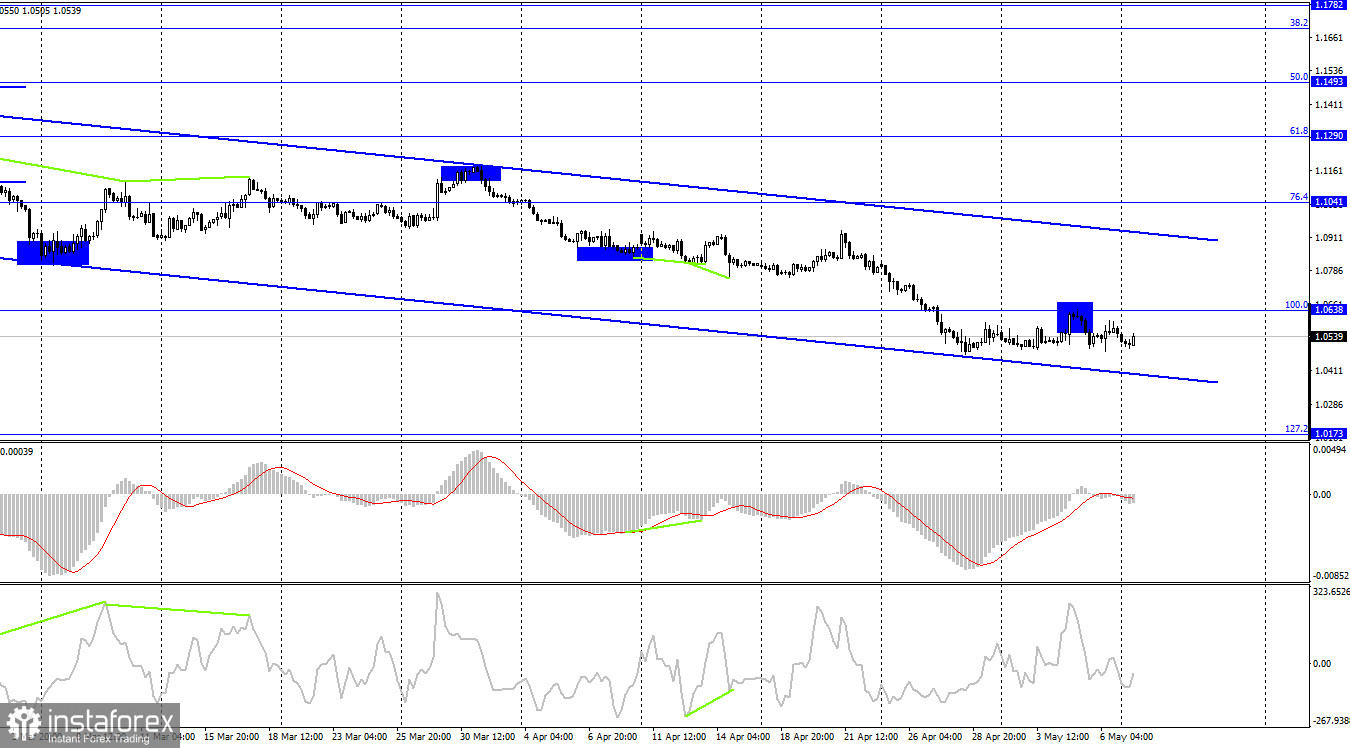

On the 4-hour chart, the pair performed a rebound from the corrective level of 100.0% (1.0638) and a reversal in favor of the US currency. Thus, the fall may now continue in the direction of the next corrective level of 127.2% (1.0173), as the downward trend corridor continues to characterize the current mood of traders as "bearish".

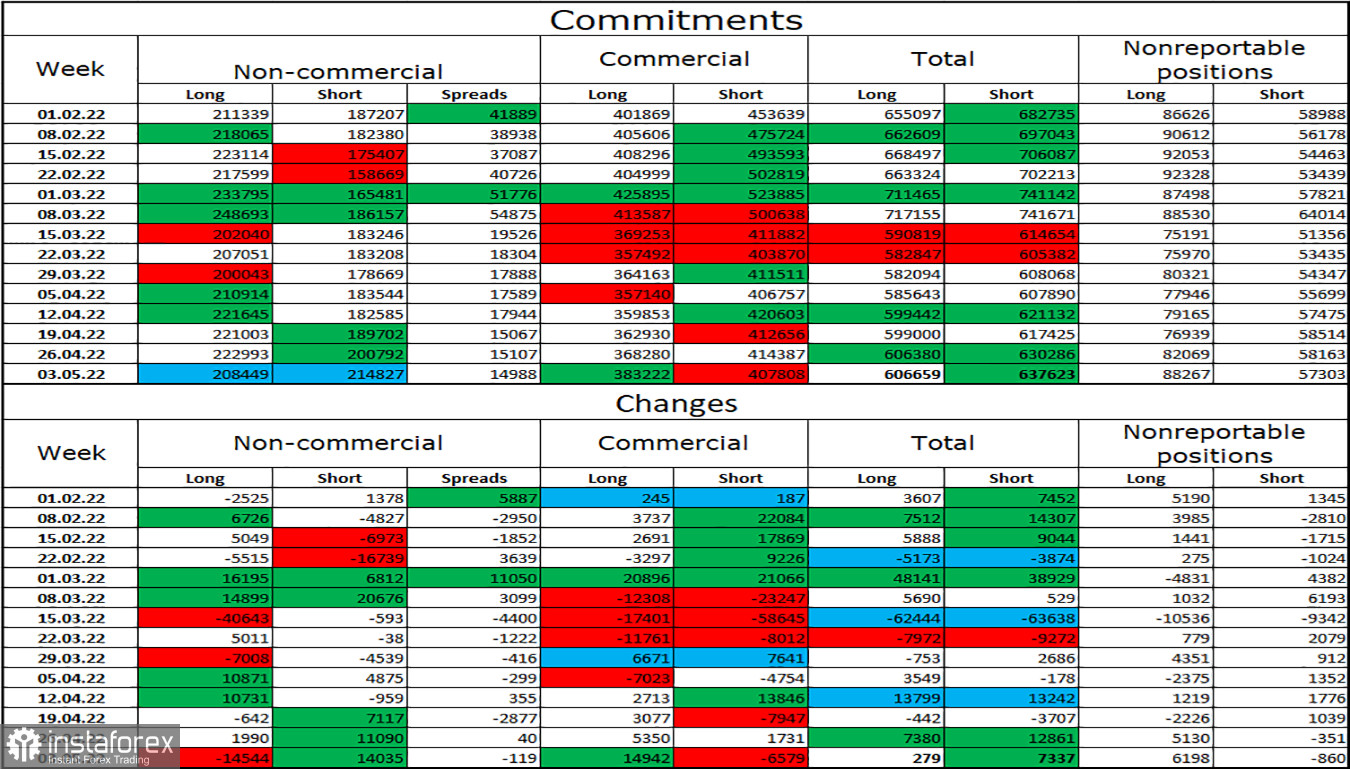

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 14,544 long contracts and opened 14,035 short contracts. This means that the bullish mood of the major players has significantly weakened, for the third week in a row. The total number of long contracts concentrated on their hands is now 208 thousand, and short contracts - 214 thousand. For the first time in quite a long time, the mood of the "Non-commercial" category of traders is characterized as "bearish", and the European currency continues its decline in pair with the dollar. For several months in a row, the COT data indicated that the euro should grow, so now I can't say unequivocally that everything has fallen into place now. The continuation of hostilities in Ukraine, the deterioration of relations between Europe and the Russian Federation, new sanctions against Russia, and the weakness of the ECB's position has a very strong influence on the mood of traders.

News calendar for the USA and the European Union:

On May 9, the calendars of economic events in the European Union and the United States do not contain a single interesting entry. The information background today will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended new sales of the pair if there is a rebound from the 1.0574 level on the hourly chart with a target of 1.0430. However, bear traders are unlikely to be able to reach this level in the near future, given the side corridor on the hourly chart. With purchases, it is also better to wait until the sideways trend on the hourly chart is canceled.