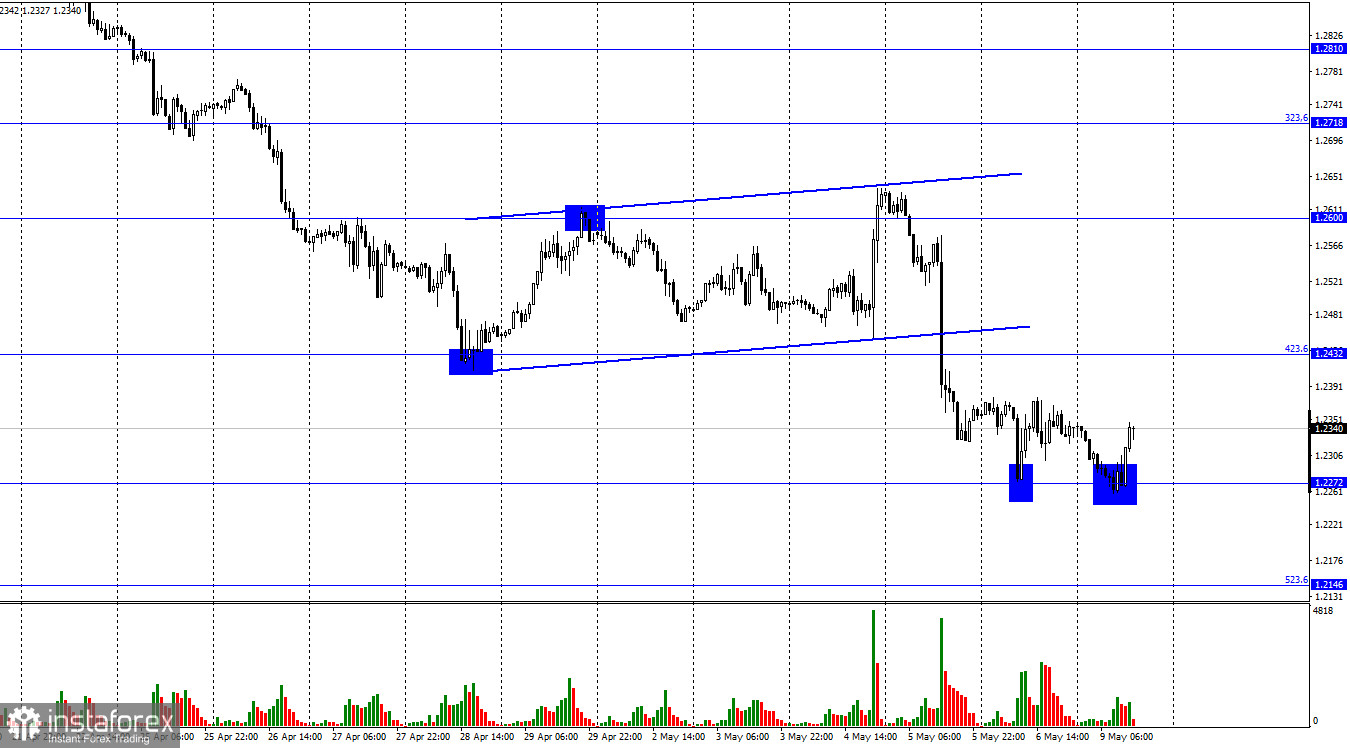

According to the hourly chart, the GBP/USD pair on Friday performed a fall to the level of 1.2272 and rebound from it. On Monday, the pair performed another drop to the level of 1.2272 and another rebound from it. At the moment, a new growth process has begun in the direction of the corrective level of 423.6% (1.2432). However, it should not mislead readers. The pound sterling has been growing extremely rarely and very weakly lately. So this growth may be replaced by a new powerful fall tomorrow. The Briton had every chance to show good growth last week, as the Bank of England, following the Fed, raised the interest rate and brought it to 1%. However, for some reason, traders felt that a break in the rate hike cycle, which is being taken by the British regulator, is a more important event. Traders also paid great attention to the negative forecasts on the economy from the Bank of England, according to which the next two years may be very difficult. I do not understand why these two factors (there were no others) led to such a strong fall of the British. After all, one should also take into account the fact that the Bank of England raised the rate for the fourth time in a row, and three members of the monetary committee voted for an increase of 0.50% at once. Nevertheless, these factors, which could support the pound, were not perceived by traders. The Briton began to fall immediately after the announcement of the results of the meeting, without even waiting for Andrew Bailey's speech. Traders were preparing for just such a scenario. Considering that the fact of the rate increase was a fact even before the Central Bank meeting, to which traders reacted so violently, it is quite difficult to understand. I believe that all factors combined are playing against the Briton now. This is also the strength of the Fed's intentions, which is not going to stop at the achieved 1% rate. This is also the Ukrainian-Russian conflict. This is also the "dovish" or "insufficiently hawkish" rhetoric of the Bank of England, which the most attentive traders could see.

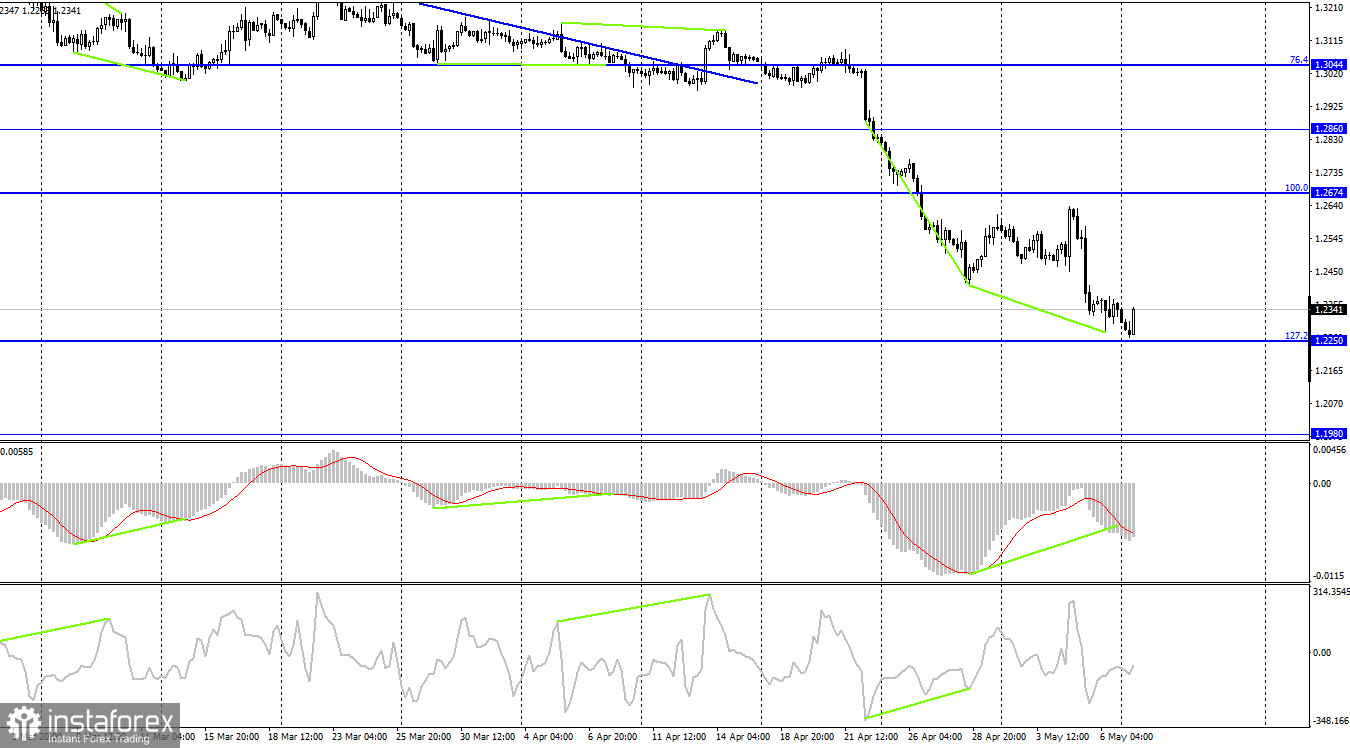

On the 4-hour chart, the pair performed a drop almost to the corrective level of 127.2% (1.2250), but there was no rebound from it. Today, the pair has already performed a reversal in favor of the British and has begun the process of growth in the direction of the corrective level of 100.0% (1.2674). This reversal was preceded by the formation of a bullish divergence in the MACD indicator. Fixing the pair's rate below the level of 127.2% will increase the probability of a new fall in the pound towards the level of 1.1980.

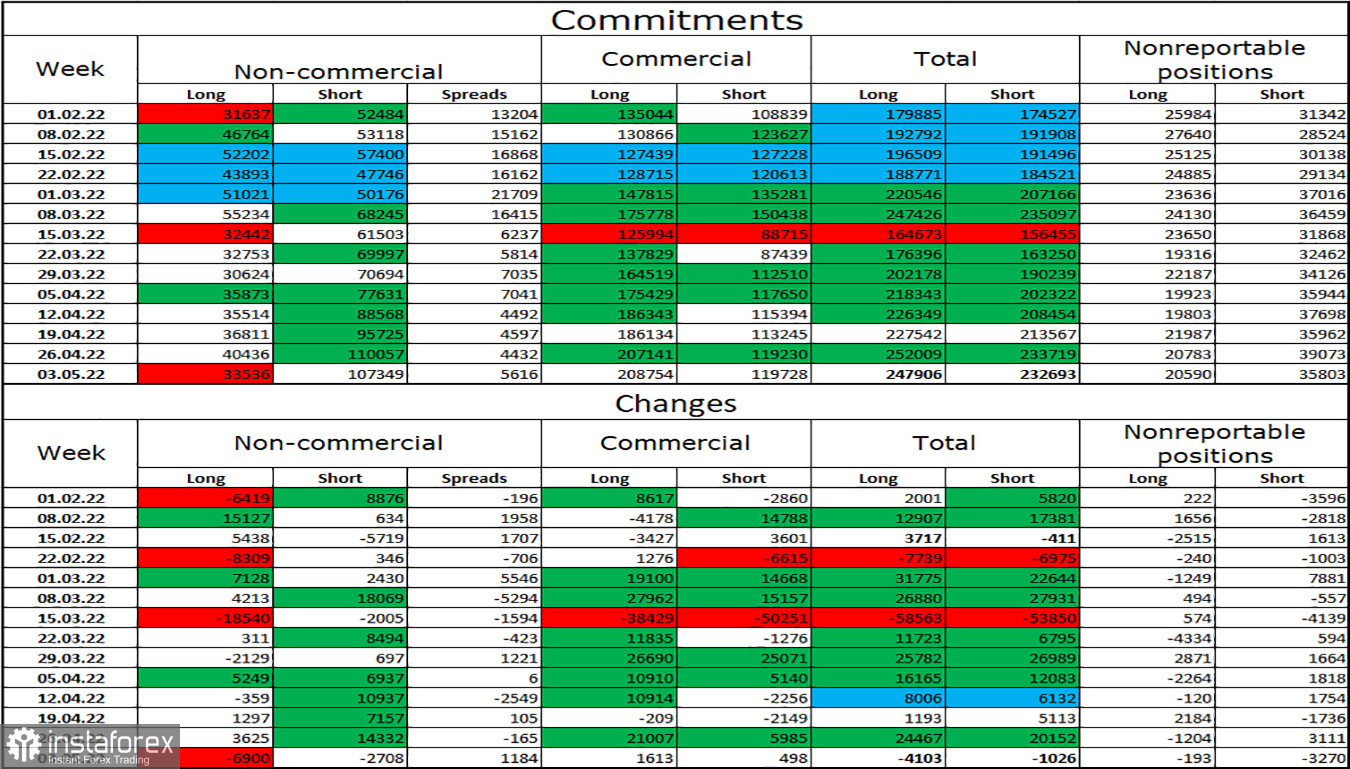

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has changed a lot again over the past week. The number of long contracts in the hands of speculators decreased by 6,900 units, and the number of shorts - by 2,708. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 3 times more than shorts. The big players continue to get rid of the pound. Thus, I expect that the pound may continue its decline over the coming weeks. But also such a strong gap between the number of longs and shorts may indicate an imminent change of trend in the market. I do not rule out that the pound will end its long fall this week.

News calendar for the USA and the UK:

On Monday, the calendars of economic events in the UK and the US are empty. Thus, there will be no influence of the information background on the mood of traders today.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British with a target of 1.2272 when rebounding from the level of 1.2432 on the hourly chart. Purchases of the British dollar could be started at the rebound from the level of 1.2272 with a target of 1.2432.