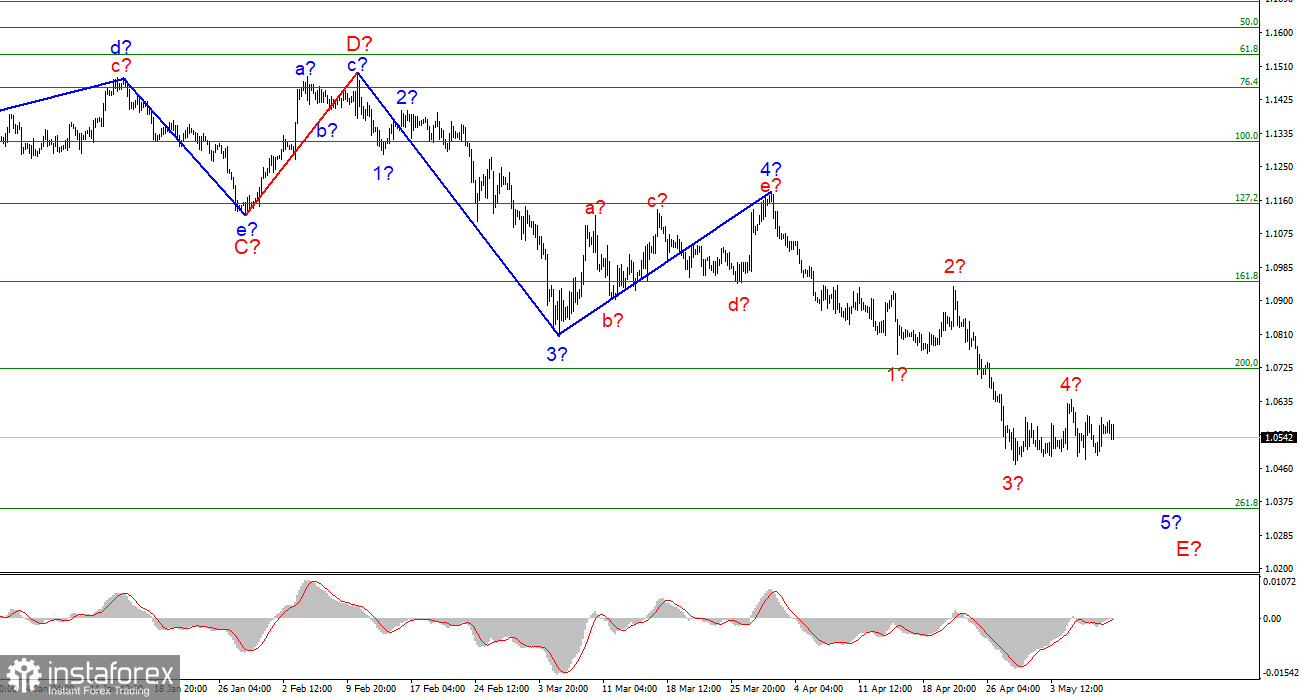

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then the decline in the quotes of the euro currency may continue for another week, since this wave turns out to be a five-wave in its internal structure. At the moment, four internal waves are visible inside this wave, so I'm counting on building another pulse wave. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, near which the construction of the current downward wave and the entire downward trend section may be completed. If the breakout attempt of 1.0355 turns out to be successful, the instrument will further complicate its wave structure and continue to decline.

A downward trend at the last gasp

The euro/dollar instrument did not rise or fall again on Tuesday. The amplitude of the movement was weak for the second day in a row. There was practically no news background, except for the index of business sentiment in the European Union, which "grew" from -43 to -29.5. Therefore, there is no news yet, I suggest looking again at the situation with interest rates in the United States. During the first months of 2022, the Fed actively created an aura of generous rate hikes during this year. The market has even tuned in to the fact that at the end of the year the rate will be at least 3.0%. However, from my point of view, this is far from a fact. At the next two meetings, the rate may be increased by another 1% and will amount to 2%. However, the further increase may be much less rapid, since the Fed must act so that the recession does not start in the American economy, which American journalists are now actively talking about. In addition, it is unknown what the Ukrainian-Russian conflict will be like in 2-3 months, and what will happen when Finland and Sweden join NATO (if this happens). Uncertainty - now it all comes down to it. From my point of view, it is precise because of the uncertainty that we should not expect the Fed to raise the rate to 3.0-3.5% now. But even in this case, we should not expect that inflation will return to 2.0% during this year. Jerome Powell spoke about this, and other FOMC members are also talking about it.

Why is all this interesting for wave markup? The downward section of the trend is nearing its end, so the demand for the dollar should begin to decline in the near future. Will the market be able to ensure this if the Fed intends to further tighten monetary policy? I believe that yes since the market could have already won back all future increases. Let me remind you that last week the dollar did not rise after the Fed meeting, and failed to continue building the fifth downward wave. That is, the fastest rate increase since 2000 did not lead to an increase in demand for the US currency, although before that it was actively growing, sometimes without any news background.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". The construction of the proposed wave 4-5-E may have already been completed.

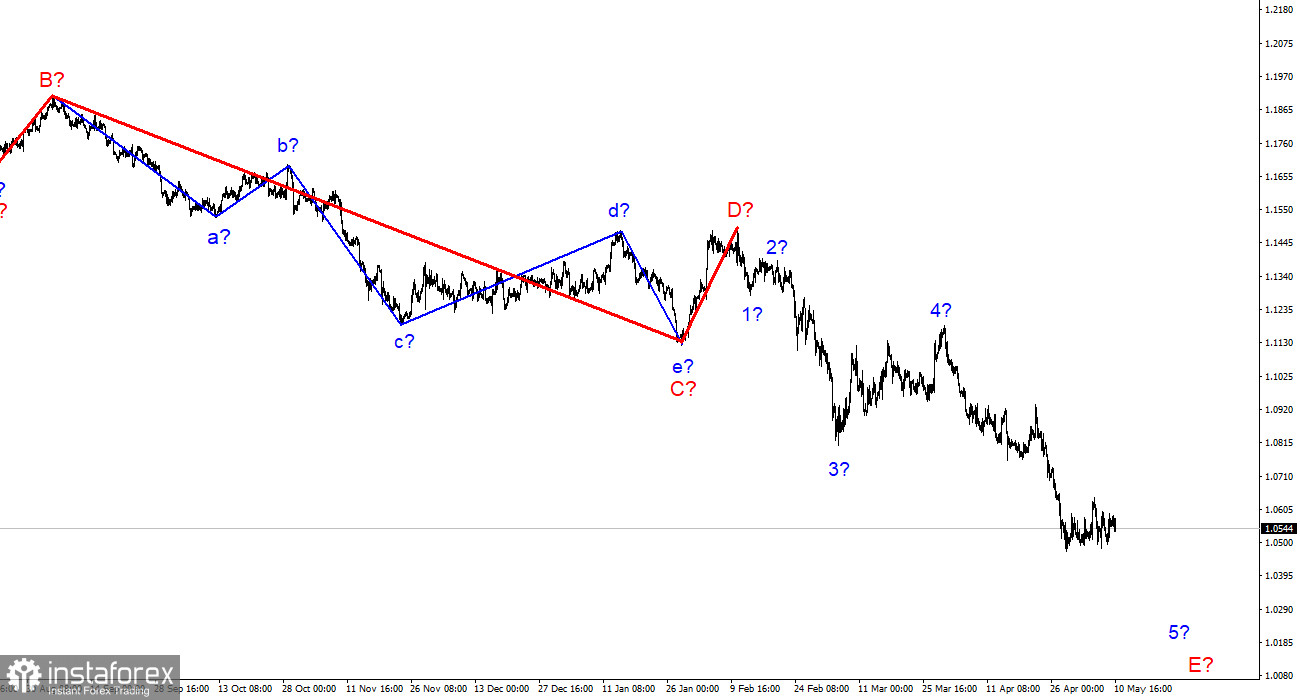

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which turns out to be as long as wave C. The European currency may still decline for some time.