The EUR/USD currency pair again showed nothing interesting on Tuesday. During the first trading day of the week, the pair tried to start an upward correction, for the nth time, but again unsuccessfully. If there is no desire to look at the chart of the currency pair, then for general understanding: after a strong fall, the pair managed to grow by only 100 points (with grief in half) and cannot yet overcome even the moving. That's all you need to know about bull market opportunities right now. Thus, for more than a week, the pair has been trading between the Murray levels "2/8" and "3/8", although it has worked out the upper limit of this channel only once. Last week, after summing up the results of the Fed meeting, the dollar initially fell, which allowed the pair to grow to the level of 1.0620, which, of course, it could not overcome. Below the level of 1.0498, the pair is also not able to gain a foothold yet, but nothing is surprising here. The European currency has been falling for a long time, and traders cannot constantly do anything but sell it. At the current levels, which are close to 20-year lows, many have a question about the feasibility of further sales. But at the same time, it is worth noting that the bears do not close sales deals either, because otherwise, the euro would be able to adjust.

What do we have as a result? Bears remain dominant in the market, they are not ready to sell the euro even more, but they are not in a hurry to fix positions either. Bulls are simply absent and do not interfere in what is happening at all. The fundamental or geopolitical background could help traders make a new decision on the euro/dollar pair, but there is neither the first nor the second now. The whole fundamental background of the last 10 days has been reduced to American Nonfarm, to American inflation (will be released today), and to the Fed meeting. The Fed did not surprise or disappoint the market, nor did Nonfarm. But this was not enough for the euro currency to fall under new sales. Thus, there remains hope for a geopolitical background.

Geopolitics continues to exert hidden pressure on the euro currency.

Unfortunately, there has been no positive geopolitical news either. Hungary's blocking of the oil embargo is temporary, as it became known yesterday that the head of the European Commission, Ursula von der Leyen, will personally communicate with Viktor Orban. It also became known about the intentions of French President Emmanuel Macron to call the Hungarian Prime Minister. Thus, when two such "heavyweights" of European politics will personally talk to the main "troublemaker", there is reason to assume that Orban will change his opinion. This means that sanctions will be imposed, which will further worsen relations between the European Union and Russia, and threatens new economic losses for both the former and the latter.

There is no positive news from the fronts of Ukraine either. Kyiv has frankly taken a wait-and-see position now and is only repelling attacks by Russian troops. Only near Kharkiv did the AFU regularly go on the offensive and liberate local villages and towns. Kyiv is waiting and waiting for everyone knows what. Western weapons. On Sunday, Joe Biden signed the law "on lend-lease for Ukraine", which means virtually unlimited supplies of weapons during the entire period of confrontation between Ukraine and Russia. What do we have? The Russian army, which is superior in the number of personnel and weapons, is being depleted, and the Ukrainian army, although not increasing in size, is receiving more and more new weapons from the West. And this flow of weapons will become a whole river in the coming weeks and months. Accordingly, there is no reason to expect that this conflict will end in the near future or will move into the "Donbas 2.0" phase. Moreover, Kyiv's rhetoric is getting tougher day by day. Now Kyiv says that there will be no peace talks until Moscow withdraws its troops beyond the borders not only of February 24, 2022 but also beyond the borders of 2014. In other words, Kyiv will either militarily or diplomatically defend the ownership of Crimea and Donbas to itself.

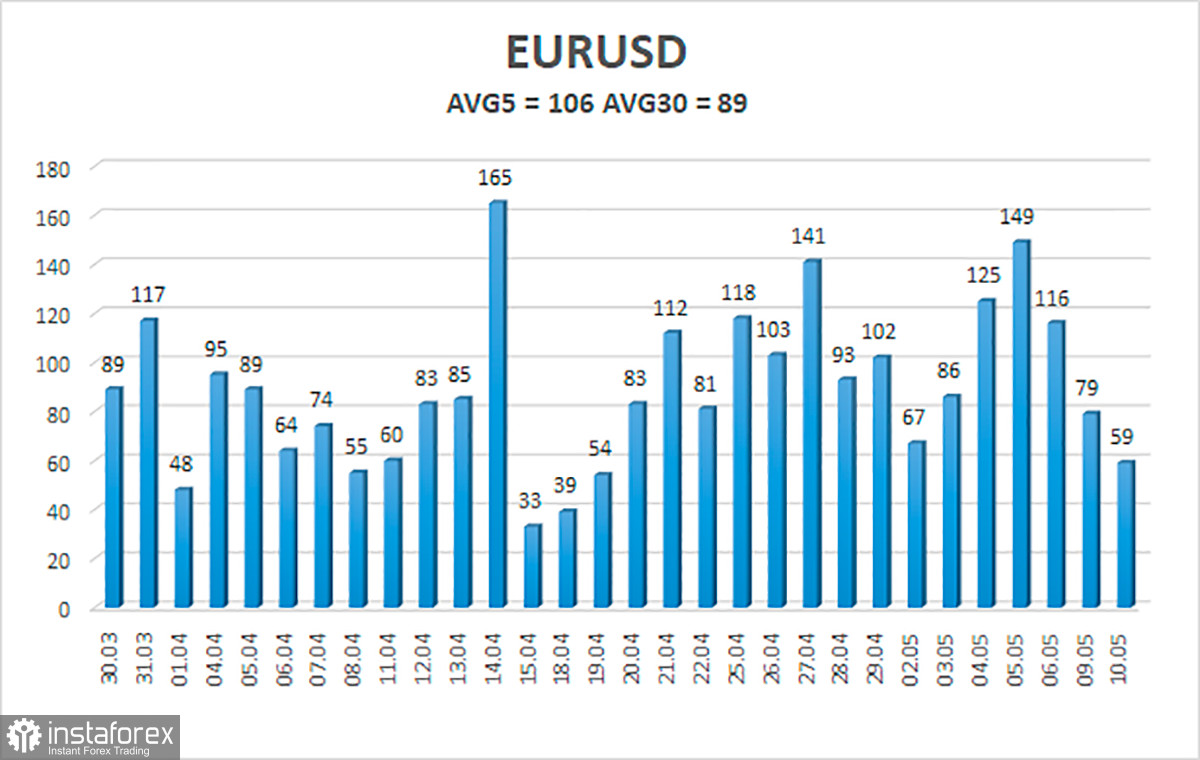

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 11 is 106 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0438 and 1.0651. The reversal of the Heiken Ashi indicator downwards signals a new attempt to continue the downward trend.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair is trying to maintain a downward trend. Thus, new short positions with targets of 1.0442 and 1.0376 should now be considered if the level of 1.0498 is overcome. Long positions should be opened with a target of 1.0742 if the price is fixed above the level of 1.0620.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.