The GBP/USD currency pair continued to trade indistinctly on Tuesday. After the record fall last week, many (including us) expected to see an upward correction. But the pound together with the euro seems to say: you will not wait. Thus, the downward trend remains in force, and all trend indicators are still directed downward. At the moment, the British currency has failed to adjust even to the moving average line. That is, the situation for the pound is almost identical to the situation for the euro. Both currencies are extremely weak and cannot even adjust. Recall that it is the factor of the mandatory presence of corrections from time to time that is almost the only factor of possible growth for both currencies. However, if the market refuses to buy the euro and the pound, then how can these currencies grow?

Based on this, it can be assumed that at this time the market is just waiting. It is waiting for new information because an important inflation report will be published in the States today. It is unlikely that this report alone will be able to radically change the mood of the market, but it still has such an opportunity. Most likely, we are talking about a pause now, which may drag on for several weeks. The situation is almost stalemate: bears do not want to continue selling, and bulls do not want anything at all now. What is the way out of it? Just wait for the thicket of scales to lean in someone's favor. After all, the market is a huge number of traders of different stripes. Therefore, if one or two even major players suddenly start acting, it is unlikely to lead to a serious change in the pair's course. The majority of market participants must make the appropriate decision. And either a strong fundamental background or a strong geopolitical background can contribute to this. We have already talked about geopolitics in the article on the euro, and the fundamental background after the meetings of the Bank of England and the Fed does not promise the receipt of important information at the disposal of traders.

The pound does not have much hope for an inflation report.

In principle, the key event of this week is the inflation report. On Thursday, important data (GDP, industrial production) will also be published in the UK, but recently the market has been reacting very sluggishly to British statistics. Therefore, you should not expect a strong reaction. But the US inflation report may become resonant. For the first time in a long time, the consumer price index may show not an acceleration, but a slowdown. It is unlikely that this can be considered a victory for the Fed, since so far it has announced only one rate increase of 0.25% (an increase of 0.5% in May has nothing to do with April inflation). That is, it is hard to imagine that the first increase will lead to a significant slowdown. We tend to think that the slowdown will be purely symbolic. If experts predict 8.1% y/y, then we believe that the actual value will be higher than 8.1%, but lower than 8.5% (the value for March). Therefore, if inflation does not suddenly fall below 8%, then traders will not have much to react to today. A slowdown of a few tenths of a percent on a strong upward trend (in terms of inflation) may be a banal accident. For example, the US GDP in the first quarter showed a drop of 1.4%, but hardly anyone can conclude that the American economy is now in recession. Consequently, there are more chances that today we will see a surge of emotions, but hardly a strong movement in one direction.

Consequently, this week, the pound will either continue to move sideways (which is visible on the lower TF), or it will slowly continue to slide down. After all, as we have already found out, bulls are not particularly active now. So far, it is difficult to imagine what can save the British pound in the current situation, even if the rate increase by the Bank of England did not give strength to this currency. It remains to hope either for chance or a "correction factor".

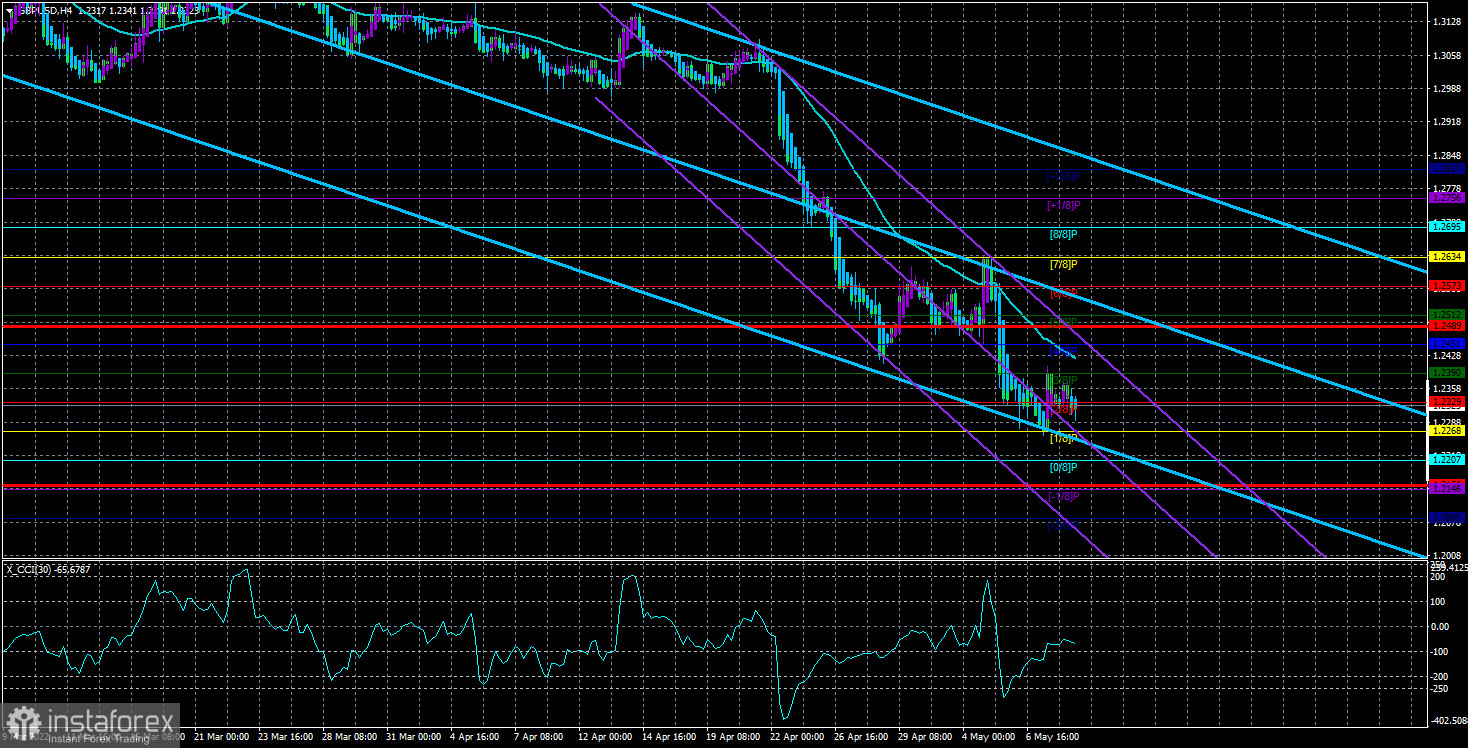

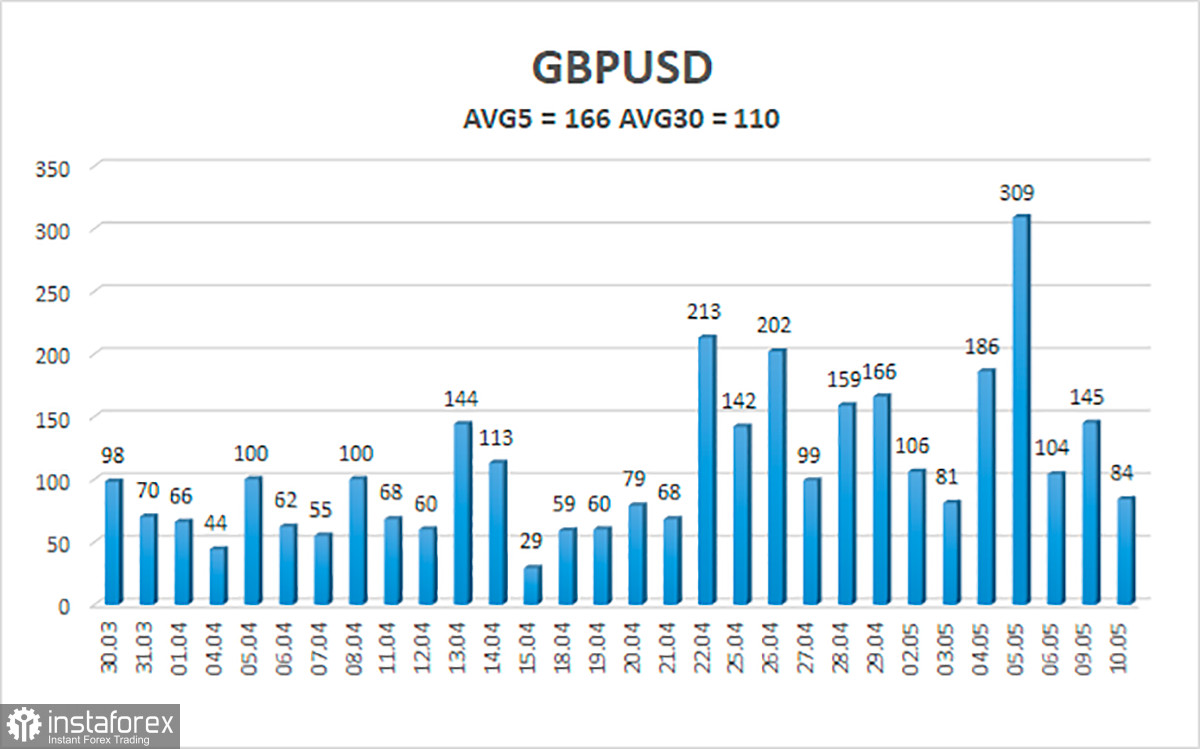

The average volatility of the GBP/USD pair over the last 5 trading days is 166 points. For the pound/dollar pair, this value is "very high". On Wednesday, May 11, thus, we expect movement inside the channel, limited by the levels of 1.2156 and 1.2489. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading recommendations:

The GBP/USD pair maintains a downward trend in the 4-hour timeframe. Thus, at this time, new ones should be considered for sale with targets of 1.2207 and 1.2156 after the reversal of the Heiken Ashi indicator down. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2489.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.