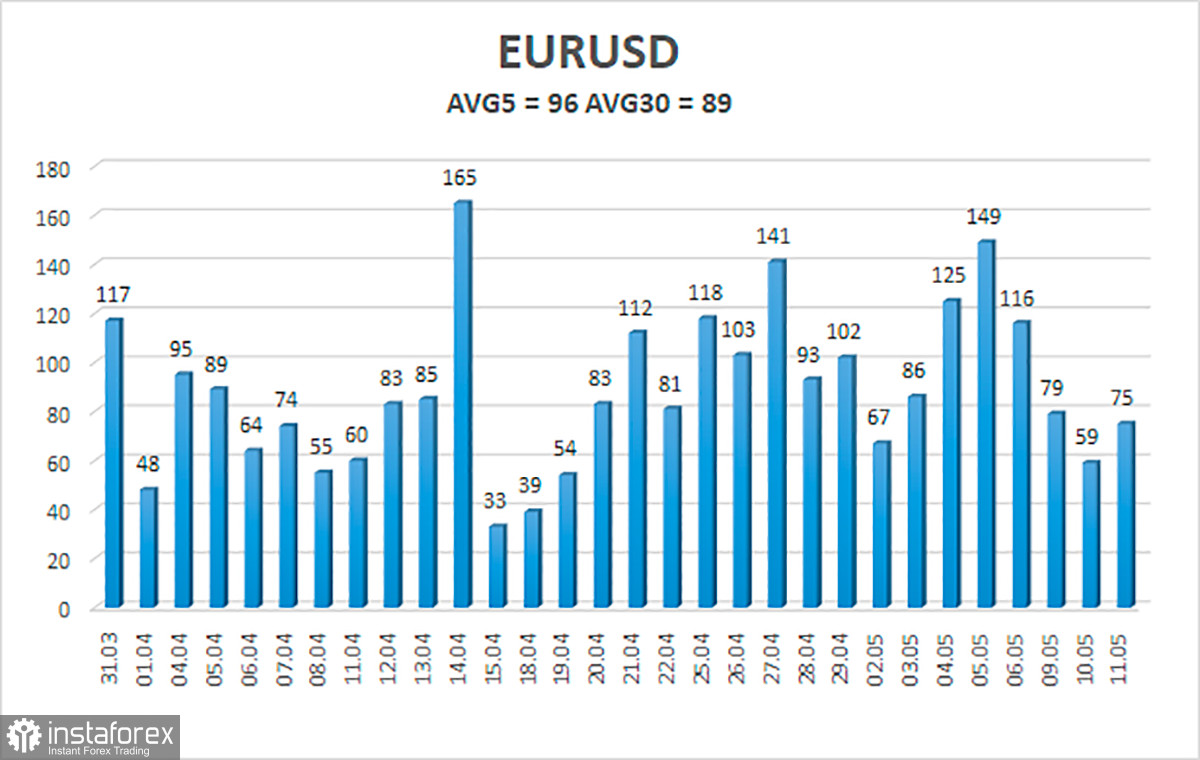

The EUR/USD currency pair collapsed by 50 points during the third trading day of the week within half an hour. It sounds a little strange and even funny. Let's figure it out. For most of the day, the pair continued to trade inside the side channel, which is visible on the lower TF. On the 4-hour TF, the pair continued to stay above the Murray "2/8" level and below the Murray "3/8" level. That is, also inside the side channel. After the inflation report was published, the pair collapsed down by those notorious 50 points, but it is impossible to call this movement a "collapse". It was just sharp, but not strong. Recall that the volatility of the euro/dollar pair has been high recently, which is perfectly shown by the illustration below. Therefore, 50 points are nothing in the current circumstances. Moreover, the pair failed to continue falling and remained inside the side channel at the end of the day. Consequently, our yesterday's forecasts came true, which said, firstly, that inflation in the US is likely to be below the March value and above the forecast, and, secondly, the pair will not be able to leave the side channel.

Thus, according to the results of Wednesday, the technical picture has not changed at all. Bears have stopped selling the pair, as it is already very low, near its 5-year and 20-year lows. Buyers are still absent from the market. The pair is waiting, but it is not clear what it is waiting for. If there is a new fundamental background, then the most interesting events have already passed. This is the Fed meeting, reports on non-farm and inflation. If there is new geopolitical news, then it is unlikely that it will receive it in the near future. The conflict in Ukraine is slowly moving into a sluggish stage. This does not mean that both sides of the conflict have taken up the positional defense and are not moving from their places. Russian troops are trying to advance deep into Ukraine, and the AFU is pushing Russian troops out of the Kharkiv region. But the progress of both sides is very slow, and there is no "loud" news from the fronts and Kyiv and Moscow now.

Christine Lagarde again talked about inflation, but not about rates.

In addition to the report on US inflation, ECB President Christine Lagarde also gave a speech yesterday. Lagarde said that "inflation forecasts indicate that the indicator is near the target level in the medium term." Not a word was said about rates, although Lagarde's deputy Luis de Guindos said a few weeks ago that the ECB could raise rates in July. However, a lot of time has passed since then, and Lagarde has never confirmed de Guindos' words. Moreover, it is completely unclear how to interpret Lagarde's words about inflation. The Fed is one thing - the US regulator has already raised the rate to 1% and intends to raise it by another 1% only at the next two meetings. That is, the Fed can count on a reduction in inflation in the medium term. And what can the ECB count on if even its head and his deputy cannot figure out when to start raising the rate? Lagarde also said that the APP program (quantitative stimulus program) should be completed at the beginning of the third quarter. That is, think about it, the ECB is still printing money and using it to stimulate the economy. What kind of reduction in inflation can we talk about if the QE program is still working?

Thus, from our point of view, the European currency has received a new reason for falling today, and the ECB has once again shown its weakness. Moreover, the head of the Bundesbank, Joachim Nagel, said that inflation is likely to accelerate in the near future. We are inclined to believe this opinion since almost all factors speak in favor of the fact that the consumer price index will not slow down in the Eurozone in the near future. The ECB's passivity, the weakness of the European economy, the geopolitical conflict in Ukraine, and the impending energy and food crises play a role here. As well as sanctions against the Russian Federation, which will work both ways.

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 12 is 96 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0455 and 1.0647. The reversal of the Heiken Ashi indicator downwards signals a new attempt to continue the downward trend.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair is trying to maintain a downtrend. Thus, now we should consider new short positions with targets of 1.0442 and 1.0376 in case of overcoming the level of 1.0498. Long positions should be opened with a target of 1.0742 if the price is fixed above the level of 1.0620.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.