The GBP/USD currency pair also tried to continue its downward movement on Wednesday and also remained inside the side channel. The pair has not yet managed to overcome the level of 1.2268, which is a local and 2-year low. However, the fact that the pair continues to remain very close to these lows suggests that there are no bulls in the market, and the bears are not going to close their trades. All this can lead to a new fall in the pound, even though it has already fallen quite low and cannot even adjust in any way. We already wondered at the weekend how much more the euro and the pound could fall. After all, new destructive factors for them have not appeared recently. And all the old ones have already been worked out by the market several times. It seems that the market is selling off European currencies simply by inertia because there is a trend. Moreover, the British pound now has objectively fewer reasons to fall, since the Bank of England has already raised the key rate four times. However, the market does not take this factor into account at all, so we believe that the pound is already in the oversold area. The downtrend will end sooner or later, after which a really strong upward correction should follow.

Of course, a lot will depend on geopolitics. Under the circumstances, it doesn't make much sense to predict something even a month in advance. Now few people believe that the Third World War will begin, or that the military conflict will spill out beyond the borders of Ukraine. However, we believe that unpleasant "surprises" are possible. And even in large numbers. After all, until February 24, few people believed that a military special operation would begin in Ukraine. First, the scale of a possible food crisis is now completely incomprehensible. Second, it is completely unclear what price values of oil and gas will eventually rise. Third, it makes absolutely no sense to try to predict future inflation. The Bank of England previously predicted 5.75%, and at the last meeting, it already indicated 10.25% of maximum inflation in 2022. That's all you need to know about the official forecasts. The situation is already changing very quickly and may continue to do so during this year. The Bank of England and the markets will react according to the place of events.

Inflation in April in the United States was 8.3%.

Well, yesterday the last of the most important reports in the US was published - the inflation report. According to it, the consumer price index was 8.3 y/y in April, which is not much lower than in March. The forecast was 8.1-8.2%. Consequently, the forecast was not reached. What does the 8.3% inflation mean? Only it is impossible to draw any conclusions from this value now. The 0.2% slowdown may be pure chance and does not mean at all that we will see a new slowdown in a month. This means that the Fed should continue to put pressure on inflation by raising the key rate and reducing its balance sheet. Moreover, at the previously stated pace, or even faster and more aggressive. Without this, inflation will remain at high values for a very long time.

Fortunately for the dollar, high inflation does not affect its exchange rate in any way. Previously, the market sought to buy the dollar if inflation accelerated, as this meant tightening the Fed's rhetoric in the future. Now the Fed's plans have been announced many times and are known to all market participants. Therefore, there is nothing to react to. Is the dollar depreciating rapidly? As we can see, no. The dollar, on the contrary, is growing. True, prices in America are also growing. But the American population is far from the poorest in the world, so it is unlikely to raise a panic because of the inflation rate, which is considered the norm in Ukraine or Russia. Thus, the pound is now likely to sell off by inertia. It is very difficult to say how much longer this process will continue since the "foundation" and "macroeconomics" do not affect the pound/dollar exchange rate very much right now.

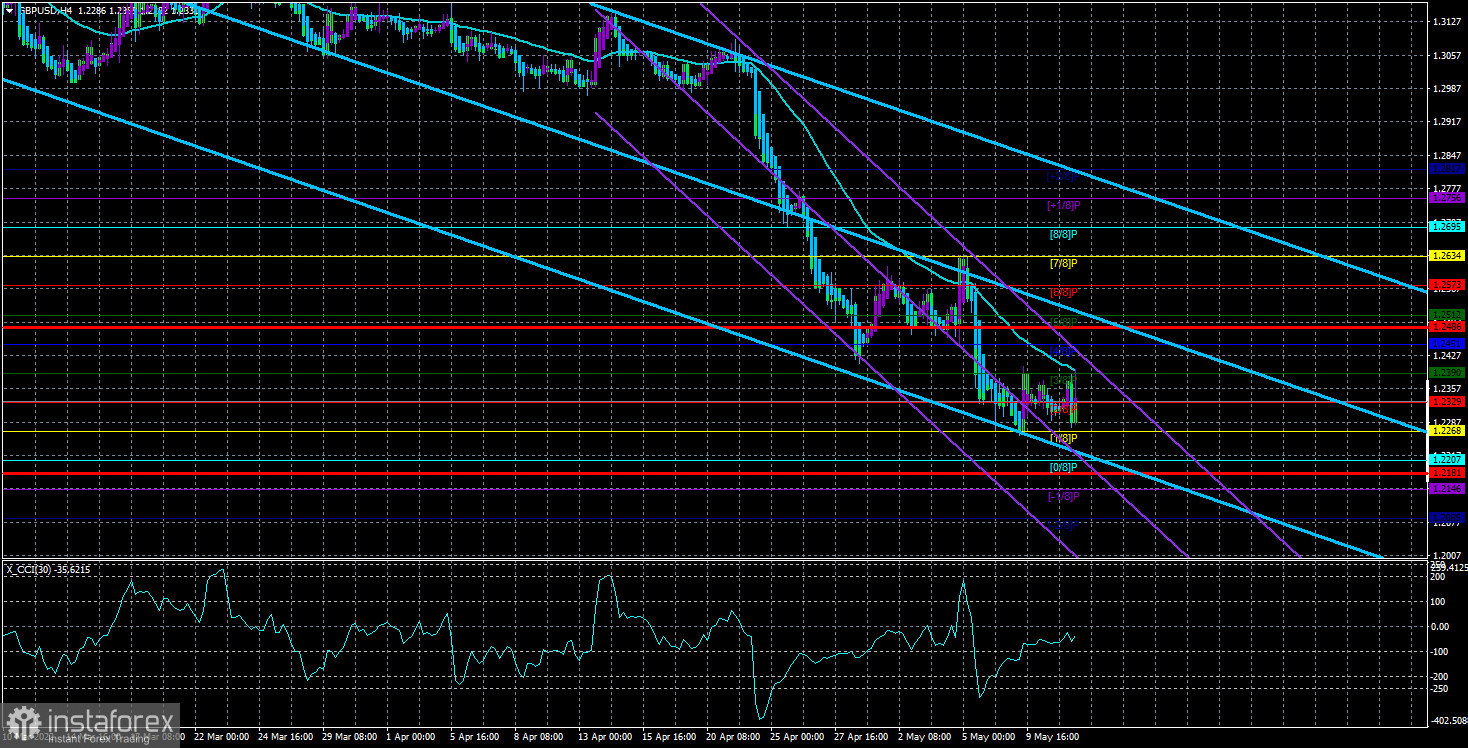

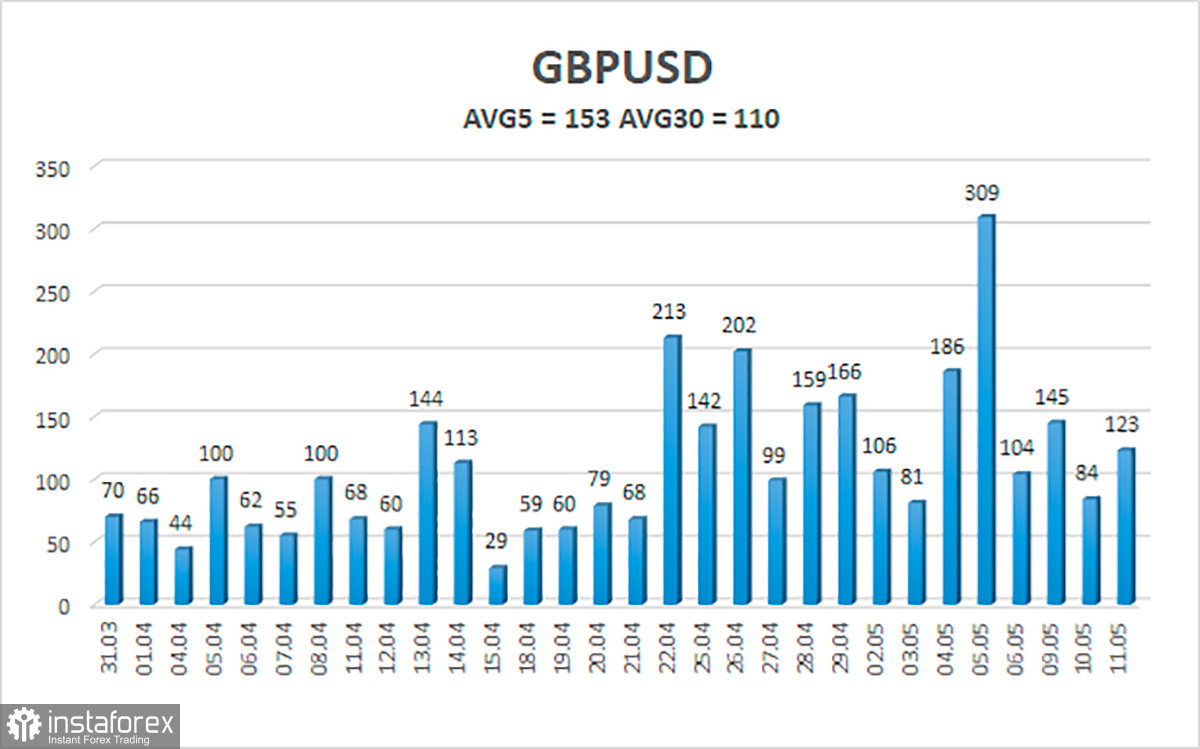

The average volatility of the GBP/USD pair over the last 5 trading days is 153 points. For the pound/dollar pair, this value is "very high". On Thursday, May 12, thus, we expect movement inside the channel, limited by the levels of 1.2181 and 1.2486. The upward reversal of the Heiken Ashi indicator will signal a new attempt to start an upward correction.

Nearest support levels:

S1 – 1.2329

S2 – 1.2268

S3 – 1.2207

Nearest resistance levels:

R1 – 1.2390

R2 – 1.2451

R3 – 1.2512

Trading recommendations:

The GBP/USD pair maintains a downward trend in the 4-hour timeframe. Thus, at this time, new ones should be considered for sale with targets of 1.2207 and 1.2181, if the level of 1.2268 is overcome. It will be possible to consider long positions if the price is fixed above the moving average line with a target of 1.2486.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.