Yesterday, there were no changes in trading on the main Forex currency pair. EUR/USD continued to trade in a relatively narrow price range. For some reason, EUR/USD is likely to remain suspended during the current five-day trading cycle. However, this could change over the next two trading days.I will start today's EUR/USD review with the US Consumer Price Index data released the day before. The actual figures exceeded forecasts in all components of this index. This indicates that the Federal Reserve is on the right track to tighten its monetary policy to combat high inflation. Today there will be data from the United States on the producer price index, including its core value, as well as a speech by Fed member Daley on the Open Market Committee. No macroeconomic data is scheduled from the Eurozone today. In this regard, it is logical to assume that today's EUR/USD trading will be influenced by the indicated US statistics, market sentiment as well as the technical component.

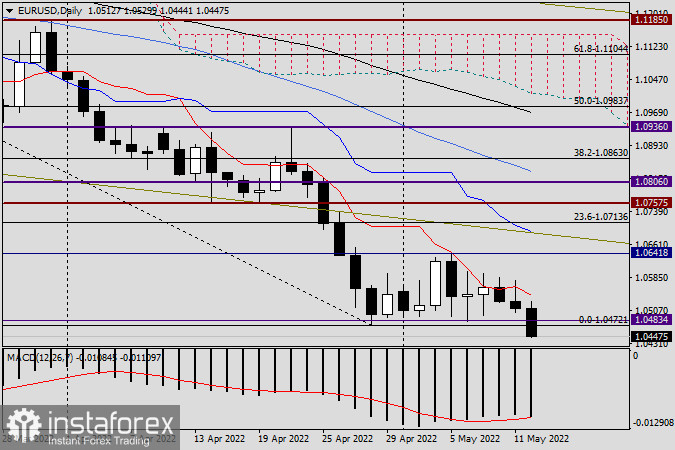

Daily

Yesterday's EUR/USD trades closed again above the crucial psychological level of 1.0500. This time, the closing price was 1.0512, down from 1.0528. Given this factor, as well as the strong resistance offered by the red Tenkan line of the Ichimoku indicator, a collapse of EUR/USD under the key support at 1.0472 (April 28 lows) would not be unexpected. There will be bullish sentiment on the main currency pair only after a strong upward break of the Tenkan line, which passes at 1.0562. Looking at the daily timeframe, we have to admit that there are slightly more prerequisites for a resumption of the downward trend. Although, range trading in EUR/USD continues, so it is better to refrain from making unequivocal conclusions for the time being.

H4

The current four-hour chart confirms the assumption made when describing the daily timeframe. This chart clearly shows that the pair is aiming to once again test the strong support zone of 1.0483-1.0472. Given the price dynamics, this is exactly what the preparation is going for. If so, the main trading recommendation for EUR/USD is to open short positions. However, opening them at 1.0500 and the support area 1.0483-1.0472 seems to be a rather risky positioning. So, it would be better to wait for the rebound to 1.0540, where the 50-MA is and/or higher, to the black 89 exponent, which is at 1.0603. A confirmation signal for the opening of short positions will be the appearance of bearish candlestick patterns beneath the indicated moving averages. As for the buying, they will be relevant only after a true breakdown of the daily Tenkan line of the Ichimoku indicator.