Previously, I assumed that the British pound is less resilient against the US dollar than the single European currency. Now we can see the confirmation on the chart. Before analyzing the technical picture, let's first check the economic calendar. In the morning, the GDP report was published in the UK which came in weaker than expected. So far, this has been the main reason to stop the Bank of England from more aggressive monetary tightening. In my previous reviews on GBP/USD, I pointed out the difference in the policies of the US and UK regulators which was again confirmed in today's reports. Market participants are also aware of this fact, so they priced in this factor in the value of the British currency a long time ago. That is why the pound is more vulnerable to the pressure from the greenback. Another report to consider today is the US producer price index that is due to be out in the afternoon. It is hard to say whether this data will affect the trajectory of the pound/dollar pair. So let's move on to technical analysis and start with a daily chart.

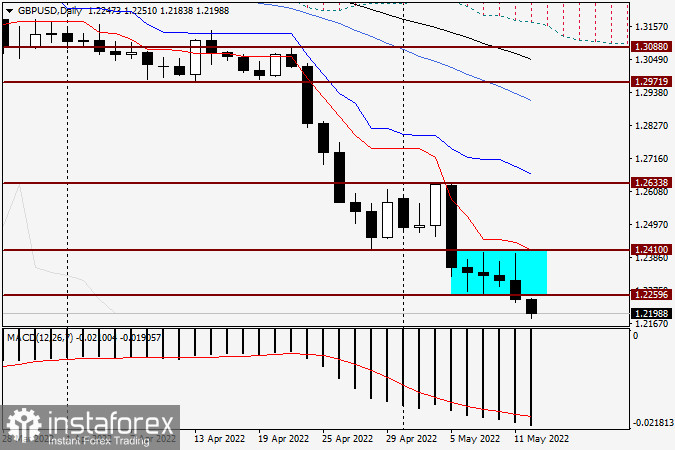

Daily chart

So, the pound/dollar pair has left, or is in the process of leaving, the trading range that was indicated yesterday. At the time of writing, the pair is trading near the strong technical level of 1.2200. A close below this level will inspire bears who are already quite strong. If a daily candlestick with a long lower shadow appears on the chart and the price closes above 1.2260, there might be another attempt to test the broken support level of 1.2410. In the meantime, all the factors confirm the bearish scenario for GBP/USD. This is especially obvious on the daily chart as the pair closed yesterday's session below the support level of 1.2260.

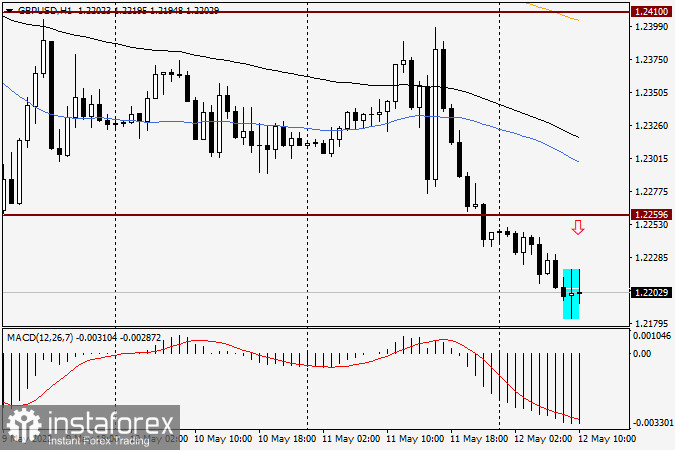

H1

On the 1-hour chart, the pair is set to develop a corrective pullback to the area of 1.2250-1.2260. This is confirmed by the Doji candlestick that looks very much like a reversal pattern. If the quote starts rising and bearish candlestick patterns appear in the mentioned price zone on H1 or H4, this will serve as a signal for opening short positions at a much better price. In the current situation, I would stay away from buying the pair. Once again, I would like to note that the British pound is very weak now. Besides, there are currently no strong signals for going long. Let's assume that bulls will somehow manage to push the pair to the range of 1.2400-1.2410, where a strong technical level and broken support are located. In this case, amid appearing bearish signals, selling the pair will become an even more attractive option thanks to the higher price. That's all for now.

Good luck!