Who can put another nail in the coffin of gold, if not the chairman of the Fed? Jerome Powell's hawkish rhetoric quickly clipped the wings of XAUUSD buyers trying to take off. He dealt a double blow to the precious metal. On the one hand, the head of the central bank said that he and his colleagues would be the first to provide the aircraft of the US economy with a soft landing in the current difficult conditions. On the other hand, Powell stressed that until the Fed sees clear and convincing evidence of easing inflationary pressures, it will continue to raise rates.

Gold was seriously counting on a recession and a 3% ceiling on 10-year Treasury yields. Especially since Elon Musk presumptuously declared that the US economy was already facing a recession. In fact, the decline in GDP by 1.4% in the first quarter is inconclusive proof of this. Domestic demand in the US is still strong, as evidenced by the fourth consecutive increase in retail sales. Most likely, the economy will rebound upwards in the second quarter, which is bad news for the precious metal.

For a long time, XAUUSD bulls have drawn strength from negative real yields on US Treasuries. However, inflation-adjusted debt rates are gradually moving into a positive area. This is facilitated by the tightening of the Fed's monetary policy. According to St. Louis Fed President James Bullard, the central bank has an excellent plan, and as soon as it lifts its pinkie finger, the upcoming monetary restriction is already reflected in financial markets. Judging by the dynamics of financial conditions, asset quotes have already taken into account the increase in the federal funds rate to 2%.

Dynamics of financial conditions and the Fed rate

The indicator is extremely important for the Fed, as Powell once again emphasized. According to him, the central bank will ensure that inflation falls and financial conditions are in the right place. This means that it will not impede either the fall of stock indices, or the rally in US Treasury yields, or the strengthening of the dollar. All these processes create an extremely unfavorable background for XAUUSD.

More and more "bears" appear on the market, and investors are discussing what can stop or reverse the downward trend for the precious metal? Most likely, only the Fed can do this if it decides to pause or complete the process of tightening monetary policy. Until inflation starts to show convincing signs of a slowdown, this should not be counted on. Local gains in the euro or a drop in US Treasury yields should be viewed as temporary phenomena that will allow you to sell XAUUSD at a better price.

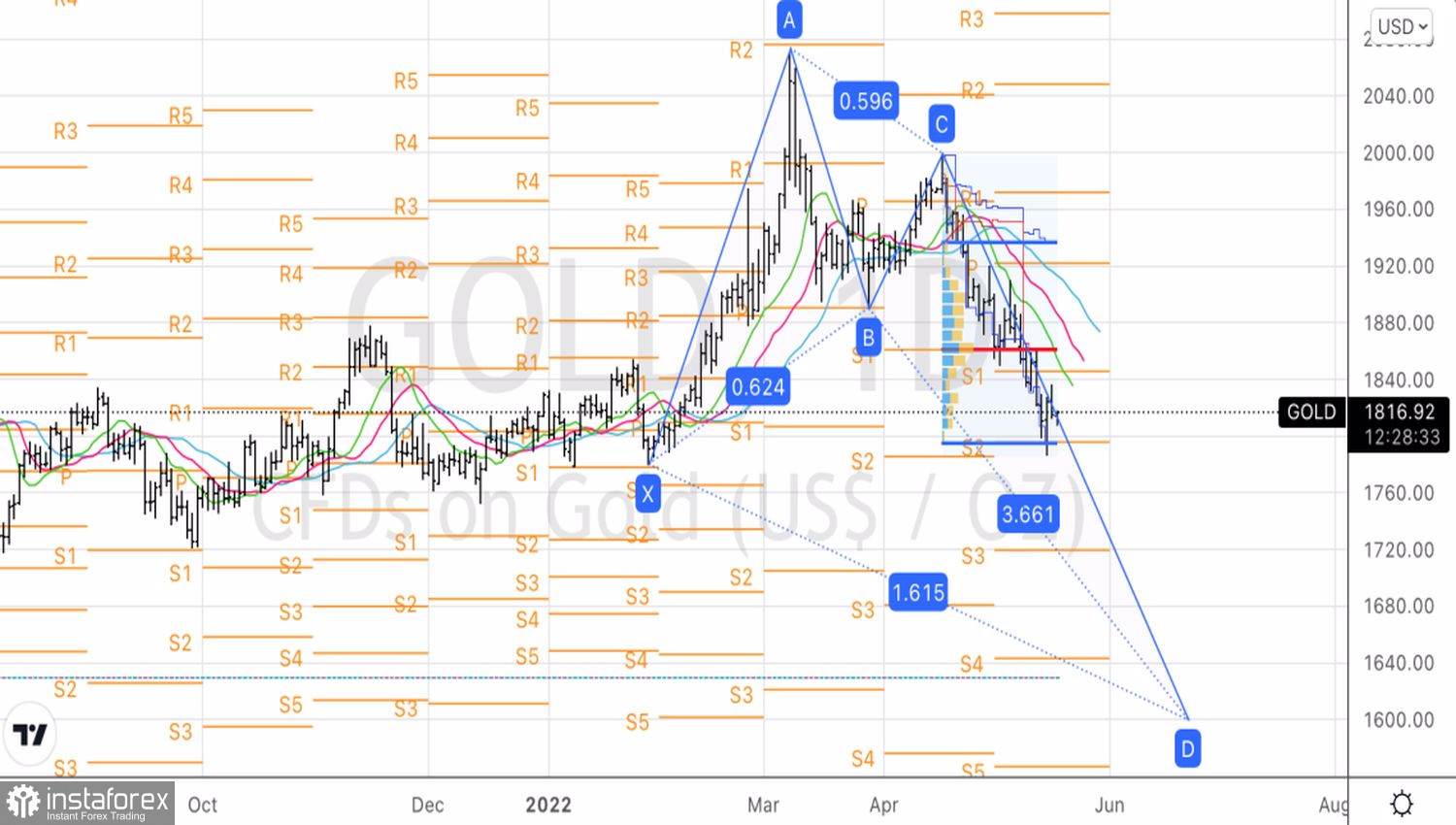

Technically, the activation of the Crab pattern indicates that the potential for a downward movement in gold is far from being exhausted. Its 161.8% target is $1600 an ounce. After the implementation of the previously announced targets at $1805 and $1795, it makes sense to set new ones at $1730 and $1700 and continue to sell the precious metal.

Gold, Daily chart