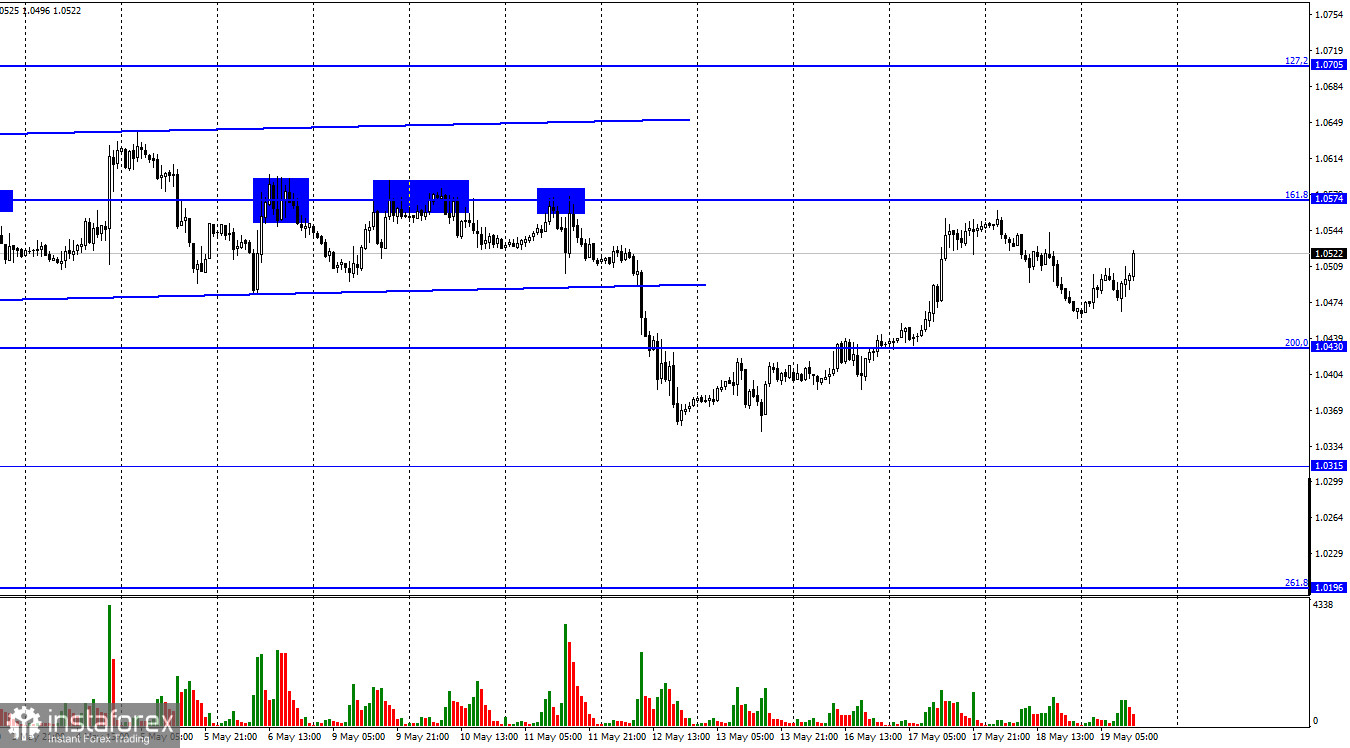

The EUR/USD pair performed a reversal in favor of the US currency on Wednesday and began to fall towards the corrective level of 200.0% (1.0430). Many traders were immediately afraid that the bears would return to the market and the euro currency would resume its long-term decline. However, Thursday showed that so far these fears are in vain. Today, the calendar of economic events of the European Union and the United States is empty, and in the meantime, the pair performed a new reversal in favor of the EU currency and began a new growth in the direction of the corrective level of 161.8% (1.0574). Two hours ago, the pair's growth even intensified, and, from my point of view, this is a very good sign for the euro. Now we will understand the prospects of this currency. Let's be honest, in recent months, the euro currency has been falling, by and large, because of the Ukrainian-Russian conflict. The Briton fell in the same way. Statistics for this period were different. There were good reports in the US, there were good data in the UK. And even when the ECB began to hint at a possible interest rate increase, the euro and the pound continued to fall, only occasionally pausing.

Traders put economic data on the second or third plan, and they could affect their mood only within one day. The global mood remained "bearish". But everything comes to an end sooner or later. If in the first month of the military operation in Ukraine almost every news on this topic from the European Union, the United States, or Ukraine with Russia caused the effect of an exploding bomb, now there has been no important news for a long time. No one is surprised by the new sanctions against Russia, and huge arms supplies to Ukraine, and military experts are increasingly saying that the conflict is moving into a protracted phase and will last at least a year. One would hardly expect that the euro and the pound will also fall for at least a year. Fears about the food crisis in Europe are exaggerated. After all, Europe is not Africa. As it turned out, Europe can also refuse oil and gas. It's going to be hard, but it's possible. So, maybe now is the turning point for the euro and the pound?

On the 4-hour chart, the pair performed a reversal in favor of the European currency after the formation of a "bullish" divergence at the MACD indicator. The process of growth has begun in the direction of the corrective level of 100.0% (1.0638), but this growth takes place inside the downward trend corridor, which still characterizes the current mood of traders as "bearish". A rebound from the level of 100.0% will work in favor of the US currency and the resumption of the fall in the direction of the Fibo level of 127.2% (1.0173).

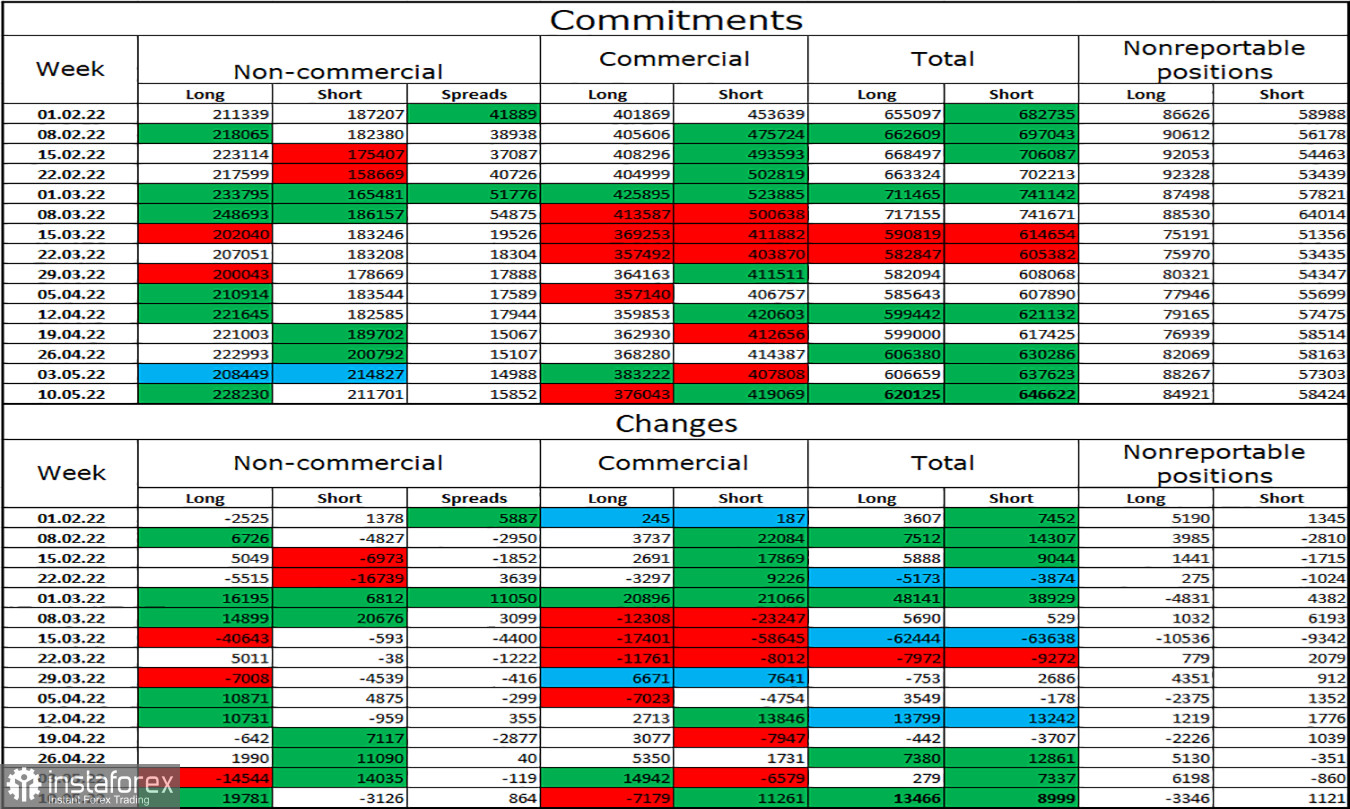

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 19,781 long contracts and closed 3,126 S=short contracts. This means that the bullish mood of the major players has intensified again. The total number of long contracts concentrated on their hands is now 228 thousand, and short contracts - 211 thousand. As you can see, the difference between these figures is minimal and you can't even say that it is a big problem for the European currency to show an increase of 100 points in the market. In recent months, the euro has mostly remained bullish, while the currency itself has been falling, falling, and falling. Thus, now the situation is approximately the same. The COT report continues to say that major players are buying euros, and the euro is falling in the meantime. Therefore, the expectations of COT reports and the reality now simply do not coincide.

News calendar for the USA and the European Union:

US - number of initial and repeated applications for unemployment benefits (12-30 UTC).

On May 19, the calendars of economic events in the European Union and the United States are almost empty. The information background for the rest of the day will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if there is a rebound from the 1.0574 level on the hourly chart with the goal of the 1.0430 level. Or in case of a rebound from the 1.0638 level on the 4-hour chart. I would recommend buying the euro currency when closing above the 1.0574 level with a target of 1.0705.