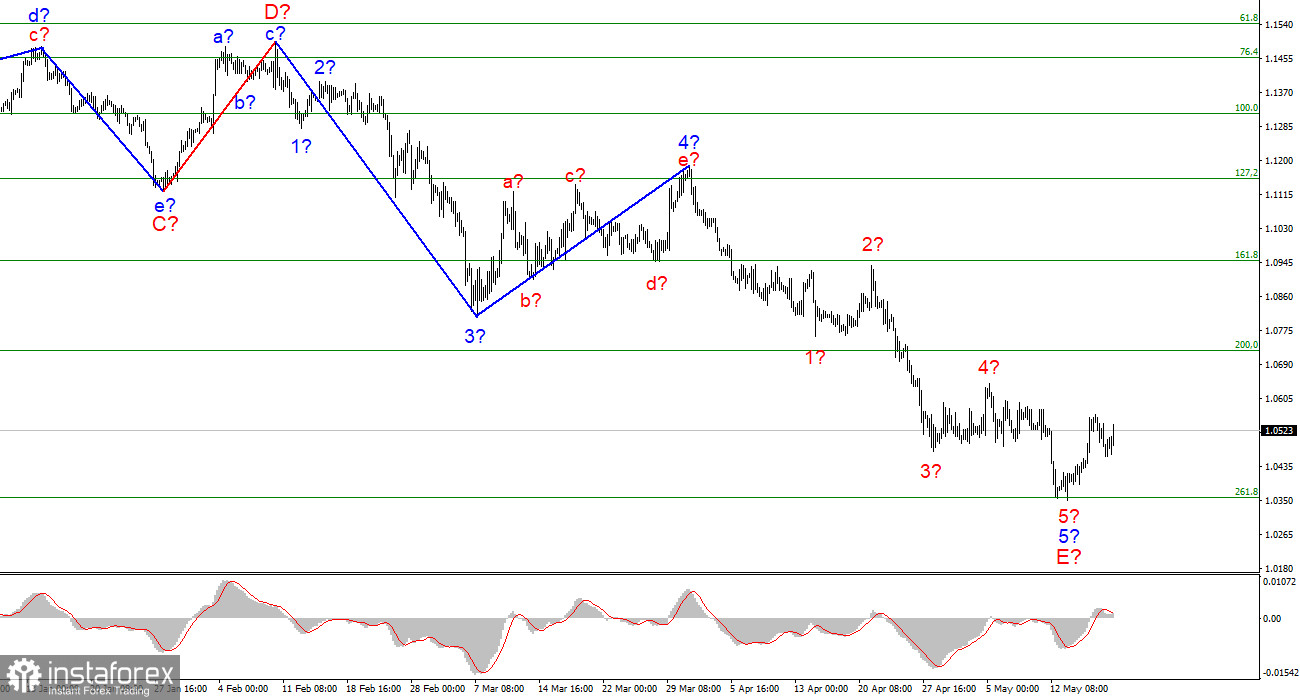

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing and does not require adjustments. The instrument has presumably completed the construction of the descending wave 5-E, which is the last in the structure of the descending trend section. If this is true, then at this time the construction of a new upward section of the trend has begun. It can turn out to be three-wave, or it can be pulsed. One way or another, the instrument has made a strong step towards completing a long downward section. The supposed wave 5-E turned out to be a pronounced five-wave, so its internal wave marking is beyond doubt. The only option in which the decline of the euro can resume is a strong complication of the entire downward section of the trend. It cannot be completely excluded, but I advise you to consider it as a backup option. The coming days will be crucial for the instrument, as Tuesday's success will need to be developed. Without this, the instrument can very quickly return to decline.

There is more and more talk of an ECB interest rate hike

The euro/dollar instrument rose by 60 basis points on Thursday. There was no news background today, nevertheless, the market found motives to increase demand for the euro currency. And this is good for the euro currency. The more demand grows, the higher the probability that my current wave markup is correct, and now the construction of a new upward trend section will begin. The demand for the euro currency is also fueled by talk that the ECB will decide to raise the interest rate this year. Let me remind you that it all started with ECB Vice President Luis de Guindos, who a few weeks ago said that the first tightening of monetary policy could happen as early as July. Then several more heads of central banks of the EU zone spoke in favor of raising the rate. Yesterday, the president of the Bank of Spain, Pablo Hernandez de Cos, said that at the beginning of the third quarter the rate will be raised, and did not rule out that it will increase in the following quarters. Yesterday, a member of the ECB's PEPP committee, Madis Muller, said that in 2022 rates will exceed zero. And already today, information has been received that the ECB has planned two increases this year. There is no official information about this. This is rather an insider, which still requires confirmation. However, you must agree that several sources from the ECB itself say that the PEPP will begin to tighten this year. And a few months ago, Christine Lagarde constantly stated that the regulator could not raise the rate in the current economic conditions, and the EU economy was too weak for this and could not take an example from the Fed. Thus, the European currency unexpectedly receives the support of the news background. Of course, it will take quite a long time until the rate is raised for the first time in many years. However, the market has already received the necessary trigger and now has the opportunity to increase demand for the euro.

General conclusions

Based on the analysis, I conclude that the construction of wave 5-E is completed. If so, then it is already possible to buy a tool with targets located near the estimated 1.0720 mark, which is equivalent to 200.0% Fibonacci, for each MACD signal "up". The downward section of the trend may still become more complicated, but it is already a backup option.

On a larger scale, it can be seen that the construction of the proposed wave E has been completed. Thus, the entire downtrend has acquired a complete look. If this is true, then in the future for several months the instrument will increase with goals, near the peak of wave D, that is, to the 15th figure.