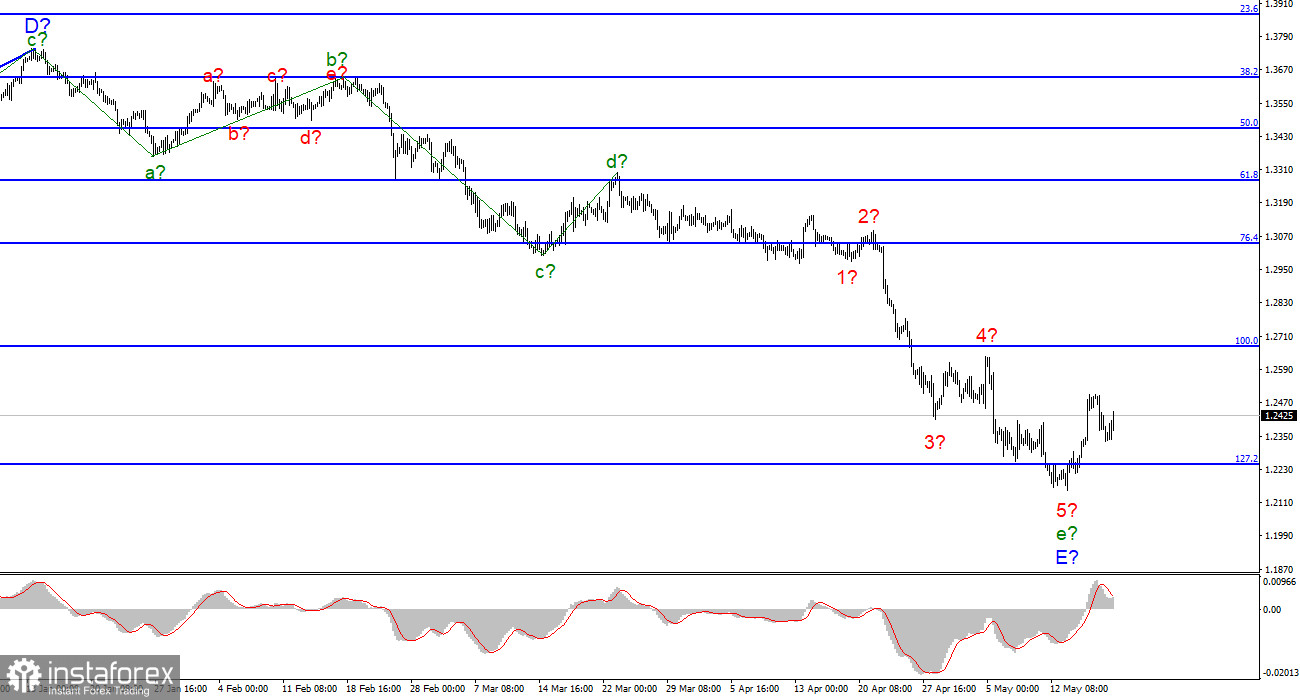

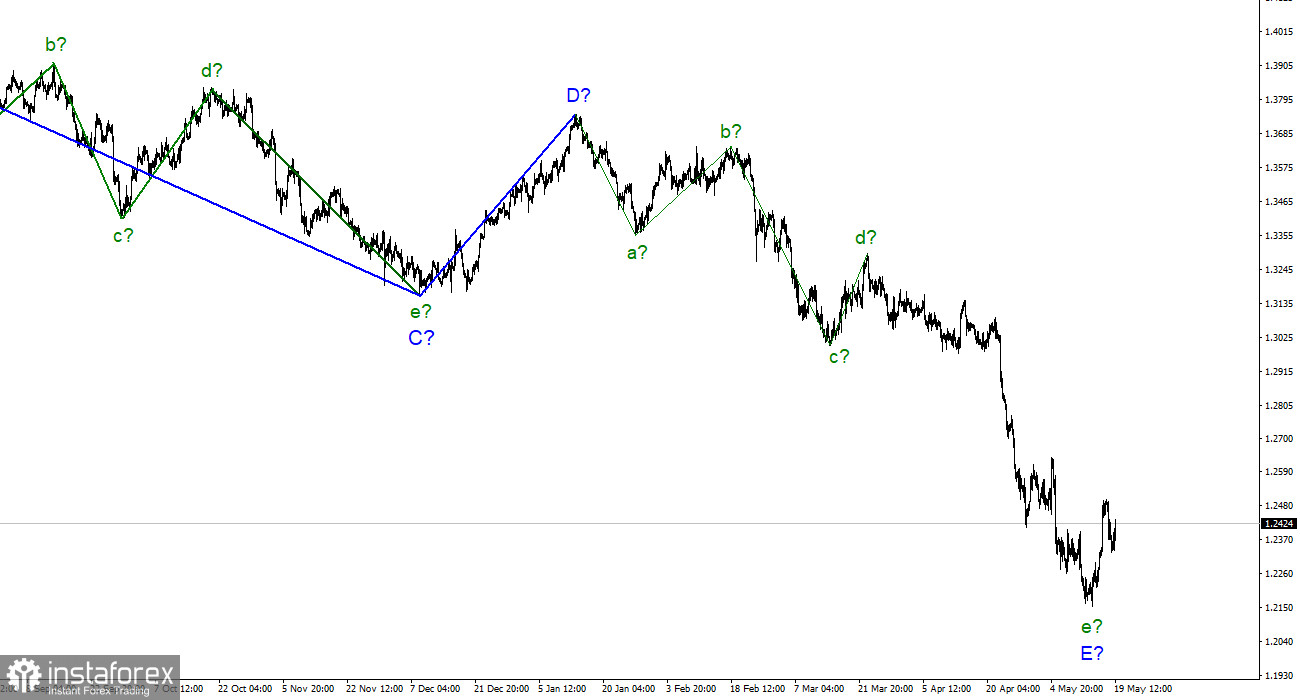

For the pound/dollar instrument, the wave markup continues to look very convincing and does not require adjustments. The downward section of the trend is presumably completed, and the wave e-E, although it has taken a rather complex form, however, is also a five-wave in the structure of the five-wave downward section of the trend, as for the euro/dollar instrument. Thus, both instruments can now complete the construction of downward trend sections, which will be very symbolic, given that they have traded very similarly in recent months. Of course, there is also a backup option, in which the descending section will complicate its internal wave structure. This may happen if the demand for the British begins to decline again. And it may start to decline due to the weak (for the British) news background. Or because of geopolitics. I suggest that at this time we start from the option that the downward section of the trend is completed, but at the same time closely monitor the news. The instrument's increase may continue with targets located near the 1.2672 mark, which corresponds to 100.0% Fibonacci.

A few months ago, it was impossible to guess the current levels of inflation.

The exchange rate of the pound/dollar instrument increased by 80 basis points on May 19. A day earlier, the instrument dropped by 160 points. The reason for such a strong decline was the report on inflation in the UK. The indicator rose to 9.0% y/y, and although this did not come as a surprise, it is hardly possible to call this news good. Today, there was no news background and the market began to recover quickly. I think this is a positive sign, as the demand for the British is growing again, even if there is no favorable news. This gives hope for the construction of a new upward section of the trend, although it may be corrective. Now it remains for the Briton to finish this week with dignity. Tomorrow morning there will be a report on retail trade volumes in April and forecasts are very weak. It is expected that volumes will decrease by 7.2%, if we take into account fuel costs, and by 8.4%, if without fuel. Whatever the real values, this is a strong drop in the indicator. And along with this indicator, the demand for a Briton may also drop significantly. However, if the market does not pay attention to this report tomorrow and continues to buy the pound, this will be another plus for building an upward trend section.

There was no more important news for the pound this week and probably won't be any more. Negotiations on the Northern Ireland protocol have resumed between the UK and the European Union, and the Bank of England is currently being heavily criticized by the government for disappointing forecasts for the British economy. Questions remain about whether the British regulator is ready to continue raising the rate and whether this will lead to a recession. Many analysts seriously fear that the British economy may begin to shrink, and how to deal with high inflation, even if raising the rate to 1.0% did not help to reduce it, remains a mystery.

General conclusions.

The wave pattern of the pound/dollar instrument still assumes the completion of the construction of wave E. As I said, a successful attempt to break through the 1.2246 mark from the bottom up will be a signal to close sales and open purchases with targets located near the estimated 1.2672 mark. This mark looks like a very confident goal. I do not think that the British, which has declined by more than 1,000 basis points in the last few weeks alone, will not be able to recover to this mark, which is near the peak of wave 4-e-E.

On the higher scale, the entire downward trend section looks fully equipped. Therefore, the continuation of the decline of the instrument below the 22nd figure is far from obvious. Wave E has taken a five-wave form and looks quite complete.