After the collapse of Terra UST, many investors began to get nervous, fearing that similar stories could repeat with other stablecoins pegged to the dollar. Only one Tether has lost about $ 7 billion since it also staggered, demonstrating a slight decoupling from the 1:1 rate. This raised quite a lot of questions about the company's reserves underlying the world's largest stable coin.

According to the data, Tether's turnover offer has fallen from about $ 83 billion a week ago to less than $ 76 billion and the outflow continues to be observed. Many experts have dubbed this another test for the entire cryptocurrency market.

As I noted above, a stablecoin should always cost $ 1, but last Thursday its price dropped to 95 cents amid panic over the collapse of a competing token called Terra USD. Terra has previously stated that all its tokens are secured one-to-one with dollars held in reserve. However, at the first massive attack, which was planned by large financial companies, all security quickly collapsed, which led to the fall of UST and the collapse of the company itself. Some well-known crypto specialists have concluded that it is Blackrock and Citadel that is behind the collapse of Terra. Most stablecoins are backed by fiat reserves, and the idea is that they have enough collateral in case users decide to withdraw their funds. But a new generation of "algorithmic" stablecoins, such as terraUSD or UST, tried to base their dollar peg on code. What this has led to - you already know everything yourself.

I have repeatedly noted the criticism of Tether. It was based on the fact that the real funds stored in the reserves of the company itself amounted to about $ 4.2 billion, another part - $34.5 billion - consisted of treasury bills with a maturity of fewer than three months, and $ 24.2 billion were invested in commercial securities altogether. Tether has repeatedly faced calls from investors to conduct a full audit of its reserves. In July 2021, the company announced that it would hold it in the coming months, but it has not yet done so.

Last week, US Treasury Secretary Janet Yellen warned about the risks to financial stability, and also called for all stablecoins to be subject to legislative regulation, and called on the Senate to approve a new bill on this sector by the end of 2022.

European politicians also did not stand aside. The governor of the Bank of France, Francois Villeroy de Gallo, said in an interview that the recent turmoil in the cryptocurrency markets should be perceived as a wake-up call for global regulators. Cryptocurrencies can destroy the financial system if they are not regulated - especially stablecoins.Fabio Panetta, a member of the executive board of the European Central Bank, also noted that stablecoins such as Tether are seriously vulnerable. If USDT owners withdraw their money en masse, there may not be enough liquidity. At the moment, the European Union plans to introduce strict regulatory supervision of stablecoins.

It is worth noting that Tether is an important part of the crypto market. With its help, transactions worth billions of dollars are made daily. Investors often transfer their money to USDT at a time of increased volatility of cryptocurrencies.

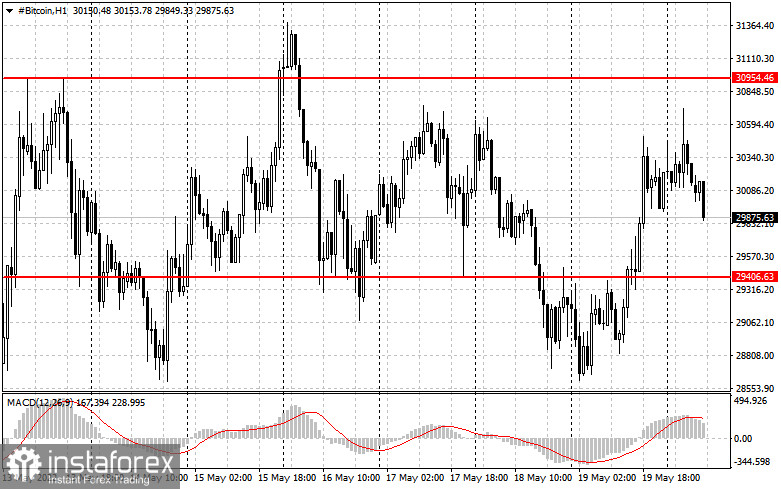

As for the cryptocurrencies themselves, after the largest sale, which was provoked by the collapse of the UST stablecoin and the Terra blockchain, the bitcoin exchange rate has stabilized a little. However, it is too early to say that buyers are actively returning to the market, rather the opposite - profit-taking and speculative traders helped to support the course, but the larger players continue to wait. To develop the initiative on the part of the bulls, active actions are needed in the area of $ 31,000, but before that, you need to try to return above $ 29,400, which they missed quite recently. Only consolidation above these two ranges will quickly return the trading instrument to $ 32,650, allowing investors to calm their nerves a little. A breakdown of the $ 29,400 level and the absence of buyers will bring the trading instrument back to a minimum of $ 27,600, and there it will be close to $ 25,700, which will turn the market upside down again and cause panic on the part of many investors.