The crypto community and its most significant figures have repeatedly stated that Bitcoin can become a key tool in countering inflation, as well as global financial and geopolitical turmoil. However, the problem was that all these statements were made during the dawn of the bull market for Bitcoin and other cryptocurrencies. And a few years later, when cryptocurrencies were significantly integrated into global financial flows, such loud statements disappeared.

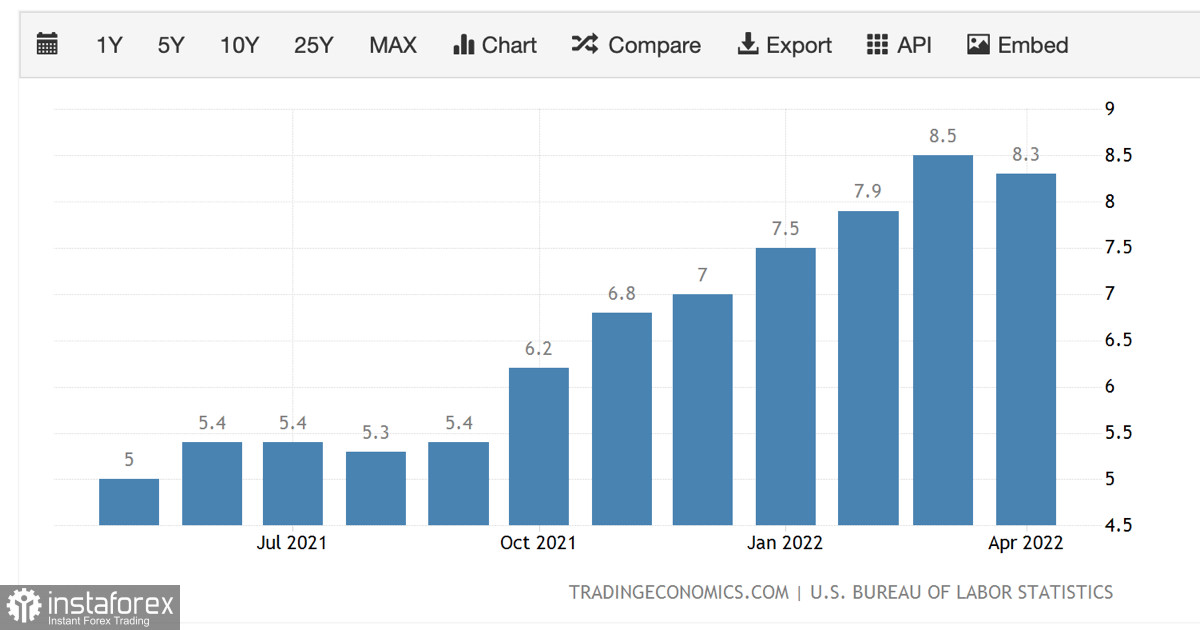

This is primarily due to the fact that Bitcoin and other assets are dependent on the general situation in the global financial arena. Digital coins receive the same liquidity and are used for the same purposes as conditional SPX and NDX. Therefore, the uselessness of Bitcoin within the new existing economic reality should not be surprising. The asset failed to prove itself during a record 40-year rise in the consumer price index. The Fed intervened in the process and began an active fight against inflation, and it turned out that this was as painful for BTC as for other high-risk assets.

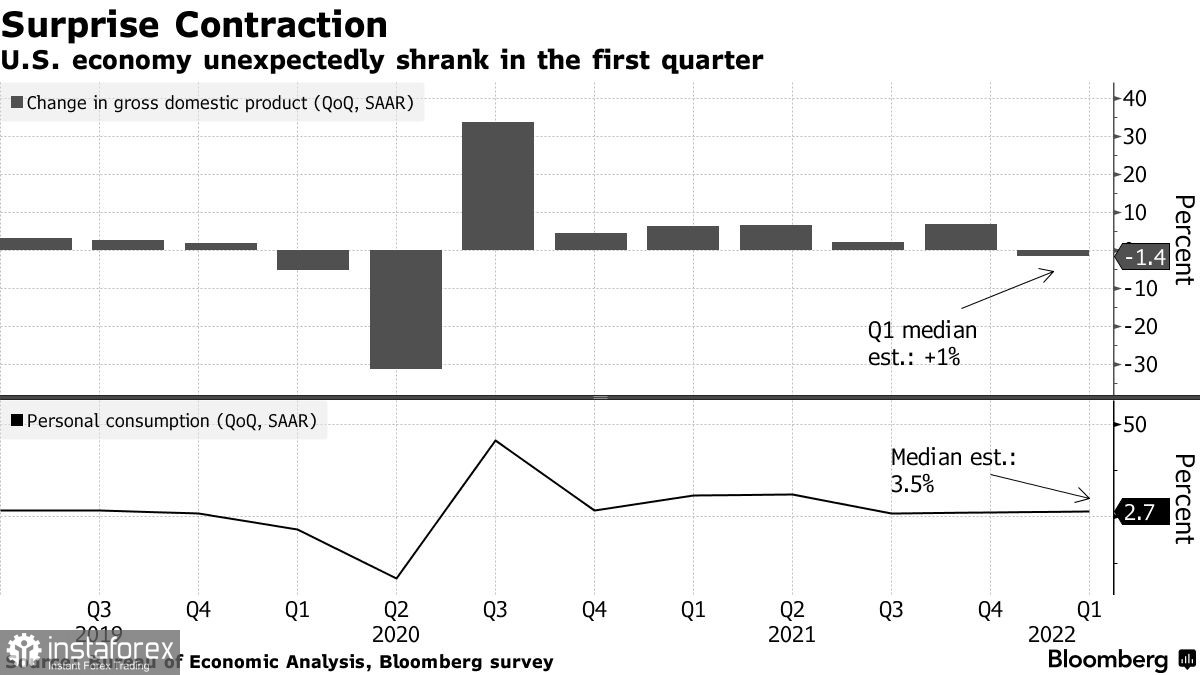

At the same time, there is every reason to believe that in the near future the global financial system will face the consequences that world economies have experienced after record inflation in the United States, tightening of monetary policy, and the war in Ukraine. The name of these consequences is stagflation. In the first quarter of 2022, the GDP of the United States fell by 1.4%, and there is every reason to believe that this process will continue. China, the world's second-largest economy, is suffering from a new coronavirus outbreak and is implementing strict quarantine rules. Also, the destruction of the usual supply chains of goods and the focus on the diversification of resource dependence exacerbate the recession of the global economy.

It may seem that under such conditions, cryptocurrencies can take the lead and become the main means of saving capital. However, as we have already stated, this tactic can really work in a bull market and a multiple increase in quotes. In the current situation, we see a completely unfavorable situation for the crypto market. On the one hand, there is a crisis that could serve as a catalyst for the growth of coin quotes. But at the same time, global financial institutions are reducing liquidity in the market, as the inflation rate has reached high levels after the coronavirus crisis.

As a result, we see a situation where the post-COVID recovery of the global economy was completely destroyed by the war in Ukraine, which turned out to be a catalyst for approaching stagflation, a raw material and resource crisis, and possibly a surge in migration from a number of poor countries left without grain.

In such a situation, cryptocurrencies become a classic instrument, which, along with everyone else, falls to local bottom. And here it is worth mentioning the correlation of the market with stock indices. This factor clearly and negatively highlights digital assets against the general background. In the current conditions, there is only one really effective mechanism for countering impending processes—tightening monetary policy. But for cryptocurrencies, this means an even greater decrease in liquidity and buying interest, as well as updating local bottom.

In the current situation, Bitcoin could not become a means of protection against inflation or other crisis processes. The incidence of the Luna Foundation and the UST stablecoin has significantly undermined confidence in the entire market, which is detrimental in the face of a rapid correction. With this in mind, there is no reason that in the next few months Bitcoin or other digital assets will become a full-fledged demanded medium in the current market, economic and geopolitical circumstances.