Despite the factors that have been repeatedly indicated that cause demand for the US dollar, the main currency pair took and grew at the auctions of the past five days. It can be seen that technical factors and the need for EUR/USD correction are affecting, which has been delayed in its expectation. As usual, we will move on to technology a little later, but for now, briefly about the geopolitical situation. As you know, all the world's attention is paid to the situation in Ukraine, where Russia is conducting its military special operation. The main thing worth noting is that the normalization of the situation and the settlement of the conflict does not even smell yet. On the contrary, Ukraine receives weapons from the so-called "allies" in unprecedented quantities. First of all, it is part of the countries of the European Union and, of course, the United States of America. Who would doubt that it is beneficial for the Americans to warm up the military conflict directly at the borders of the Russian Federation in every possible way?

I dare to assume that the full normalization of relations between Russia and Ukraine, as well as the cessation of all hostilities, is still very far away. It may take years for this to happen. It is easier to kindle fire than to extinguish it. It is clear that in such a situation, risk sentiment is minimized, and the US dollar receives significant demand as a safe asset. But investors cannot endlessly buy up the American currency, especially since this risk factor has long been embedded in the price of the "American". The same can be said about the Fed's aggressive tightening of its monetary policy. Let me remind you that after both rate hikes by the Federal Reserve, the US dollar was sold. Why? Yes, because before that, the US currency was bought on the expectations of these events, and after the actual increase, purchases of the US dollar were closed, which is quite natural.

As for the single European currency, investors want it, but they need good reasons to buy euros. Thus, in the minutes of the ECB's April meeting published last week, it was again noted that the increase in the main interest rate will occur only after the completion of the asset purchase program. At best, it is the middle or the end of the summer of this year. To be honest, such an overly cautious and extremely "dovish" position of ECB President Christine Lagarde is not entirely clear. Inflation is too high, and its growth does not seem to stop in the near future. So why wait so long?

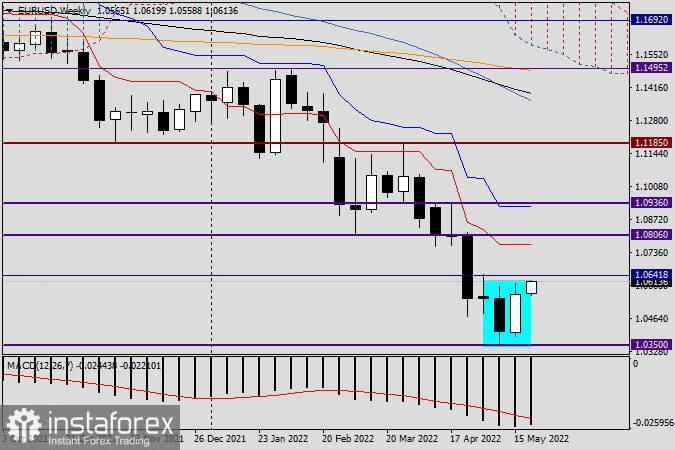

Weekly

Okay, let's turn to our technical matters. According to the results of last week, the EUR/USD currency pair did not just grow but formed a reversal model of the "Bullish absorption" candlestick analysis. The essence of this model is that the previous bearish candle should be inside the last bullish one, and this is determined by the opening and closing prices of both candles. I can't say that this reversal pattern is very strong and is often won back by bidders, but nevertheless. The fact that last week's trading lows were higher than the previous ones increases the likelihood of testing this model. If so, we should expect growth to the levels of 1.0600, 1.0640, 1.0700, 1.0745, and, possibly, to the red Tenkan line, which runs at 1.0767. If the market ignores this candlestick signal, we will expect a breakdown of support at 1.0350 and the closing of weekly trading under this level.

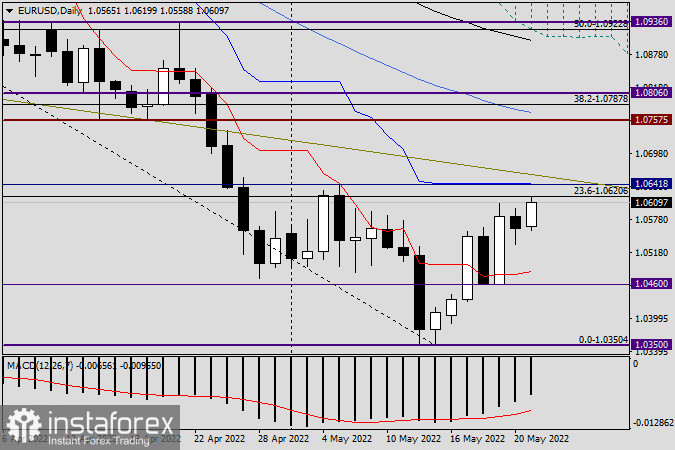

Daily

On the daily chart, we see that the strong growth, which was shown on May 19, stopped the next day, as a result of which a Doji candle appeared. Considering that it was the last trading day of last week, I don't see anything terrible in this. The growth will likely continue, and its nearest target will be the area of 1.0600-1.0640. Turning to trade recommendations, purchases from the 1.0545-1.0515 price zone are suggested. We will look closely at sales if bearish candlestick signals begin to appear in the area of 1-0.600-1.0640 on lower timeframes. In tomorrow's article on EUR/USD, we will just look at smaller time intervals and, perhaps, add something to the current trading recommendations.