Bulls have the initiative

Hi, dear traders!

As forecasted earlier, Friday's Doji candlestick did not stop EUR/USD from extending its upwards movement on Monday.

Recently, Christine Lagarde, known for her dovish stance on monetary policy, has signalled that the European Central Bank would increase interest rates in July and September. However, it has still left hawkish policymakers on the ECB's Governing Council dissatisfied. Inflation in the eurozone is extremely high, and quelling it would require concluding the asset purchase program and hiking interest rates as soon as possible. The Federal Reserve, on the other hand, has already committed itself to an aggressive monetary tightening course. The good state of the US economy allows the Fed to carry out this hawkish policy without significant losses. Tomorrow, the FOMC meeting minutes will be released, which will be the main event on this week's economic calendar. Today's key data releases are services and manufacturing PMI in both the EU and the US.

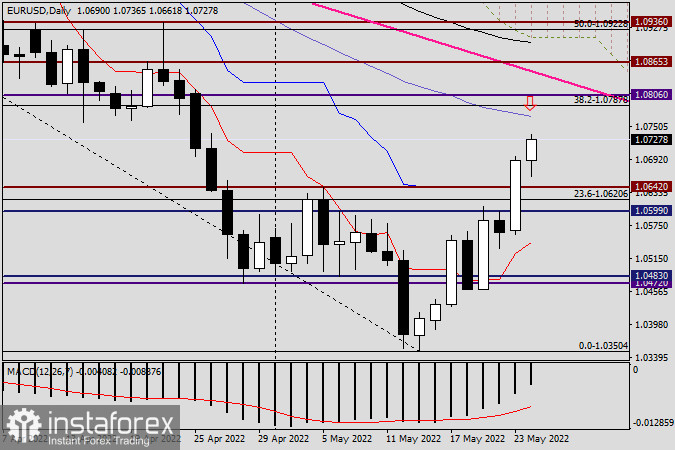

Daily

According to the daily chart, EUR/USD broke through Friday's intraday high at 1.0600, the strong resistance level at 1.0642 and the blue Kijun-sen line of the Ichimoku cloud yesterday. At the moment of writing, EUR/USD was trading near 1.0728. If the pair continues to rise, it will likely test the 50-day SMA line at 1.0769. Above it lies the Fibo level of 38.2% of the 1.1495-1.0350 range, as well as the key level of 1.0800. Short positions can be opened in the 1.0769-1.0800 area.

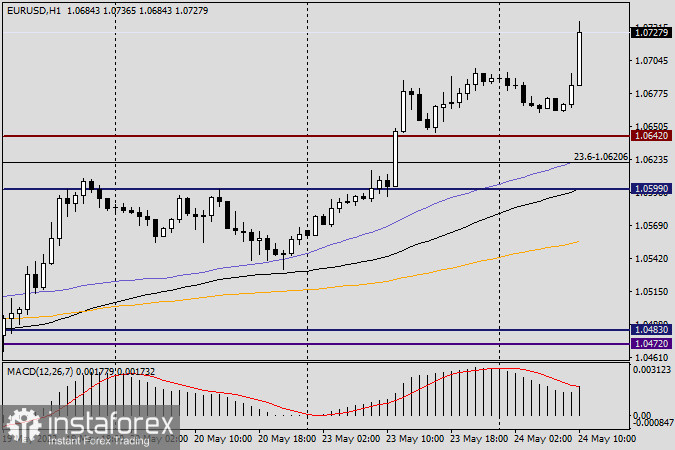

H1

According to the H1 chart, EUR/USD rebounded after a breakout below the resistance at 1.0642 and continued its upwards movement. The pair continued to climb during the Asian session, despite several downward corrections. EUR/USD is likely to rise even higher. In this situation, traders willing to take risks can open long positions in the pair. However, the 50-day MA on the daily chart should be taken into account. If bearish reversal candlesticks appear in the 1.0770-1.0800, short positions with small targets could also be opened. Today's main trading strategy is going long on EUR/USD - bullish traders have the initiative today.

Good luck!