The economic data published on Friday from the United States did not contain any surprises, however, they were interpreted quite positively by the players. The April base deflator PCE was +0.3% for the month, the trend corresponds to +4.3% y/y, this is the lowest indicator in 6 months and may indirectly indicate a decrease in inflationary pressure. The reaction to the report on durable goods is neutral, the level of household savings during the pandemic reached $ 2.2 trillion, which suggests a softer entry into a possible recession.

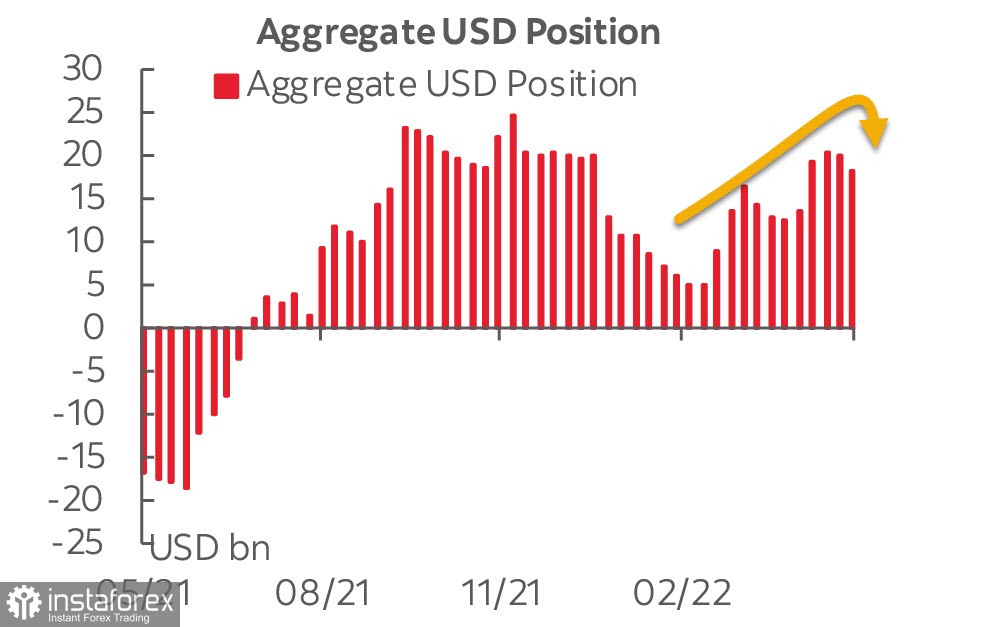

The US dollar has quite significantly sunk against most G10 currencies, which gives reason to assume that its weakening will not only be corrective. The cumulative long position on USD decreased by 2.018 billion to 18.2 billion, this is a five-week low, the trend shows that investors have begun to assess the prospects of the dollar less positively.

Some positive news from Europe (more on this below), as well as the lack of growth in inflation expectations, which, according to the University of Michigan, are stuck at 3%.

We assume that the grounds for the continued growth of the dollar have become a little weaker, which may lead to the development of its corrective decline across the entire spectrum of the foreign exchange market.

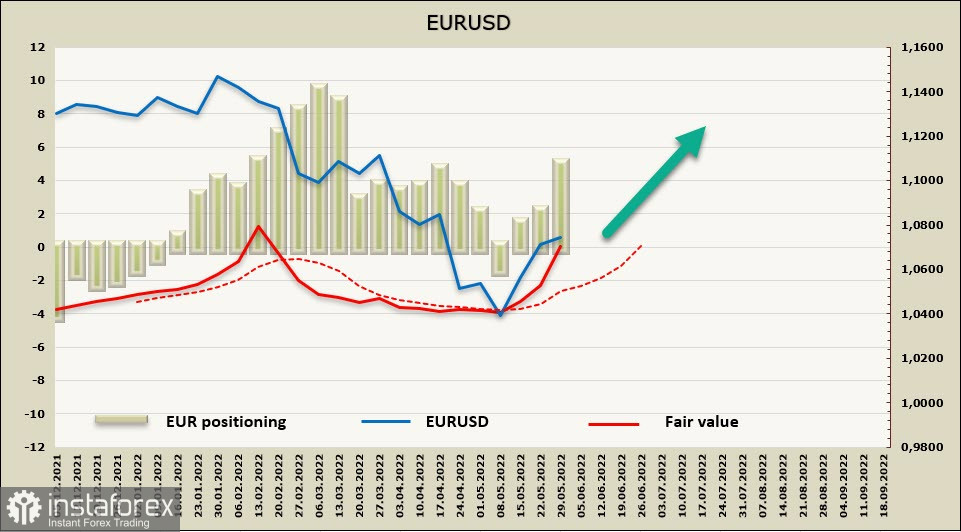

EURUSDThe euro is experiencing a surge of positivity. With a high probability, the ECB will announce in June the end of QE starting in July and also confirm its intention to start a cycle of rate increases in the very near future. The revision of the ECB's plans is one of the key factors in the growth of demand for the euro.

The second factor is no less important, although much less is said about it, and consists of the actual agreement to pay for gas from Russia in rubles. The payment scheme proposed by Russia allows, without violating the sanctions regime, to receive the gas, which dramatically reduces the likelihood of energy starvation in Europe. The lack of agreement in the EU on restrictions on oil purchases also indicates that Europe can avoid a catastrophic scenario, and everything that does not destroy Europe does not support the dollar at the same time.

In the reporting week, according to the CFTC, there was an increase in the net long position on the euro again, with a significant weekly change of +2.54 billion, the accumulated excess of +5.2 billion, the estimated price goes even higher.

The probability that a trend change has taken place looks high. The resistance of 1.0630/40 could not resist and turned into support, we should expect a test of 1.0800/30, the chances of continued growth look strong, consolidation above this level will mean technical confirmation of a bullish reversal and will open the way to 1.1115.

GBPUSD

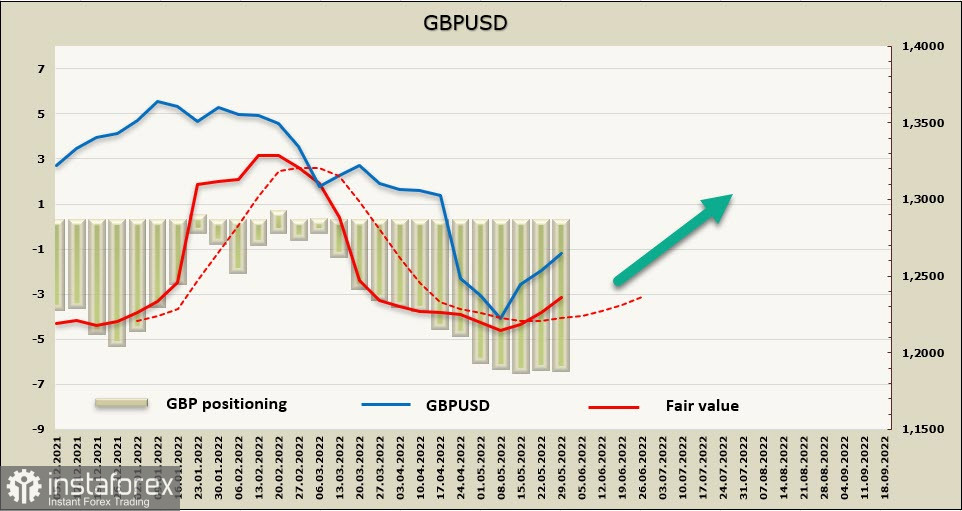

There are not much macroeconomic data from the UK, so the main intrigue lies in how aggressively the Bank of England is ready to act to curb rising inflation. Research from NIESR shows that inflation is growing primarily because of energy, for other groups of goods it is also higher than historically average values, but not so critical. The government is starting to implement measures to support consumers, in particular, up to 650 pounds (about 15 billion) will be paid to 8 million households. GBP) to compensate for energy costs, this will add a few more points to inflation expectations.

Now the markets are expecting about +1.25% to the current rate by the end of the year, the rate growth rate is slightly lower than the Fed's expectations, but the gap in expectations is noticeably narrowing, which increases the chances of the pound against the dollar.

Although the estimated price of the pound, like the euro, goes up, the grounds for a full-fledged reversal are still less than in the eurozone. The net short position increased slightly during the week (-108 million, the total margin is -6.295 billion), that is, the cumulative speculative position remains distinctly bearish, and the estimated price goes up under the influence of short-term rather than long-term factors.

Most likely, we see a corrective growth in the pound. GBP has reached, as expected, the resistance zone of 1.2635/50, an attempt to overcome the resistance will be made, but there is no confidence in further growth. Short-term factors indicate an increased probability of moving towards 1.2950/3000, however, in the long term, the upward trend looks very unstable and the end of the correction may occur at any moment.