Hi, dear traders!

EUR/USD finished last week in positive territory, thanks to efforts of euro bulls. The hawkish Fed meeting minutes, which confirmed the Fed's aggressive monetary tightening plans, did not help USD come out on top. However, US data releases of May 23-27 could affect the Fed's course. Many key reports were well below expectations of economists. Taking this factors into account, market players began to worry about the Fed possibly softening its stance. This could be seen in statements by FOMC's hawkish board member Raphael Bostic, whose rhetoric became notably more dovish.

It is likely that disappointing Markit PMI, durable goods orders and revised US GDP data for the first quarter were taken into account. This macroeconomic data will likely influence the Fed's monetary tightening plans. Now, market players will likely react more strongly to US data releases, focusing on fundamentals. Today's only key data release is Germany's CPI. This week, US labor market data will be published on Friday, June 3.

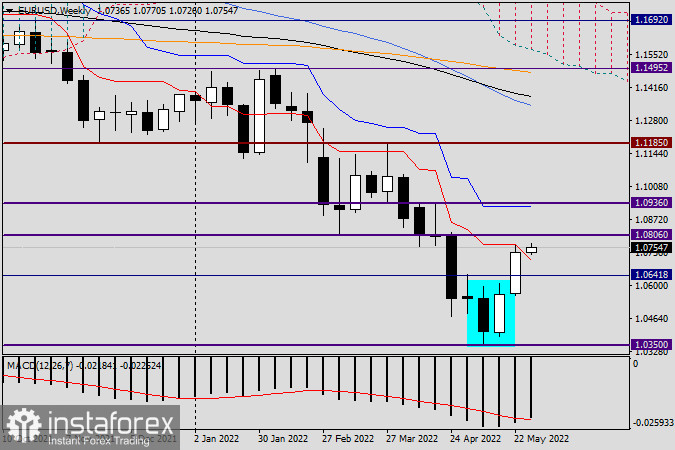

Weekly

EUR bulls had the initiative during the previous trading week - last week's candlestick has no lower shadow. However, even its upper shadow was quite small. EUR/USD reached 1.0765 and approached the red Tenkan-Sen line of the Ichimoku cloud, but bounced downwards slightly. The pair's performance matched last week's outlook, when it formed a Bullish Engulfing pattern.

Unlike earlier reversal signals, which were ignored, market players have reacted to the highlighted pattern. Currently, EUR bulls would need to break above the red Tenkan-Sen line and settle above the key technical level of 1.0800. The main goal for bears is pushing EUR/USD below the broken resistance level of 1.0641 and the key technical level of 1.0600. However, the weekly chart suggests the pair's uptrend will continue.

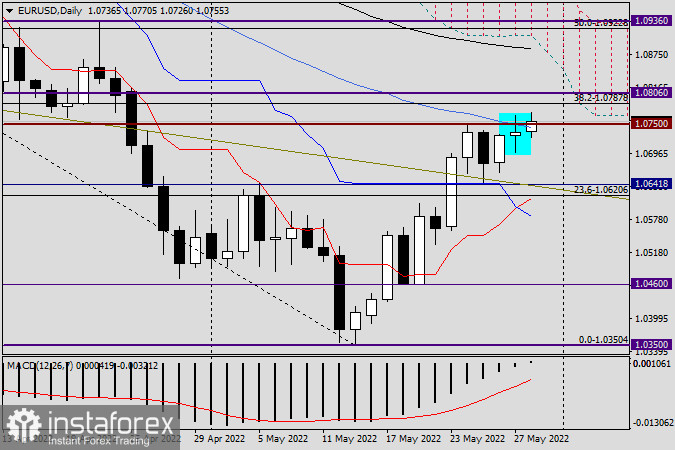

Daily

On Friday, a bearish reversal pattern appeared on the daily chart after EUR/USD failed to break through the 50-day SMA line and the resistance at the 1.0750, which was the high of May 24. There are two possible scenarios for the pair - either EUR/USD will reverse downwards or rise above it, nullifying it. While there could be a chance of a bullish scenario, a bearish reversal should not be ruled out as well. The pair's performance early on Monday has not cleared it up, despite rising bullish sentiments. Traders are recommended to open long positions from the price area of 1.0720-1.0700 while the pair remains above 1.0700.

Good luck!