Greetings, dear traders!

Last week, the pound sterling climbed against the greenback despite the fact the BoE downgraded the UK growth outlook and several weak macroeconomic reports, e.g. PMI indexes and GDP data for the first quarter. Perhaps the optimistic comments of Chancellor of the Exchequer Rishi Sunak about changes in QE, as well as tools to combat inflation, fueled hopes for a further increase in the interest rate. However, comments are just comments. So far, the Bank of England has been rather cautious when it comes to monetary policy tightening due to deteriorating economic conditions in the UK.

As for the economic calendar, US labor market reports will remain in the limelight, especially the weekly initial jobless claims and the Nonfarm Payrolls data. The Fed's statements about a strong economy were undermined by weak GDP data for the first quarter. The regulator has also mentioned many times that the labormarket is resilient. If the NFP report turns out to be disappointing, the US dollar is likely to face another wave of sell-offs. In the meantime, let's look at how the GBP/USD pair ended last week.

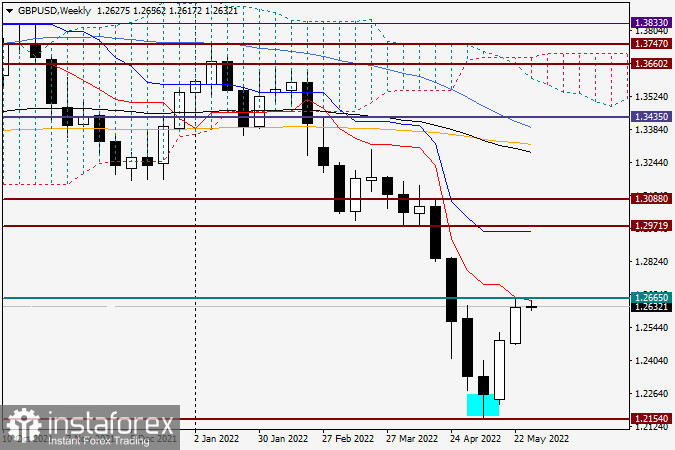

Weekly

The pound/dollar pair advanced on May 23-27 as I stressed at the beginning of this article. The pair ended the week above the strong level of 1.2600, closing at 1.2627. As clearly seen on the weekly chart, the further downward movement of the pair was limited by the red Tenkan line of the Ichimoku indicator. The high levels of the previous week are also located in this range near 1.2665. If GBP bulls manage to push the pair above these highs, it will open the way to 1.2700. A breakout of this level will signal a rise to new highs of 1.2900-1.2970. The blue Kijun line is located in this range, as well as the previously broken support level. However, these levels are still far away because the pair needs to break through the 28 level. Bears will regain the upper hand if the price declines below the 1.2500 level.

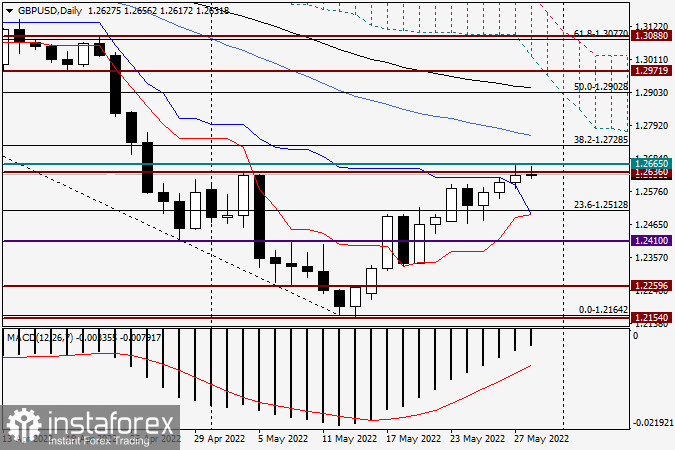

Daily

Last Friday, a Doji candlestick appeared on the GBP/USD daily chart. The bullish movement would not have been affected by this candlestick if it did not appear after unsuccessful attempts to break through the strong resistance level of 1.2636. Now, the further trajectory of the pound sterling, especially versus the US dollar, will largely depend on market sentiment. However, I have already mentioned that the British pound tends to break reversal patterns quote often. If Friday's candlestick is erased by an upward reversal today, the likelihood of an upward movement will be extremely high. A decline and close below the psychologically important level of 1.2500 will indicate the resumption of the bearish movement. The resistance zone is 1.2636-1.2665 and the support area is 1.2490-1.2470.

Good luck!