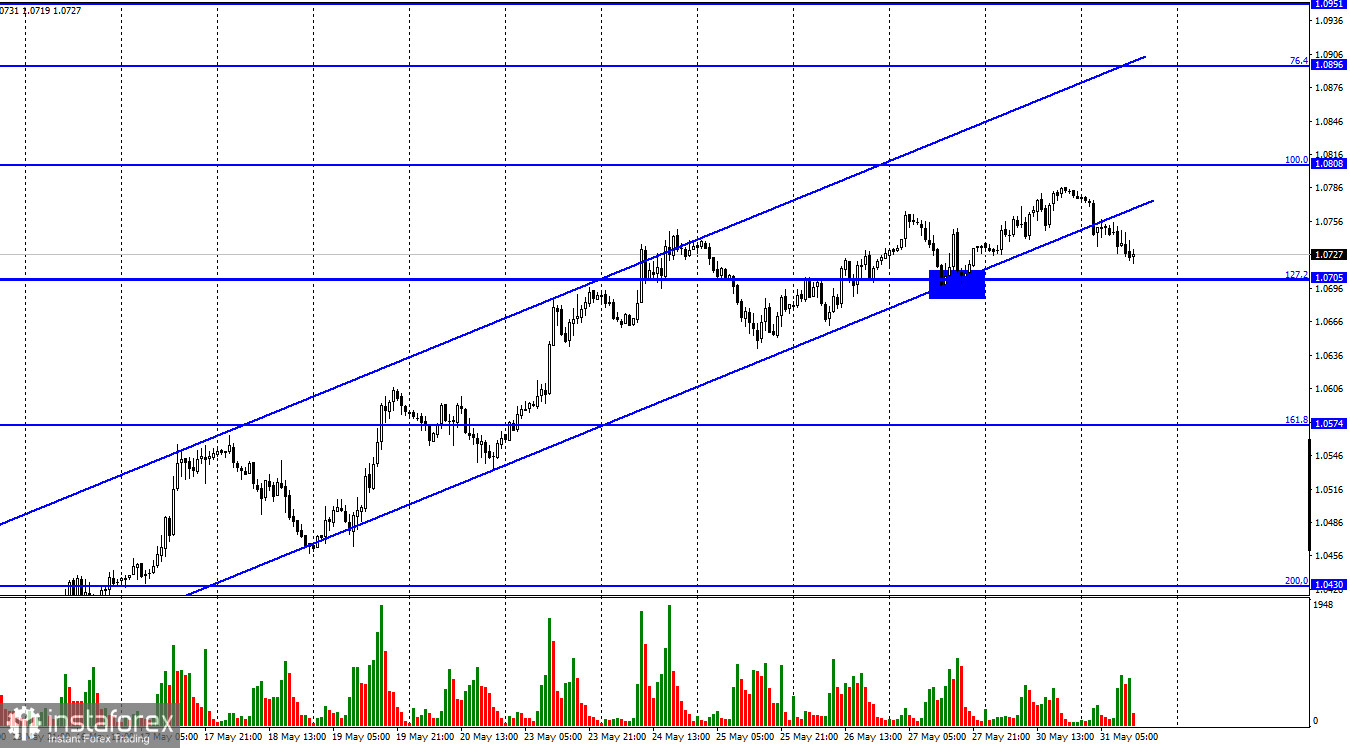

The EUR/USD pair performed a reversal in favor of the US currency on Tuesday and anchored under an upward trend corridor. Thus, the process of falling in the direction of the corrective level of 127.2% (1.0705) began. Closing the pair's exchange rate below this level will increase the probability of the euro continuing to fall towards the next Fibo level of 161.8% (1.0574). The rebound will allow us to count on a reversal in favor of the euro currency and the resumption of growth in the direction of the corrective level of 100.0% (1.0808). The information background of Monday left much to be desired, as it was completely absent. Bull traders found the strength to lift the pair a little more, but it was evident in recent days that their strength was running out. Today, there was only one important report, but it most likely led to the fall of the euro currency. The situation with monetary policy and inflation in the EU is difficult now. The ECB cannot decide to raise the interest rate in any way and so far only half-hints to traders that there may be one or two increases this year.

However, from my point of view, one or two increases will not affect inflation in any way, for the sake of which this whole "banquet" is being started. Let me remind you that the Fed and the Bank of England have already raised their rates to 1%, and inflation in the US and the UK is either growing or continues to remain very high. Thus, an increase in the ECB rate in the range of 0-0.25% will not have any positive effect. And today, it became known that inflation in the European Union continues to grow and amounted to 8.1% y/y in May. Traders expected growth to be 7.7%, which is not much higher than the April value. It seems that traders initially did not believe in optimistic forecasts. Since the ECB is still not ready to raise the rate aggressively, no matter how much inflation increases, this will not affect Christine Lagarde's rhetoric in any way. Inflation may rise even to 10%, but this will not mean that the ECB will announce multiple increases in the rate, which is now below zero.

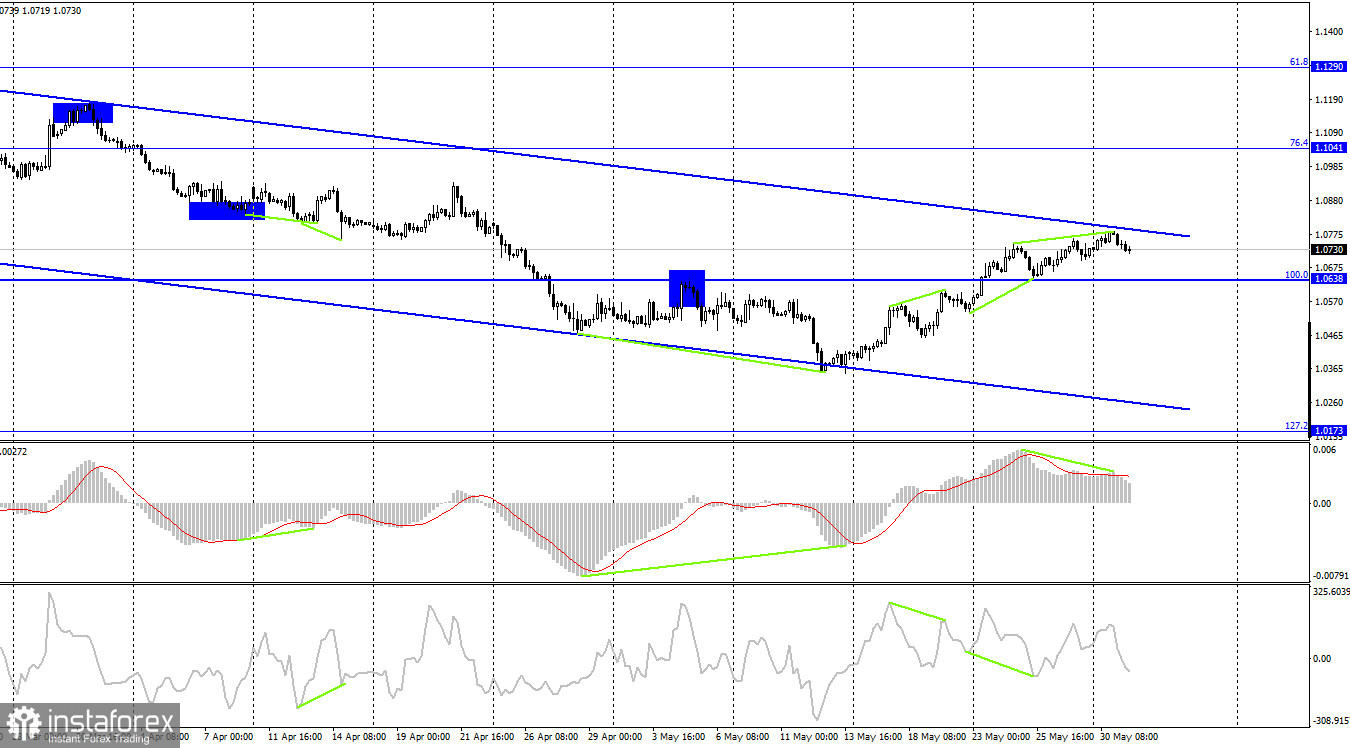

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the MACD indicator. The reversal occurred near the upper line of the descending corridor, which still characterizes the mood of traders as "bearish". And on the hourly chart, the quotes closed under the ascending corridor. Thus, now the probability of a new fall in the euro currency has grown significantly. The fall may continue in the coming days in the direction of the corrective level of 100.0% (1.0638).

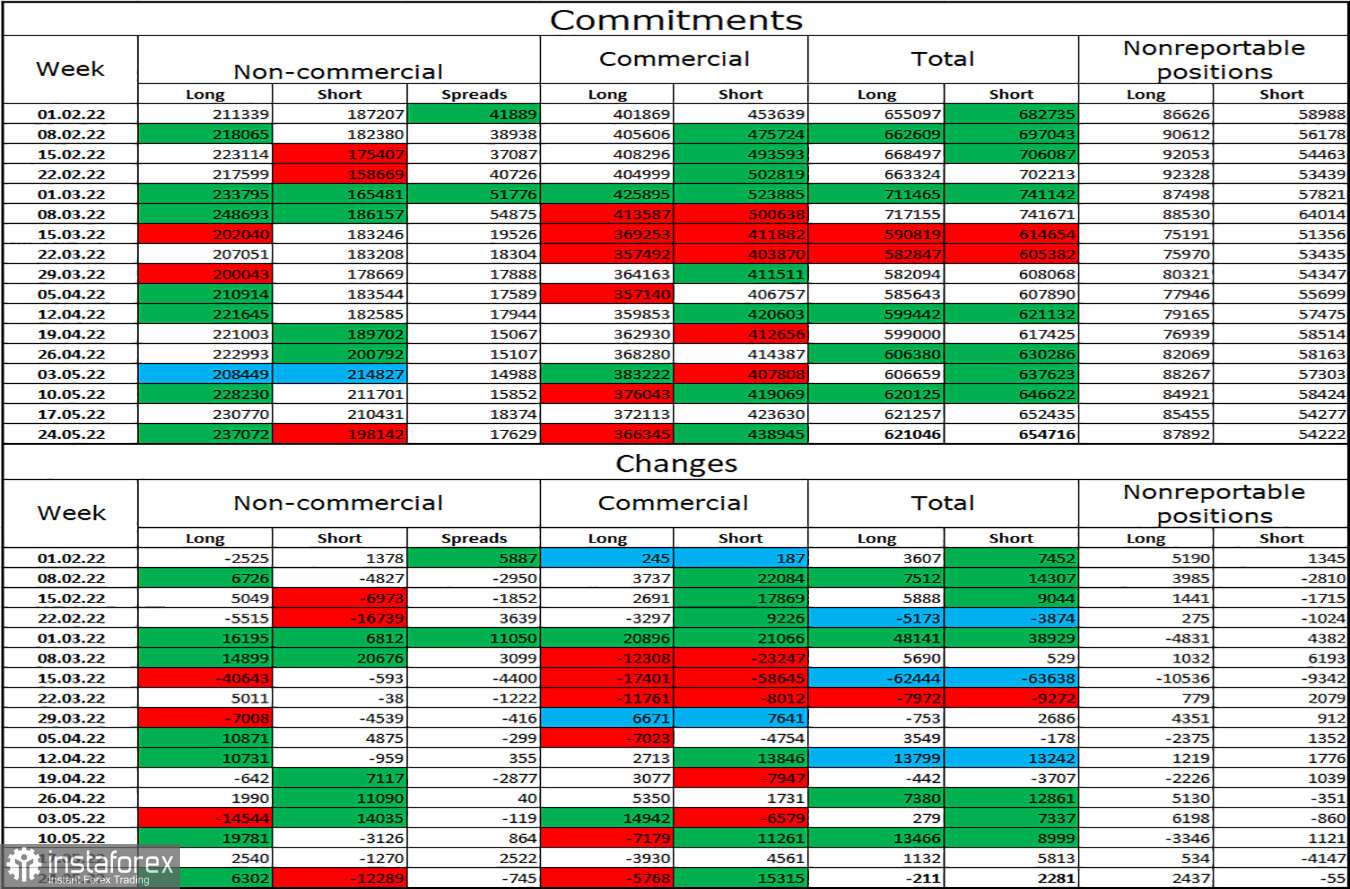

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 6,302 long contracts and closed 12,289 short contracts. This means that the bullish mood of the major players has intensified again. The total number of Long contracts concentrated on their hands is now 237 thousand, and short contracts - 198 thousand. As you can see, the difference between these figures is not very big and you can't even say that the European currency has been falling nonstop in recent months. In recent months, the euro has mostly maintained a "bullish" mood in the category of "Non-commercial" traders, but this did not help the EU currency. However, now we still see how on all charts the mood of traders begins to change to "bullish". Thus, the prospects for the euro currency are improving every day. If bear traders do not start to retreat sharply from their intentions in the next week or two, the euro may seize the initiative from the dollar for a long time.

News calendar for the USA and the European Union:

EU - consumer price index (09:00 UTC).

US - consumer confidence index (14:00 UTC).

On May 31, the calendars of economic events in the European Union and the United States contain one interesting entry each. I have already said about inflation, now in the US, the consumer confidence index is less important. The information background in the rest of the day may have a weak impact on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommended selling the pair if there is closure under the corridor on the hourly chart, with targets of 1.0705 and 1.0574. Now, these transactions can be held. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.1041.