It is obvious that a slump in the euro influenced the pound sterling via the US dollar index. However, after the beginning of the US trade, the British currency managed to rise. It was a short-lived increase that was replaced by a decline. The jump was caused by Janet Yellen's comment. She said that underestimated the negative influence from inflation on the US economy. Notably, since Janet Yellen took up the post of the Fed's chair, the regulator has been trying to accelerate consumer price growth. Of course, against the current conditions, the regulator has to take measures to cap inflation that is spiraling out of control. Therefore, Janet Yellen admitted that her actions had negatively affected the US economy. At present, she is holding the post of US Treasury secretary. Nevertheless, in Europe, inflationary risks are considerably higher than in the US. The fact is that US economists have already noticed first signs of the inflation slowdown, whereas in Europe, it is just accelerating. Against the backdrop, the pound sterling showed just a brief increase.

Today, the US dollar is likely to go on gaining in value. Even a decline in the US job openings will hardly stop the greenback's appreciation. Thus, the indicator slumped to 11,400 thousand from 11,549 thousand. The fact is that the number of new jobs was climbing more than needed, thus boosting employment. As a result, the unemployment rate hit an extremely low level. Since there are more than needed new jobs, their rise stopped. However, the decline in the number of new jobs is unlikely to affect the unemployment rate. In fact, economists noticed some signs of overheating in the US labor market long ago. That is why a decline in some indicators is a positive signal.

US JOLTs Job Openings

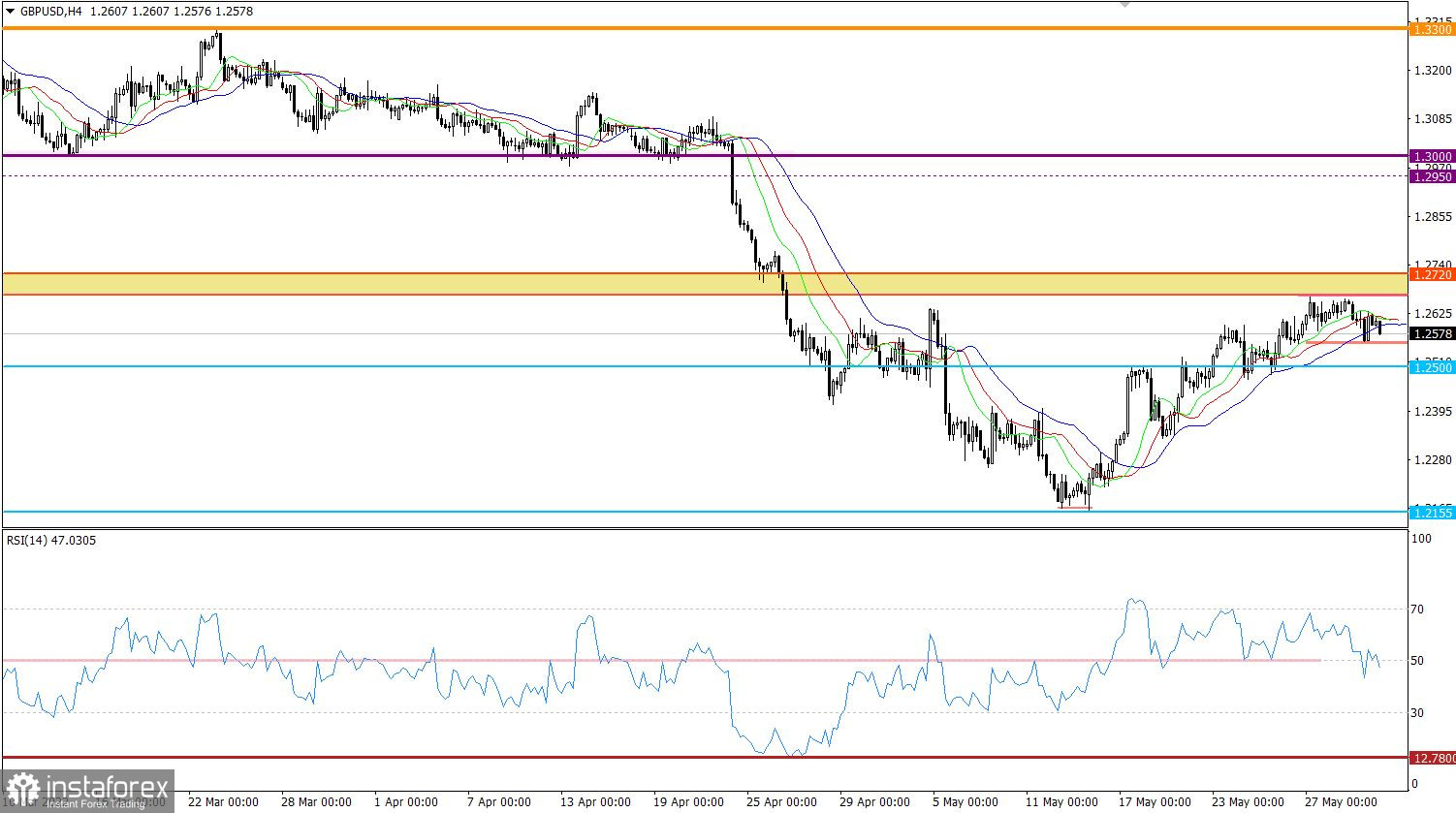

The pound/dollar pair stopped hovering within the 70-pip channel and dropped. As a result, the volume of short positions surged, thus affecting the correctional movement.

On the four-hour chart, the RSI technical indicator downwardly crossed the mid line 50. This is the first signal of a change in the market sentiment. On the daily chart, the indicator is moving along line 50, reflecting a slowdown in the correctional movement.

On the four-hour chart, the Alligator's moving averages are intersecting each other, pointing to a slower rise.

On the daily chart, we see a correctional movement from the support level of 1.2155, which does not violate the structure of the downtrend.

Outlook

If the price settles below 1.2560, the US dollar may go on climbing. This, in turn, may cause a new drop in the pound sterling.

The alternative scenario will become possible if the pair returns to the earlier broken range of 1.2600/1.2670. In this case, the upward correction may continue.In terms of the complex indicator analysis, we see that technical indicators are signaling sell opportunities on the short-term and intraday periods. On the mid-term period, the indicator is providing buy signals amid the ongoing correction.