"It is likely that we [the ECB] will be in a position to exit negative interest rates by the end of the third quarter," said ECB President Christine Lagarde, also confirming that the Asset Purchase Program (APP) will end very early in the third quarter, and "if inflation stabilises at 2% over the medium term, a progressive further normalisation of interest rates towards the neutral rate will be appropriate. The ECB will take all necessary steps for this."

The euro strengthened, and the EUR/USD pair rose in May after Lagarde's statements. This was also facilitated by recent positive macro statistics from the Eurozone.

Thus, the previously published Purchasing Managers' Index (PMI) for the manufacturing and service sectors continued to point to strong growth. Despite the relative decline, the Eurozone PMI stands well above the 50 mark separating growth from slowdown in business activity: the preliminary manufacturing PMI fell to 54.4 in May from 55.5 in April, and the services index fell to 56. 3 from 57.7.

As Eurostat reported yesterday, Eurozone GDP grew in the 1st quarter of 2022 by +0.6% (+5.4% in annual terms) against +0.3% (+5.1% in annual terms) in the 4th quarter of 2021.

The region has experienced very high inflation. For example, annual inflation growth in April was +8.1%, which increases the pressure on the leaders of the ECB to tighten monetary policy. Today, the ECB may also announce a complete end to the asset purchase program.

The ECB's decision on interest rates will be published at 11:45 (GMT), and during a press conference starting at 12:30 (GMT), Lagarde will explain the bank's decision. Even if experts' forecasts that the rate will not be raised today come true, new tough statements from Lagarde about the need to soon move to tighten the ECB's policy will cause the euro to rise.

Conversely, the soft tone of statements and the propensity to continue the soft policy of the ECB, which remains one of the softest among the world's largest central banks, will have a negative impact on the euro. In this case, EUR/USD risks falling to the levels of 5 years ago and to the level of 1.0500.

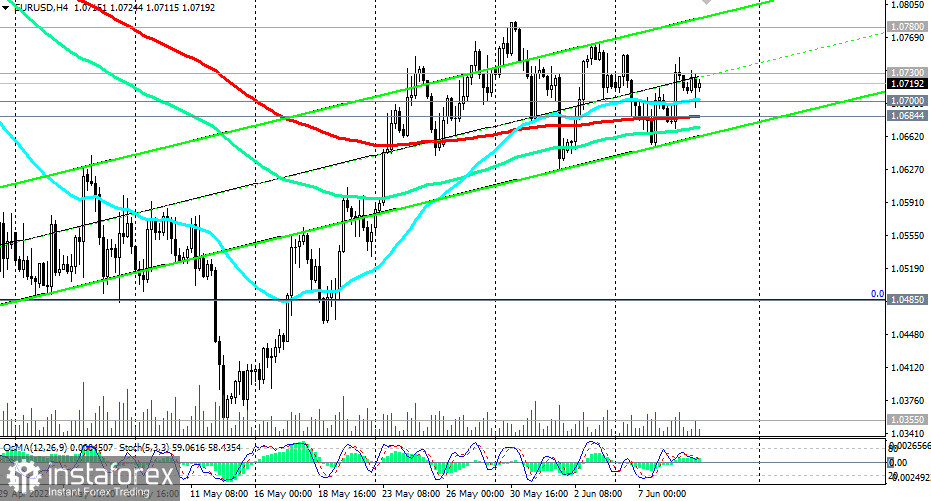

In the meantime, EUR/USD is trading in a narrow range around today's opening price and 1.0715. A break of yesterday's low at 1.0672 and high at 1.0748 is likely to be the starting point for EUR/USD to move lower or higher.

Support levels: 1.0700, 1.0684, 1.0650, 1.0600, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Resistance levels: 1.0730, 1.0780, 1.0800, 1.0810, 1.1000, 1.1020, 1.1100, 1.1140, 1.1285

Trading Tips

Sell Stop 1.0670. Stop-Loss 1.0770. Take-Profit 1.0650, 1.0600, 1.0500, 1.0485, 1.0400, 1.0355, 1.0300

Buy Stop 1.0770. Stop-Loss 1.0670. Take-Profit 1.0800, 1.0810, 1.1000, 1.1020, 1.1100, 1.1140, 1.1285