The European Central Bank left all the parameters of monetary policy unchanged, so all the attention of the market is now shifted to the contents of ECB chief Christine Lagarde's press conference.

According to her, the central bank needs to complete all their previously taken incentive measures before beginning the process of raising interest rates. But for July, it is likely that the ECB will increase its rates, albeit by 0.25. The rate hike may be more than 0.25% in September.

In short, serious changes in the ECB policy will occur about a year after inflation in the euro area exceeds 2%. That will narrow the gap with the Federal Reserve, which has raised interest rates twice since March.

Other topics that Lagarde may mention today are growing inflation, high energy prices and the conflict in Ukraine. If she hints at a more aggressive rate hike, by about 0.50%, EUR/USD will increase sharply. If not, the pair will continue to decrease.

Nonetheless, Lagarde will try to calm European markets as much as possible and contain the increase in market volatility.

Forecasts for today:

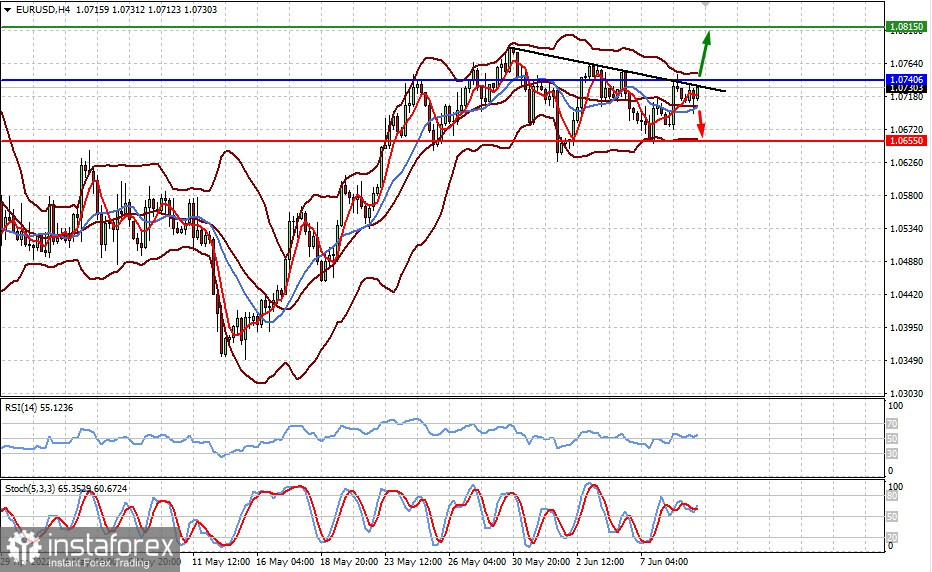

EUR/USD

The pair is consolidating in anticipation of the speech of ECB chief Christine Lagarde. Any statements about aggressive rate hikes will increase the quote to 1.0815, while a softer position will put pressure on the pair and bring it to 1.0655.

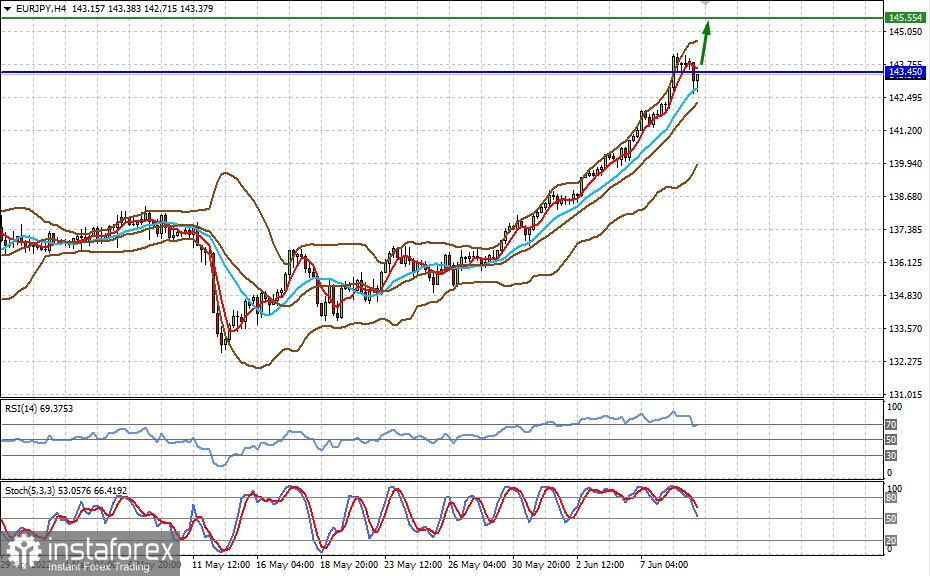

EUR/JPY

The pair is trading below 143.45. Positive news from Lagarde will lead to its growth to 145.55.