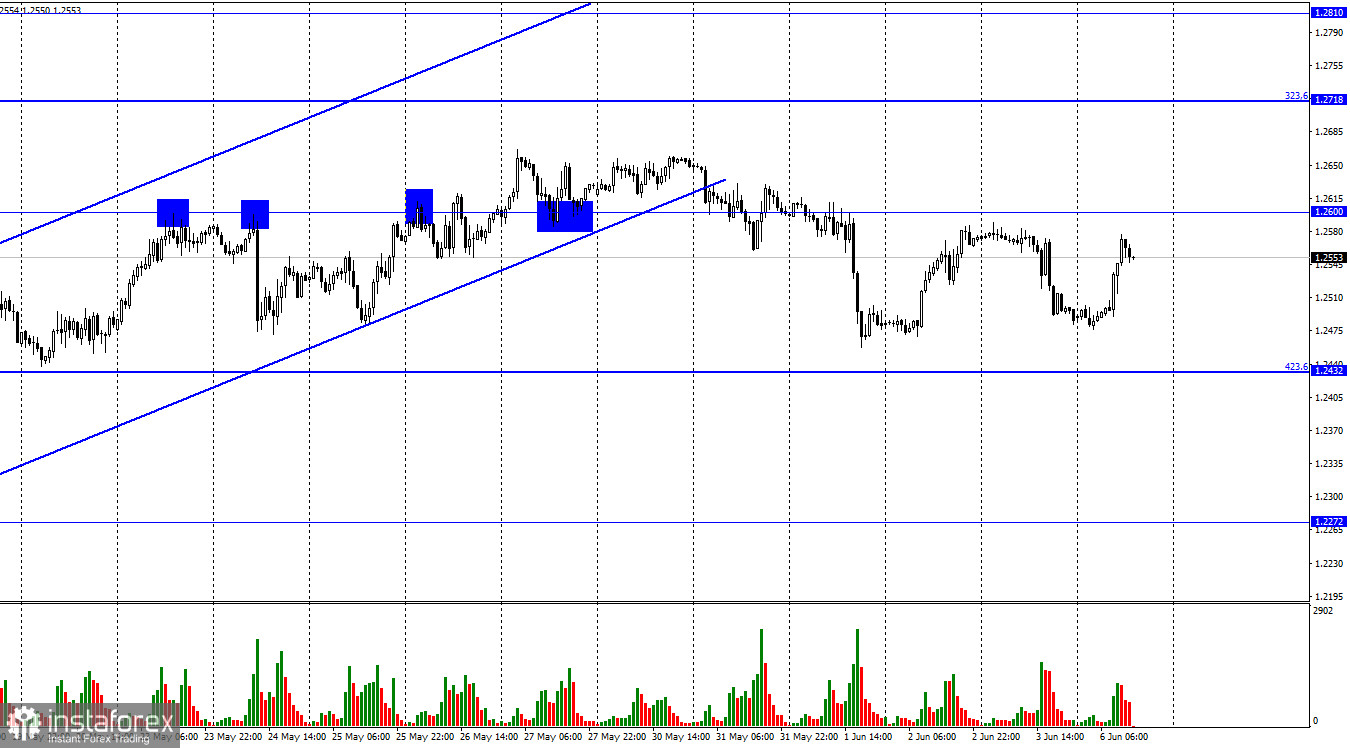

According to the hourly chart, the GBP/USD pair on Friday performed a fall in the direction of the corrective level of 423.6% (1.2432). However, today, on Monday, it performed a reversal in favor of the British pound and began to grow towards the level of 1.2600. In the end, it did not reach either the first or the second level. Friday's drop in quotes was due to American statistics, which turned out to be quite strong. However, at the same time, the fall of the US currency on Monday indicates the passivity of bear traders. In general, the British dollar has been trading in a narrow range for the last two weeks, and traders are thinking about what to do next. Let me remind you that all the recent meetings of central banks were held under the auspices of the fight against inflation. Rates are raised for a reason - this is the main tool for reducing inflation, but only when inflation runs out of its economy. Simply put, if inflation depended only on the quantitative stimulus program that was carried out during the pandemic years, then central banks could control it.

In the current situation, they are only able to influence it, since the factors of price growth around the world are hidden in the Ukrainian-Russian conflict, because of which oil and gas prices are rising. Therefore, it is impossible to receive food and grain from Ukraine and Russia, due to violations in the supply chains of the whole world. How can the ECB or the Fed influence these factors? At the same time, oil has resumed its growth on world markets, which is due to the sixth package of EU sanctions against the Russian Federation, which just involves a partial rejection of oil purchases. The refusal will apply only to oil delivered "by water", the EU has not yet refused oil from pipelines. Mainly because of Hungary and several other EU countries that are landlocked and can only receive oil through pipelines. However, as EU officials say, the issue of a complete oil embargo is a matter of time. Thus, inflation may continue to rise around the world.

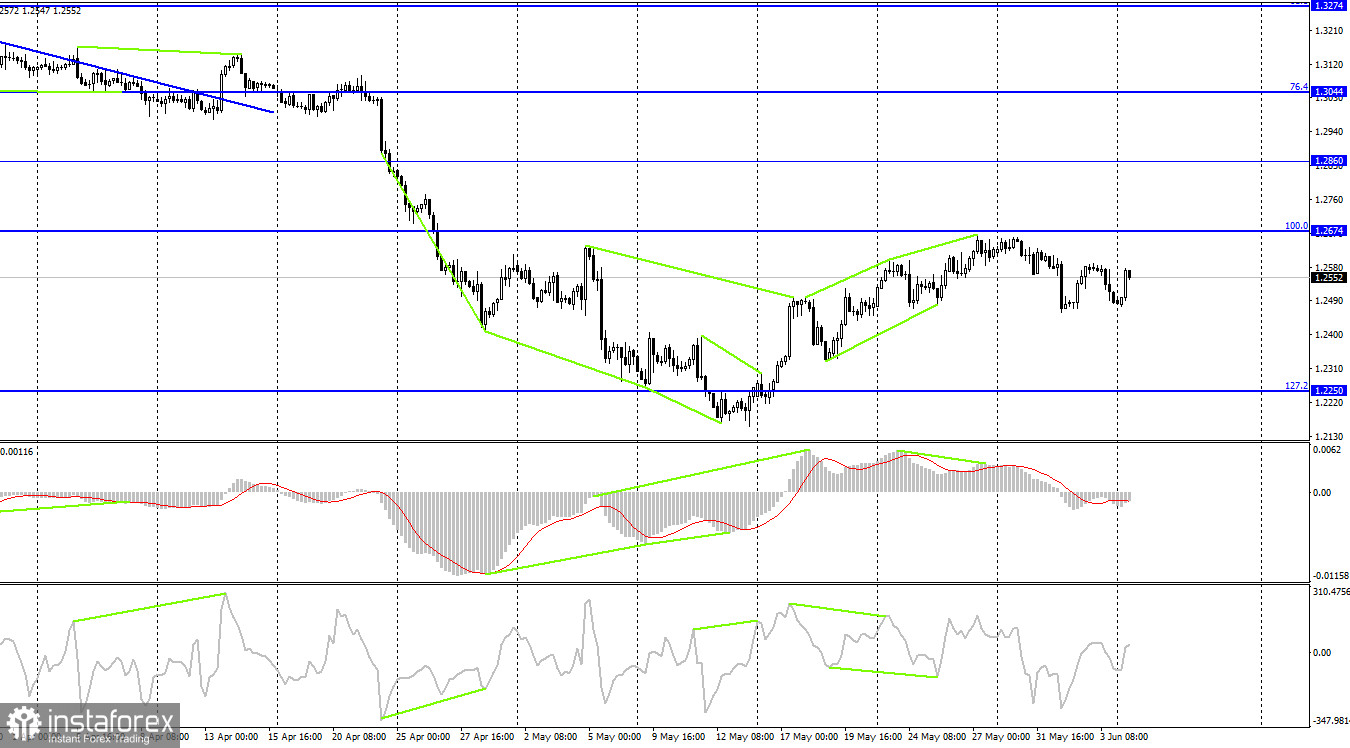

On the 4-hour chart, the pair performed a reversal in favor of the US currency after the formation of a "bearish" divergence at the MACD indicator. The reversal occurred near the corrective level of 100.0% (1.2674), but there was no rebound. Thus, the fall in quotes has begun and can be continued in the direction of the corrective level of 127.2% (1.2250). Fixing above the Fibo level of 100.0% will work in favor of the British and will increase the likelihood of the pair resuming growth in the direction of the 1.2860 level.

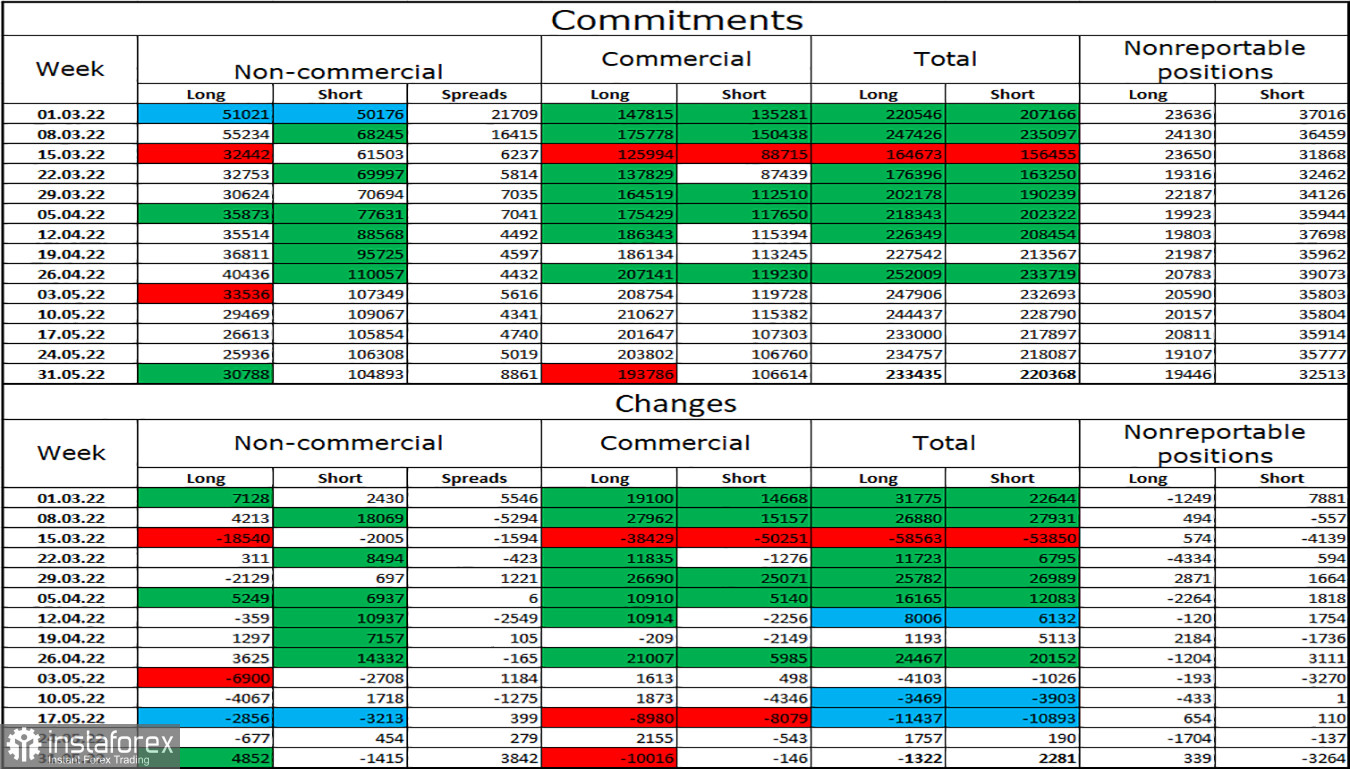

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little more "bullish" over the past week. The number of long contracts in the hands of speculators increased by 4,852 units, and the number of short contracts decreased by 1,415. Thus, the general mood of the major players remained the same - "bearish", and the number of long contracts exceeds the number of short contracts by three times. Major players continue to get rid of the pound for the most part and their mood has not changed much lately. So I think the pound could resume its decline over the next few weeks. Now the corridors on the hourly and 4-hour charts will be of great importance since such a strong discrepancy between the numbers of long and short contracts can also indicate a trend reversal. But there is no point in denying that speculators sell more than they buy.

News calendar for the USA and the UK:

On Monday in the UK and the US, the calendars of economic events do not contain a single interesting entry. Today, the information background will not have any effect on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommended selling the pound if the closing is performed under the corridor on the hourly chart. Anchoring below the 1.2600 level allows you to hold sales with a target of 1.2432. I recommend buying the British if the 4-hour chart closes above the level of 1.2674 with a target of 1.2860.